|

#2

9th December 2014, 01:22 PM

| |||

| |||

| Re: Income Tax Officer Recruitment Application Procedure

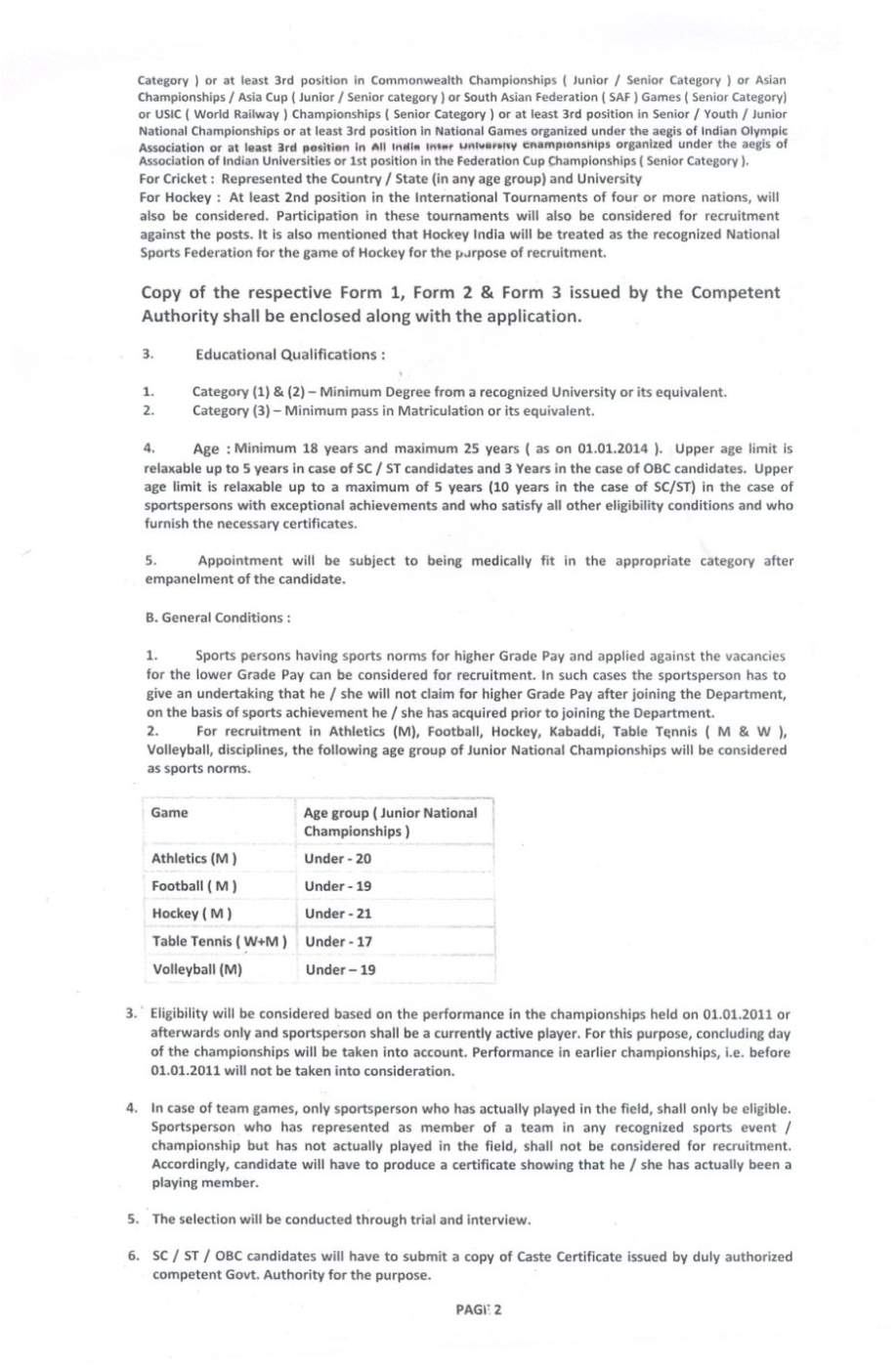

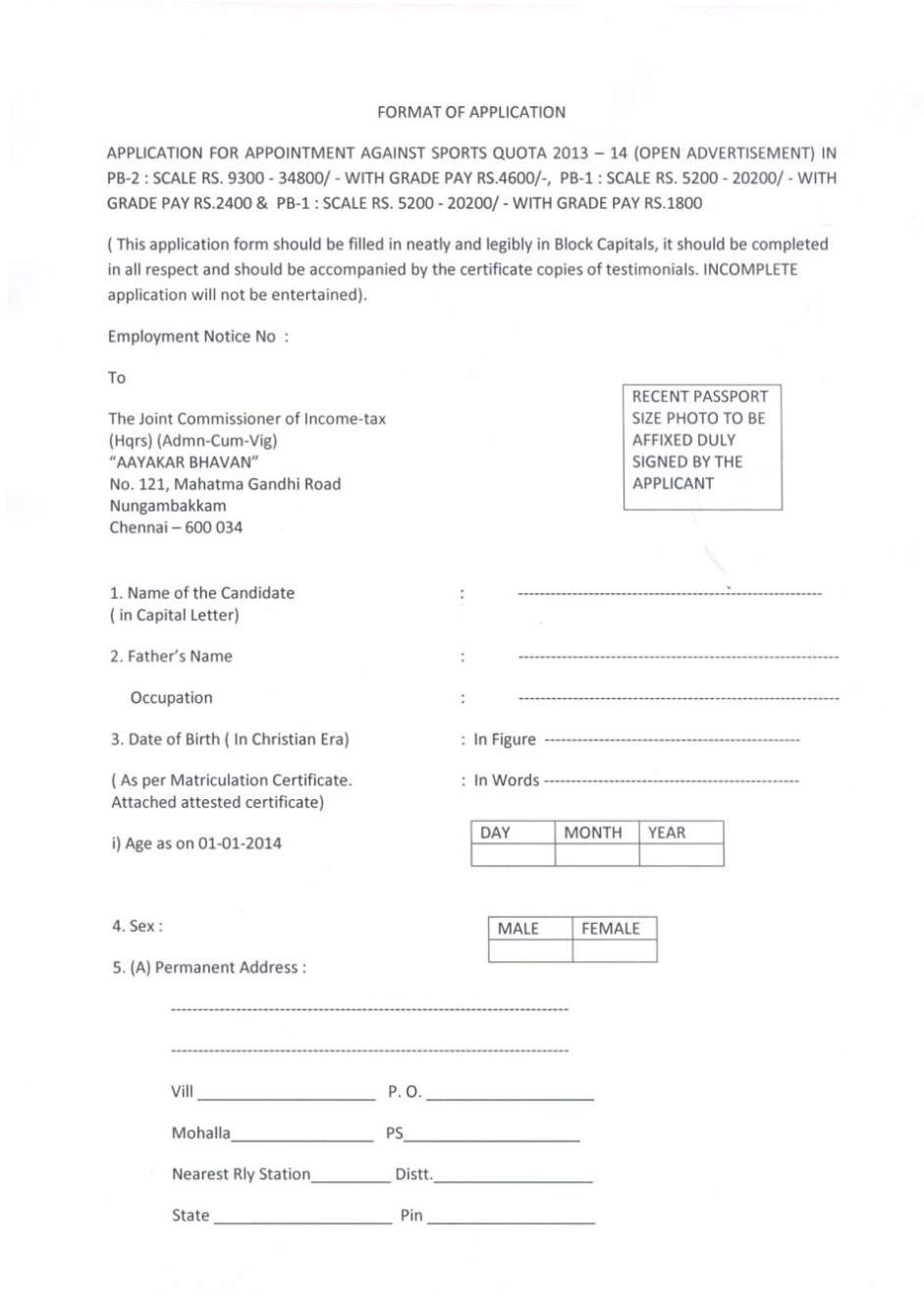

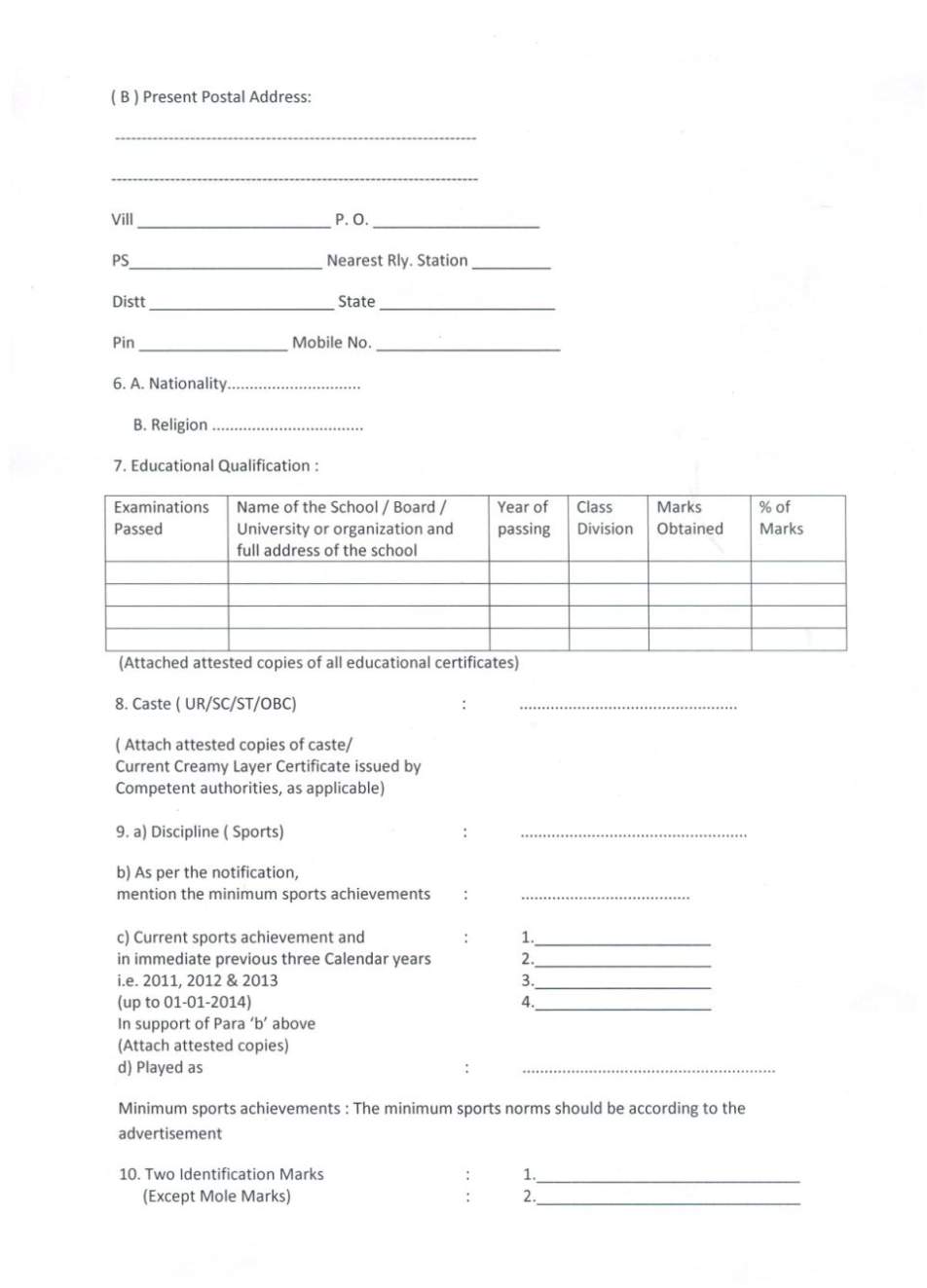

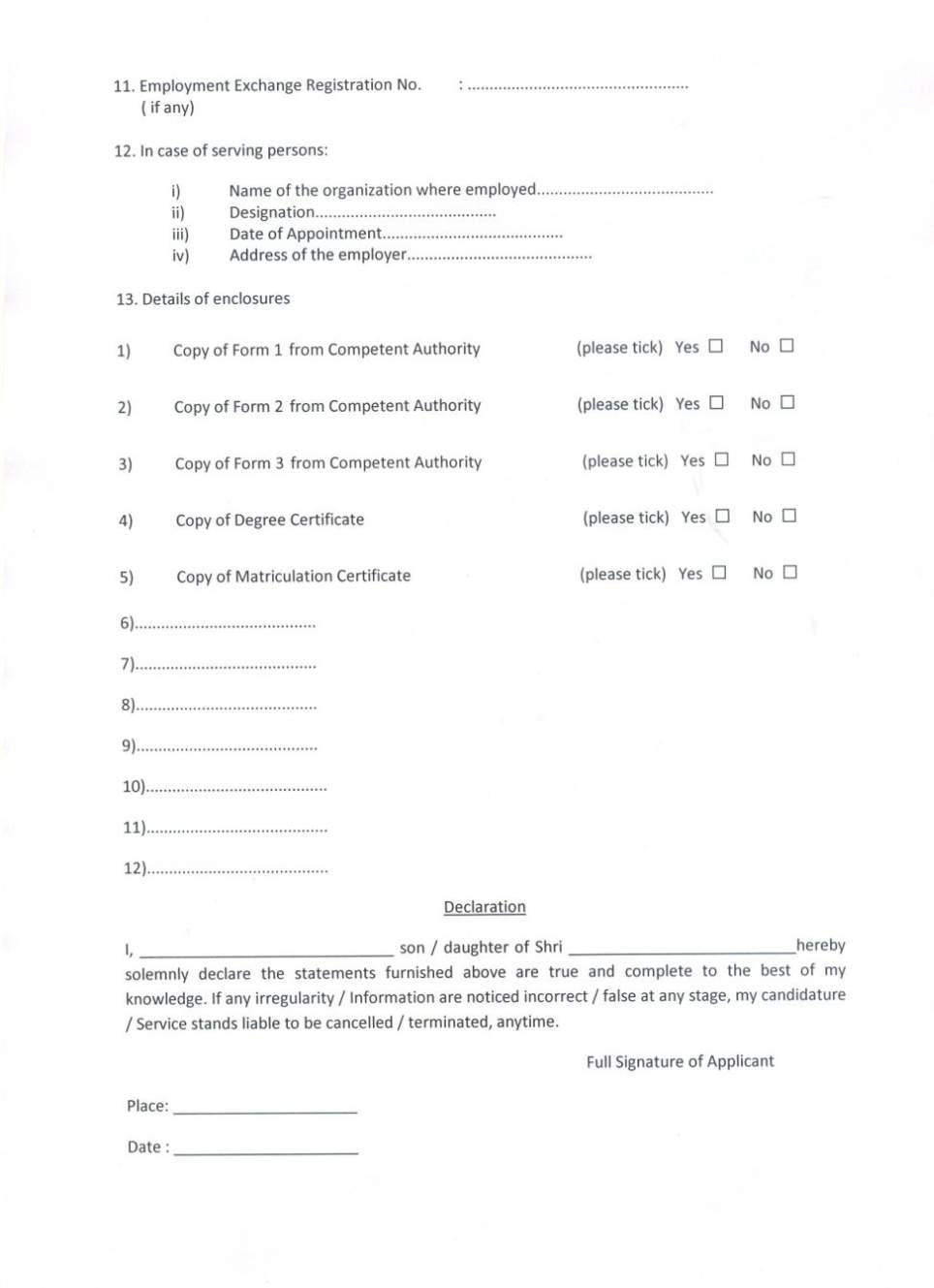

Income Tax Department, Government of India has issued notification for recruitment of the Inspector of Income Tax and Tax Assistant and other posts against Sports Quota in the Income-Tax Department Tamil Nadu & Puducherry. Vacancy Details: Total No. of Posts:25 Name of the Posts: 1. Inspector of Income-Tax: 02 Posts 2. Tax Assistant: 20 Posts 3. Multi Tasking Staff: 03 Posts Educational Qualification: Applicants should possess Degree from a recognized university or its equivalent for Post No.1 &2 and pass in Matriculation or its equivalent for Post No.3. Age Limit: Applicants minimum age limit is 18 years and maximum age is 25 years as on 01-01-2014. Important Dates: Last Date for Submission of Applications: 24-02-2014 till 05:00 PM Last Date for Submission of Applications from the Far Flung Areas: 03-03-2014 up to 05:00 PM.       |