|

#2

15th March 2016, 01:01 PM

| |||

| |||

| Re: PNB MF Transaction Slip

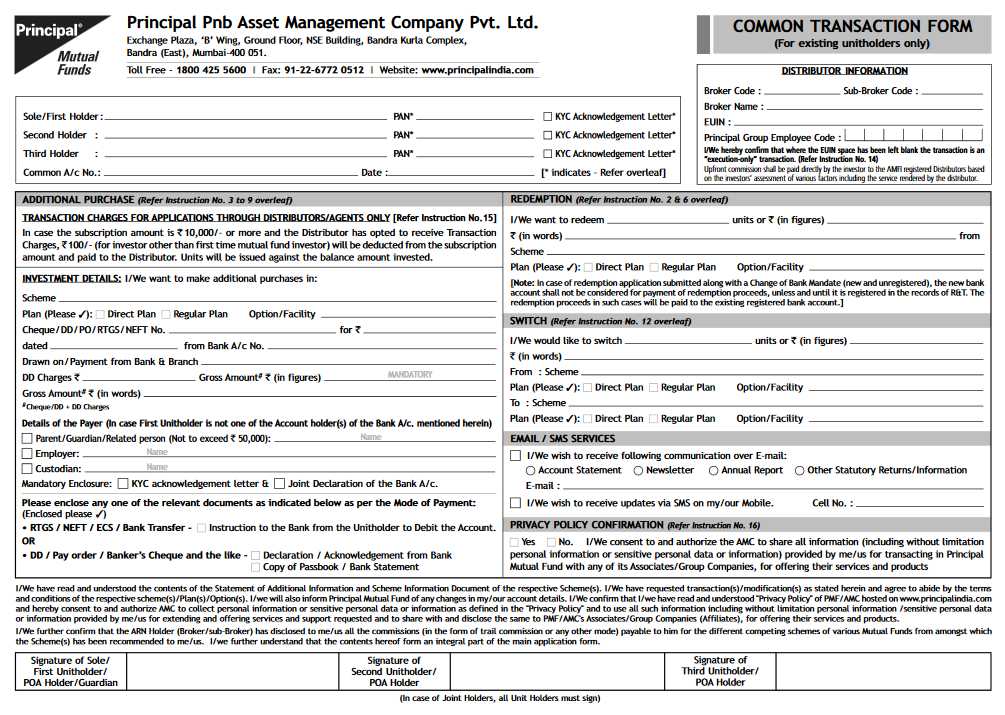

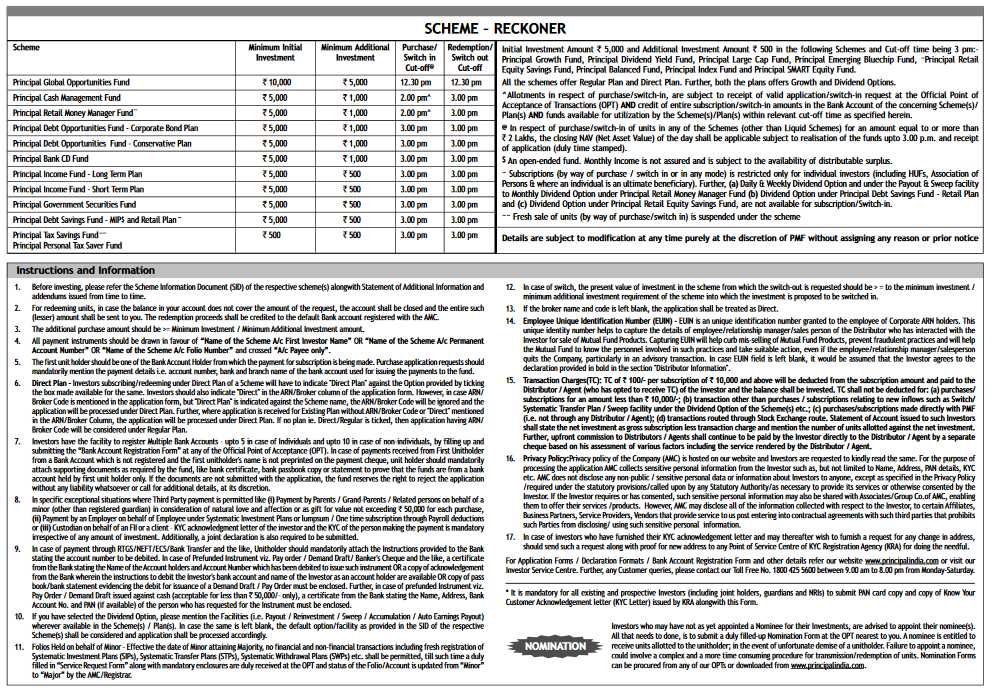

In a endeavor to develop the scope of administrations accessible to our clients, PNB has been appropriating the results of Principal PNB Asset Management Company Pvt. Ltd. from its assigned branches, since July, 2004. To give assortment of Mutual Fund Products to its clients, Now the Bank has likewise begun the Distribution and Marketing of UTI Mutual Fund Products. To suit different sort of necessities of the speculators, a portion of the plans of Principal PNB AMC and UTI AMC are as under: Principal PNB AMC: Principal Growth Scheme: Open-finished value store with a venture arrangement of stocks differentiated crosswise over various parts of the economy. Principal adjusted Fund: Open finished asset with a value (differentiated) part of 51% to 70% and Debt segment (counting Money Market) 30% to 49%. Principal Income Fund: Open-finished asset with up to 100% interest in Debt instruments (counting Money Market instruments and securitized obligation) Primary Income Fund – Short Term Plan: The plan is implied for speculators looking for stable returns over shorter-term venture skylines contrasted with the Principal Income Fund. Primary Cash administration Fund: An Open-finished asset that puts 100% of its corpus in Money Market instruments and looks to give a superb parkway to stop transient money surpluses and procure returns connected to the call currency market rates. Foremost Index Fund: An Open-finished asset that tracks S&P CNX Nifty (NSE) nearly. The point of the asset is to give its financial specialists returns equivalent with the Nifty. Primary Large Cap Fund: An open-finished plan to put resources into the loads of the organizations having a vast business sector capitalization. The asset is suitable for speculators intrigued by long haul capital appreciation. Important Child Benefit Fund The plan is suitable for a financial specialist looking for long haul development and gathering of capital for the recipient. The goal of the plan is to create consistent returns and/or capital thankfulness/gradual addition with the point of giving singular amount capital development toward the end of the picked target period or generally to the Beneficiary. Main Global Opportunities Fund It is an open-finished development store. The asset is suitable for financial specialists who might want to enhance speculations into different markets/securities by exploiting the potential development in the worldwide markets and in this way lessen the danger of having a portfolio dominatingly put resources into India. The venture goal of the plan is to assemble a high caliber. Global Equity portfolio out of the allowable speculations as characterized and allowed under the regulations every once in a while and give returns and/or capital thankfulness alongside standard liquidity to the financial specialists. Central Infrastructure and Service Sector Fund: An open-finished Equity Scheme with a target to give capital thankfulness and salary circulation by putting dominatingly in Equity/Equity related instruments of Infrastructure and Service Sector organizations.. Central Tax Savings Fund: An open-finished Equity connected reserve funds plan suitable for speculators looking for money charge derivations under segment 80C(2) of Income Tax Act alongside long haul value market comes back from interest in values. Vital Personal Tax Saver Fund: The plan is suitable for financial specialists looking for money charge reasonings under segment 80C(2) of ITA alongside long haul value market comes back from interest in values. Key Monthly Income Plan: An open-finished pay plan having periodical appropriation with no guaranteed month to month returns. MIP endeavors to give pay on a month to month premise and is, hence, especially suited for speculators looking for normal wellspring of pay.   |