|

#2

11th December 2014, 10:31 AM

| |||

| |||

| Re: Procedure to do Chartered Accountant after B.Com

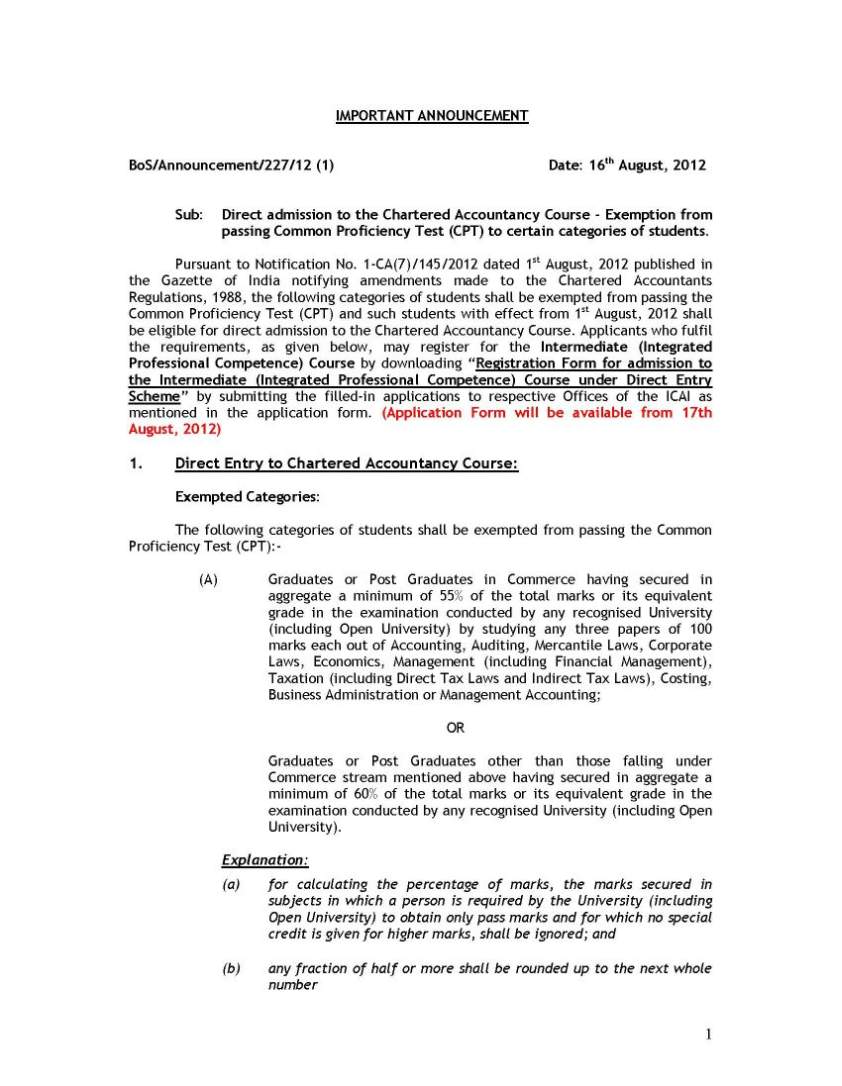

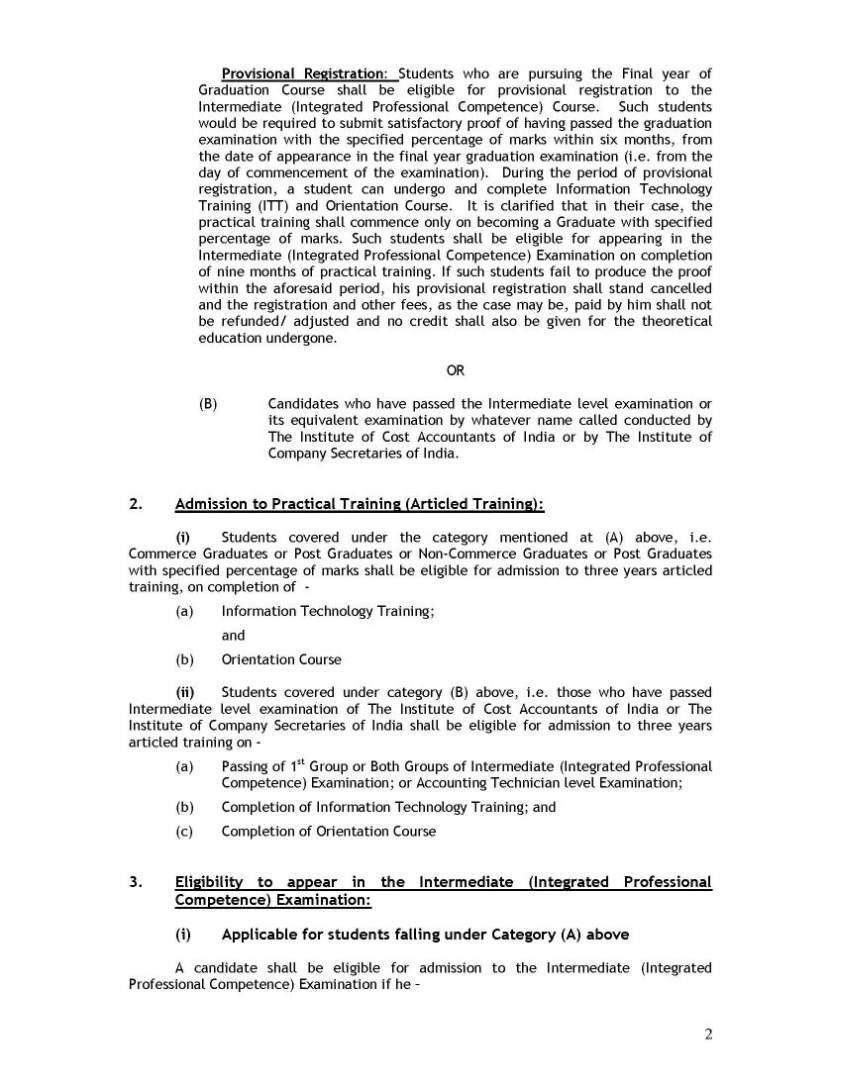

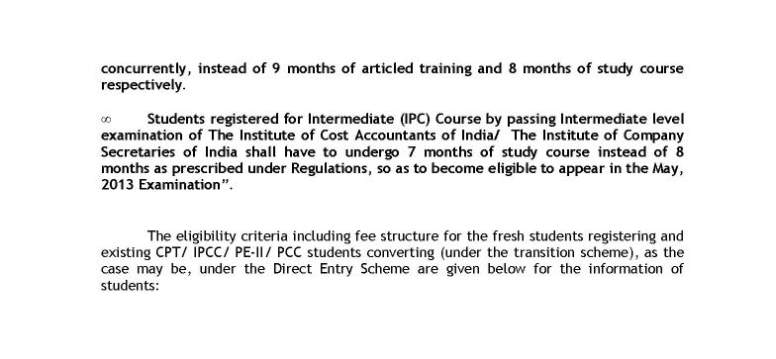

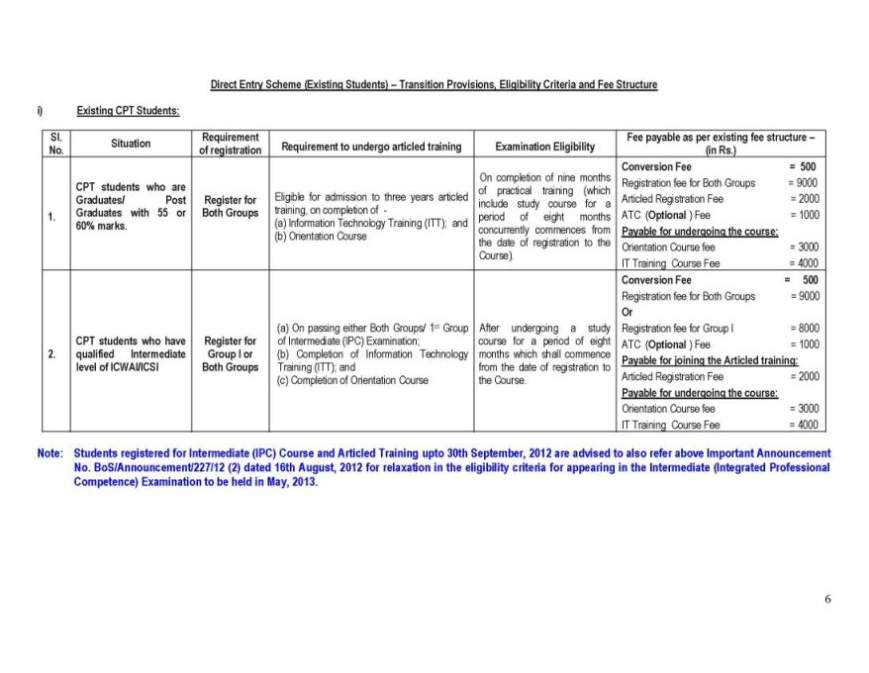

As you have done graduation, so there is no need to give CPT exam you can directly register yourself for IPCC exam. Eligibility for IPCC after graduation: Graduates or Post Graduates in Commerce having secured in minimum 55% or equivalent grade in the exam conducted by recognized University You can apply online or you may buy the prospectus and admission form from its centers. There are 3 levels in CA Common Proficiency Test (CPT) IPCC (2 GROUPS) Final examination Subjects in Executive level Accounting Law, Ethics and Communication Cost Accounting and Financial Management Taxation Advanced Accounting Auditing and Assurance Information Technology and Strategic Management Duration of Chartered Accountancy course for graduates 2.5 years minimum. Fee of Chartered Accountancy course - 40000/- For more details here is the attachment Direct admission to the CA Course Details       |