Reserve Bank of India conducts Grade B Officer Examination in two phases. These are followings.

RBI Phase I: Objective Type questions.

i) General Awareness

ii) English Language

iii) Quantitative Aptitude

iv) Reasoning

RBI Phase II: Descriptive Type Questions.

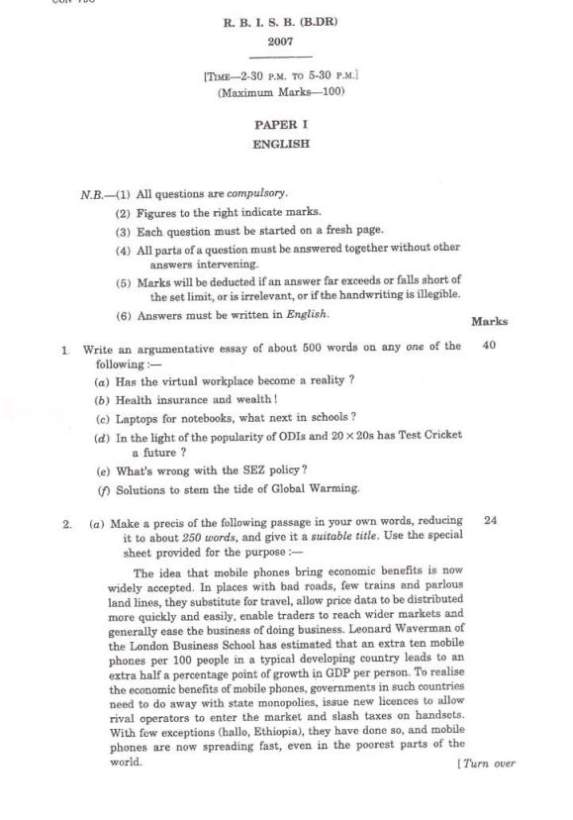

(i) Paper I – English

(ii) Paper II – Economic and Social Issues and

(iii) Paper III – Finance and Management.

As per your request, I am forwarding you RBI Grade B Phase II previous year question paper.

Essay (40m)

Write an argumentative essay in about 500 words on any one of the following topics: 40marks

Can technology bring about economic growth with social justice?

Has the RBI succeeded in curbing inflation?

Can we have a corruption-free sobriety?

Has the economic balance of power tilted eastwards?

Is social ‘net’ working a blessing or a curse?

Précis writing (24m)

Make a

précis of the following passage reducing it to about (230 words) and give it a suitable title. Write the

précis on the special sheet provided for this purpose. 24marks

Microfinance is now understood as a financial activity. But, it actually emerged from development considerations. The need for access to capital was specifically articulated by women during the UN Conference on Women and Development in Mexico City in 1976. The focus then was on the micro-person, the person with a micro-status in society.

The term microfinance came much later and its association moved from savings to microcredit to financial services. However, the primary objective of microfinance has always been developmental in nature. All along, it was aimed at removing poverty and hunger. But these two questions cannot be addressed adequately without factoring in the issue of health.

Financial services are not just about money or giving loans to the poor. They are really about building assets to provide security and livelihood to poor people. This would be impossible to achieve without taking into account the health status of poor individuals and their families.

All too frequently, the poor default on paying back their loans cause of ill health and inability to earn during that period. This has taught us an important lesson: The poor work at the cost of their own body.

A poor woman’s health and, therefore, her body is the first and foremost asset of her work and her life. For microfinance to achieve its objective of providing financial services to the poor it has to lay stress on health security as a crucial element of social security. They are indeed, two sides of the same coin.

When I started organizing informal sector labour in the late 1960s and early 1970s, I asked the poor what they wanted most invariably, it was work they sought and not charity. Yes, they longed for a better life but not the one without dignity. At the same time, it was clear that their earnings could easily be wiped out without support services most importantly, health and childcare.

Capacity building in numeracy and literacy also required social security. This is necessary for sustained development and higher levels of efficiency. This is where microfinance can play an important role and, for this reason, we need more microfinance co-operatives today.

But addressing this and providing health security is currently difficult since insurance schemes are generally not suited to the poor. We must therefore, develop innovative insurance products that meet the requirements of the poor while satisfying insurance principles. That is why an integrated approach that links microfinance with healthcare is so essential for development.

A product that has worked well is the deposit-linked life and non-life insurance. As the demand for insurance grows, the need for an independent, autonomous body offering health insurance to its members grows as well. This is an important social security measure because, among other things, it can help finance medical expenditure.

The banks can play an important role in this area by providing financial services that cater to the healthcare needs of the poor borrowers. These include flexible savings and loans and particularly emergency loans on demand. Housing loans too can mitigate the hardship of the poor improved living conditions lead to better and healthier lifestyle. In this connection one needs to strengthen the participation of women in banking especially in microfinance.

In the final analysis, it is the women of the household who balance the family budget. They can, therefore, play a vital role in nourishing not just kinship ties but health and well-being of the family as well. Thus, when she borrows from a Microfinance Institution (MFI) she sees it not just as access to money but as access to an input that will strengthen her family To ensure that women continue to play a pivotal role in MIFIs, we have to ensure that they are protected through social security and health security.

A Government that fails in its duty to provide basic healthcare services at the local level adds to the indebtedness of the poor workers. That is why, the microfinance sector should collectively take up this policy issue with tie Government. We must remember that income security and health security are two sides of the same coin, especially for the poor who are at the heart of MFIs.

Ela Bhatt.

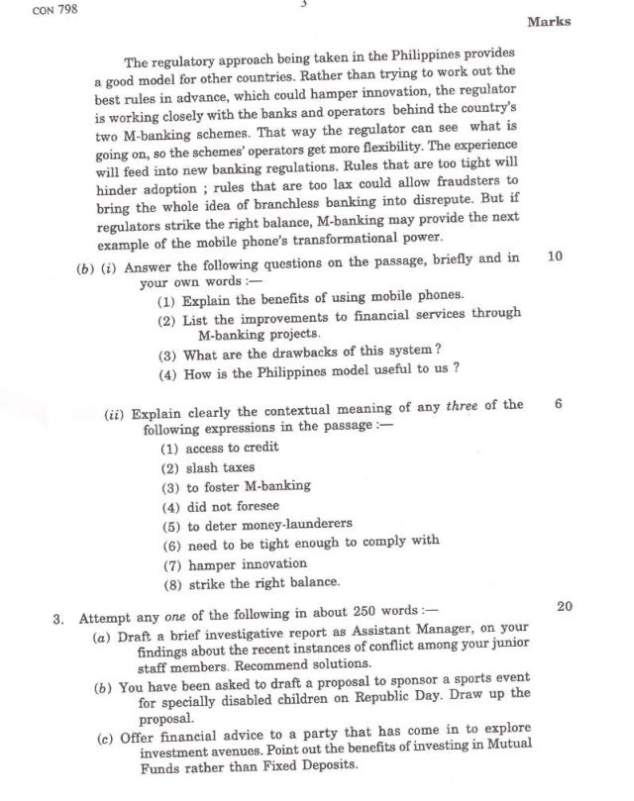

Comprehension (16m)

From the above passage, Answer following Questions in your own words (Any three, 12m)

1. Trace the in of the term microfinance What has been its aim all along?

2. Why do the poor default on repayment? What lesson has the author learnt from this experience?

3. Why does the author say that to truly benefit the needy microfinance sector should focus on the issue of health?

4. What role can insurance companies and banks play in providing social security to poor borrowers?

5. Why does the author say that women can play a vital role in ensuring the success of MFIs

Explain contextual meaning of any four (4 marks)

1. development considerations

2. crucial element

3. informal sector

4. support services

5. sustained development

6. integrated approach

Letter/Report writing (20m)

Write Any one of the following (250 words)

Indian households have savings of above 30%— one of the highest in the world. A Committee has been constituted to suggest various financial products where these savings can be invested with a view to protecting the principal from inflation and also to give positive and real returns. Draft the Committee Report.

Commuting to office during peak hours has become an ordeal particularly in large cities. This is affecting the efficiency of the employees. As the HR Manager draft a proposal to be sent to RBI for introducing flexible working hours in the bank. Highlight the salient features of flexi-time and how it would enhance efficiency at workplace.

RBI had issued a Notification directing commercial banks against lending more than 80% of the value of the property for loans above Rs. 20 lakhs. The President of the Association of Real Estate Developers of India has written to RBI stating that this move does not bode well for developers as it may lead to drop in home sales. On behalf of RBI write a suitable reply to be sent to the President of the Association. Impress upon the real estate developers that the notification is aimed at curbing speculation in the market and not at affecting home sales.

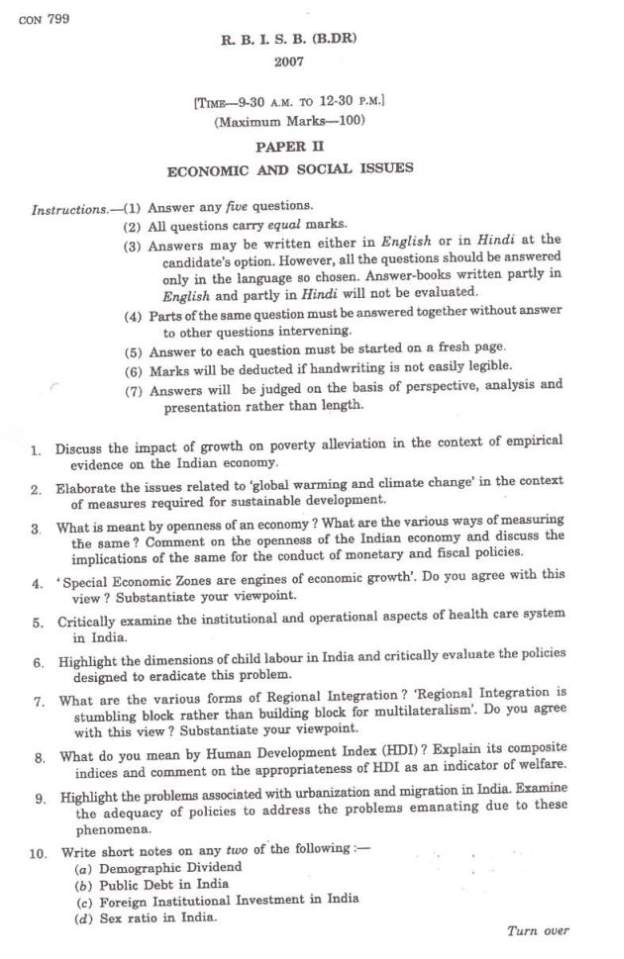

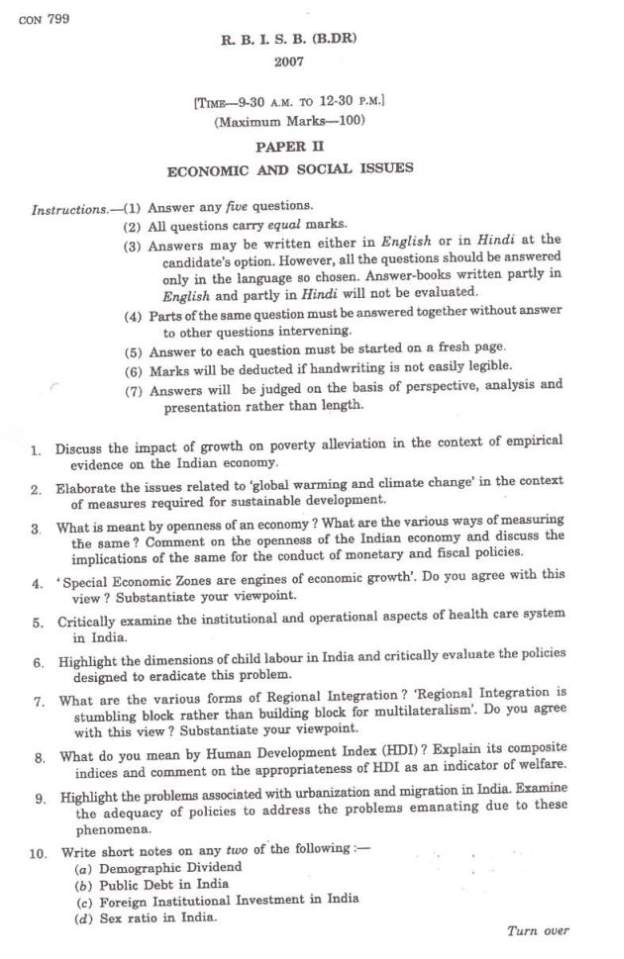

Paper 2: ECONOMIC AND SOCIAL ISSUES

Questions (Attempt any five)

Examine the banking sector reform measures undertaken in India since 1991. Briefly describe the recent changes in RBI’s monetary policy.

What is sustainable development? What should be done to achieve it?

What is environment management? Explain social and economic aspects of environment management.

Do you agree with a view that public sector enterprises have played a strategic role in accelerating economic growth? Explain.

Explain the importance of service sector and its contribution to employment in India.

Monetary measures have failed to control inflation in India.” Explain. (b) Suggest suitable options for controlling inflation.

Explain the measures and strategies adopted by India on the following subjects

Provision of Social Security

Foreign Direct Investment.

Explain the factors responsible for rapid growth of export over the past decade.

What changes have taken place in the product composition of exports in recent years.

Religion continues to be an important source of identity for most people in South Asia. Discuss.

Examine the need of secularism in our country with special reference to constitution of India.

Is creation of smaller states the right solution to improve the quality of governance and check corruption? Discuss.

Explain the changes in public administration in the age of globalization and liberalization.

Caste factor is most dominant and omnipresent in Indian politics ‘. Discuss the statement with suitable illustration.

Explain the impact of reservation policy on scheduled castes and scheduled tribes.

Write notes on any two :

Impact of globalization on culture, media and technology.

Role of small and medium enterprises in Indian economy.

Privatization of higher education.

IMF in the changing world.

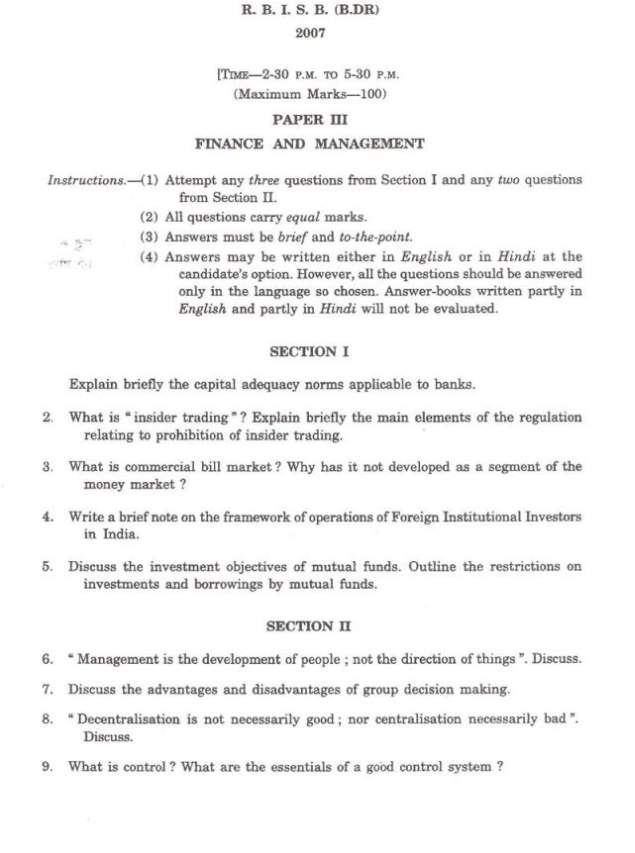

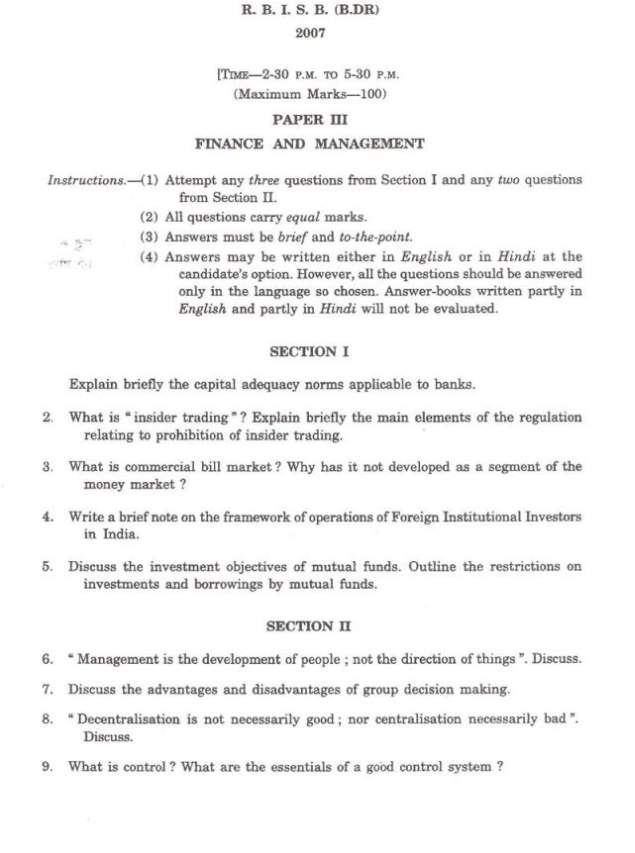

Paper 3

Section I (Write Any Three Qs)

What is meant by merchant banking? Discuss in detail the various functions performed by merchant bankers.

Briefly explain the salient features of the Foreign Exchange Management Act.

“A tax is a burden on the present ; a debt (loan) puts the burden of repayment on future generations.” Explain.

Explain in detail the different methods of credit control in India.

(a) What is securitization? What purpose does it serve? (b) Discuss the benefits and limitations of securitization.

Section II (Write Any Two Qs)

Sound organization is an essential prerequisite of efficient management.” Explain.

What are the major differences between autocratic, democratic and abdicative styles of leadership?

(a) Explain the terms authority and responsibility (b) What is delegation of authority? How can delegation be made effective?

Discuss the role of communication in an organization. What are the barriers to effective communication?

RBI Grade B Phase II Previous Year Paper