|

#2

31st July 2017, 03:14 PM

| |||

| |||

| Re: Loan against Property Ratnakar Bank

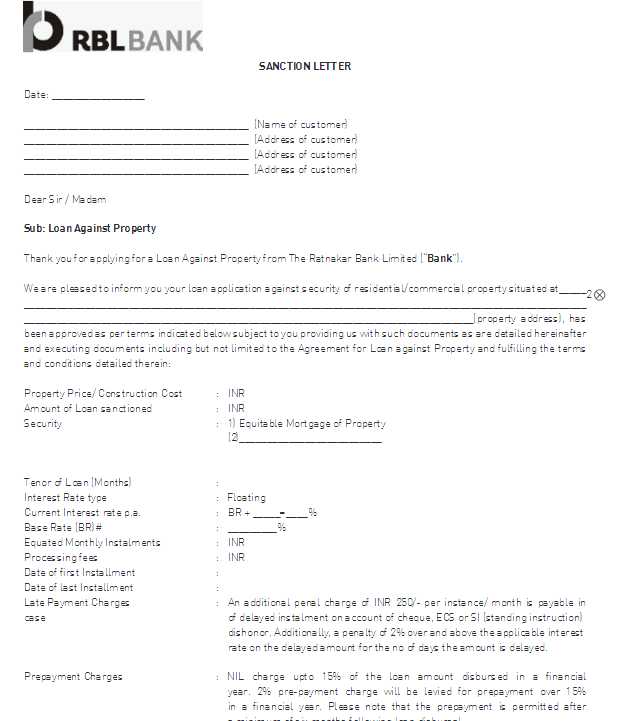

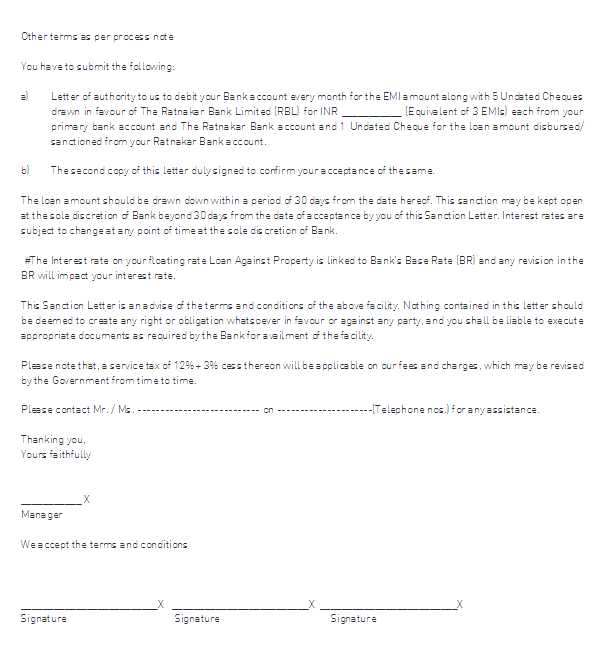

As you are looking for information about Loan against Property offering by Ratnakar Bank, so I am giving following information: Ratnakar BankLoan against Property Features: Loan amount of upto 10 Crores Both residential and commercial property accepted as collateral Attractive interest rates Fixed rate for first three years available Minimal documentation and faster approvals Convenient loan repayment option of upto 180 months Avail loan upto 80% of your property value Eligibility: It can be availed by salaried individuals, self-employed individuals, self-employed professionals, sole proprietorships, partnership firms and private limited companies Loan Against Property can be offered to Indian Residents only. Salaried Individuals Minimum gross salary of 150,000 per annum. Minimum age at loan sanction - 23 years. Maximum age at loan maturity - lower of 60 years or retirement age. Self-Employed Individuals and Professional Minimum net profit as per latest year ITR / Financials of 150,000. Minimum age at loan sanction - 23 years. Maximum age at loan maturity - 65 years. Documents Required: PAN Card - For Individual / Partnership Firm / Company Identity Proof - Any one (e.g. Voter ID / Driving License / Passport) Address Proof - Any one (e.g. Voter ID / Driving License / Passport / Telephone Bill / Electricity Bill / Registered Lease Deed or Sale Agreement / Bank Statement) Business Continuity Proof - Any one document dated 5 years old (Bank Statement / Sales Tax Challans / IT Returns / Shops & Est. Certificate / COI / Partnership Deed) Passport Size Photographs Financial Documents Required: For Salaried: Last 2 years Income tax returns or latest 3 month salary slip or latest Form 16 issued by the employer. Six months bank statement required with salary credits For Self-Employed Individuals / Sole Proprietorships: Latest audited ITR and financials for the last 3 years. (Balance Sheet, Profit & Loss A/c., Computation of Income along with all schedules.) Bank statements from the borrower's main account/s for last 6 months and 3 months of all other bank accounts mentioned in the Balance Sheet For Self-Employed Professionals: Latest audited ITR and financials for the last 3 years. (Balance Sheet, Profit & Loss A/c., Computation of Income along with all schedules.) Bank statements from the borrower's main account/s for last 6 months and 3 months of all other bank accounts mentioned in the Balance Sheet. Professional Qualification Certificate and Degree Certificate for professionals. (Doctors, Architects, Chartered Accountants etc.)   I am attaching application form to apply for Loan Against Property at Ratnakar Bank for your reference: Last edited by sumit; 31st July 2017 at 03:34 PM. |