|

#2

21st October 2014, 02:14 PM

| |||

| |||

| Re: Procedure To Become Income Tax Officer

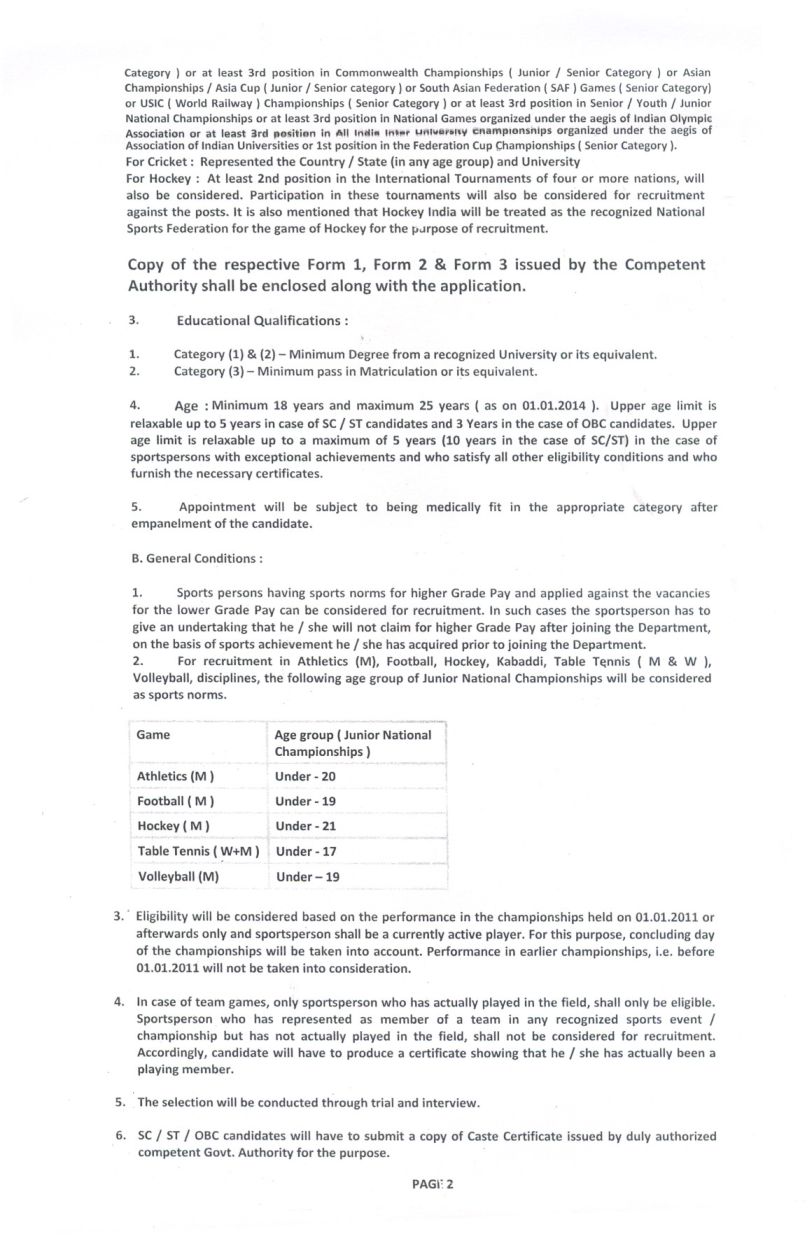

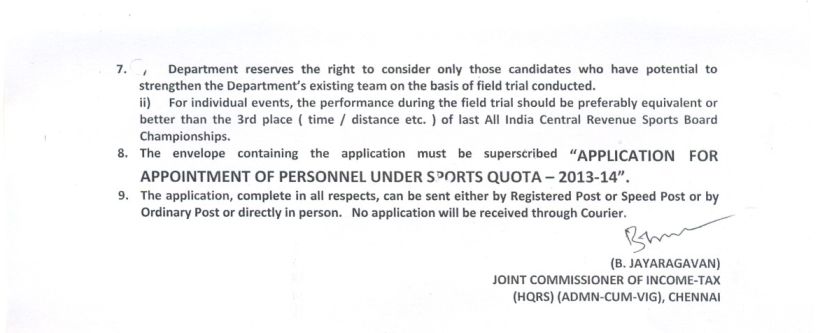

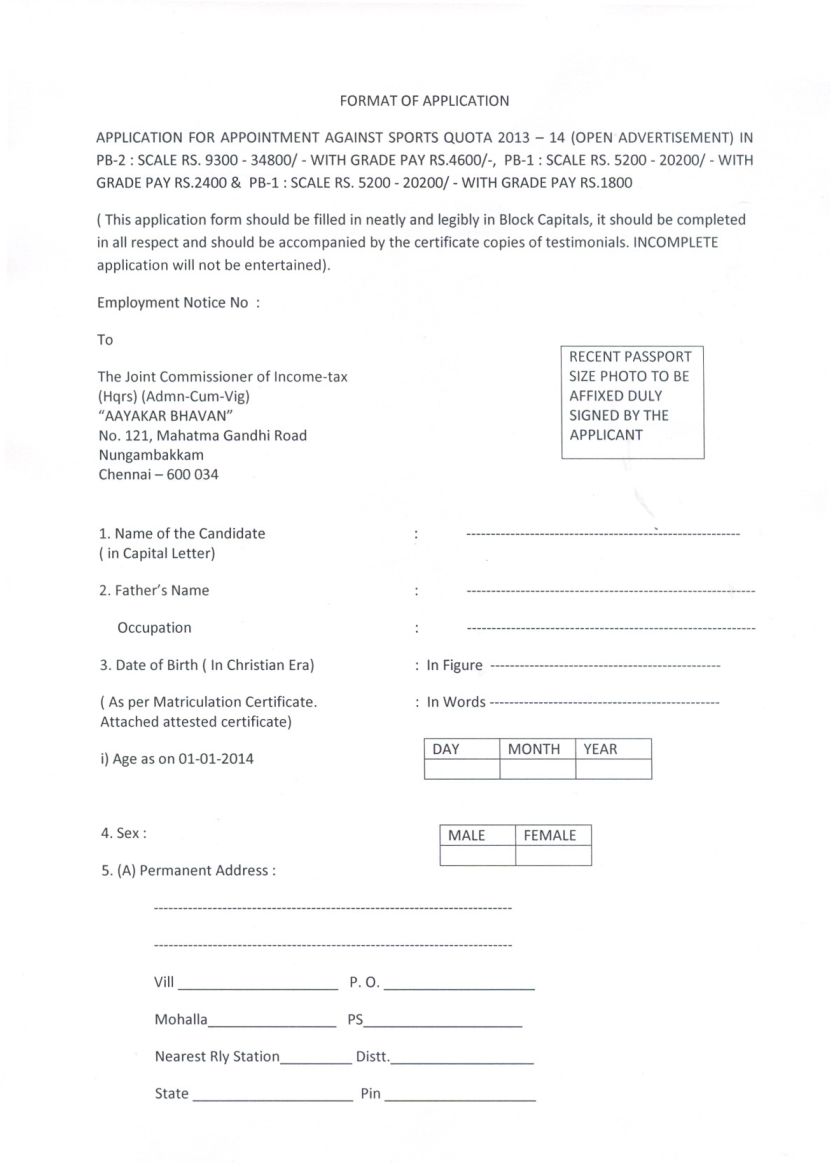

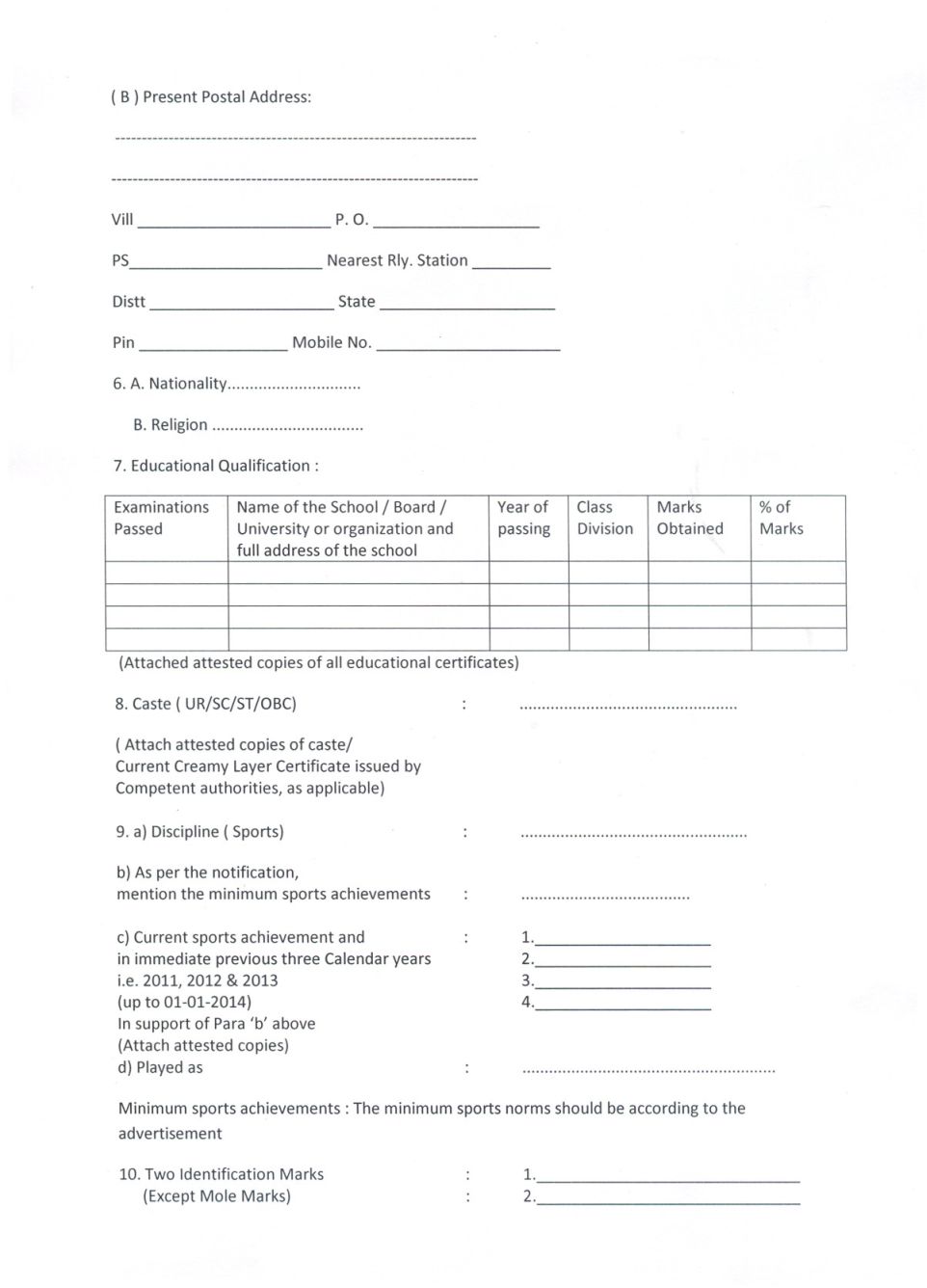

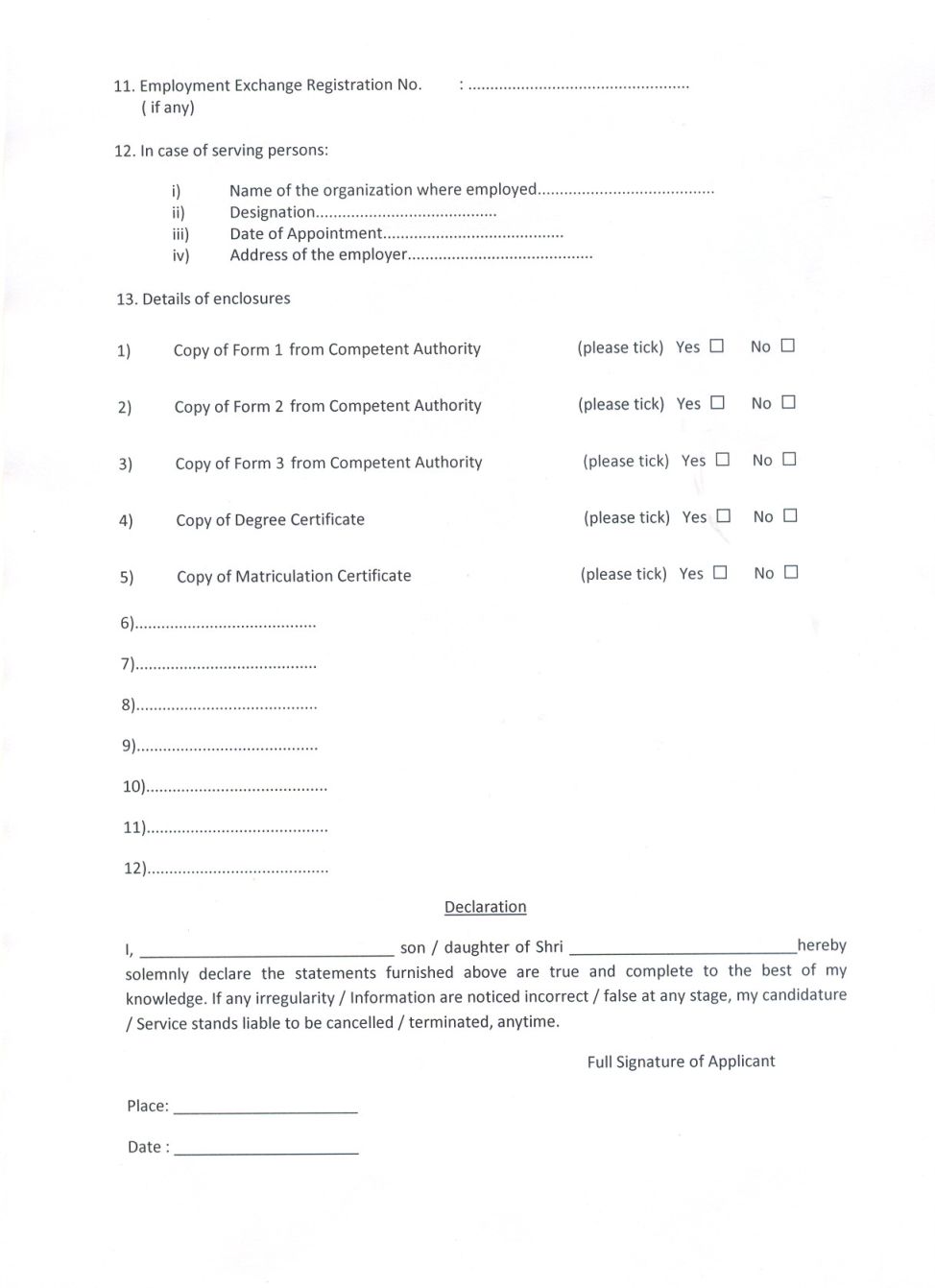

Candidates who are interested to become an Income Tax Officer , have to go through Recruitment procedure which is done by Income Tax Department, Government of India Income Tax Department invites the application for the Recruitment where you can apply . For your idea , here I am providing the recent notification of the Income Tax Department. Income Tax Department, Tamil Nadu & Puducherry has issued notification for recruitment for various posts against Sports Quota Vacancy Details: Total No. of Posts:25 Name of the Posts: 1. Inspector of Income-Tax: 02 Posts 2. Tax Assistant: 20 Posts 3. Multi Tasking Staff: 03 Posts Eligibility: Candidates should possess Degree from a recognized university or its equivalent for Post No.1 &2 and pass in Matriculation or its equivalent for Post No.3. Selection Process: Performance in trails Interview Important Dates: Last Date for Submission of Applications: 24-02-2014 Last Date for Submission of Applications from the Far Flung Areas: 03-03-2014       |