|

#2

2nd February 2017, 09:24 AM

| |||

| |||

| Re: Online TDS Payment Syndicate Bank

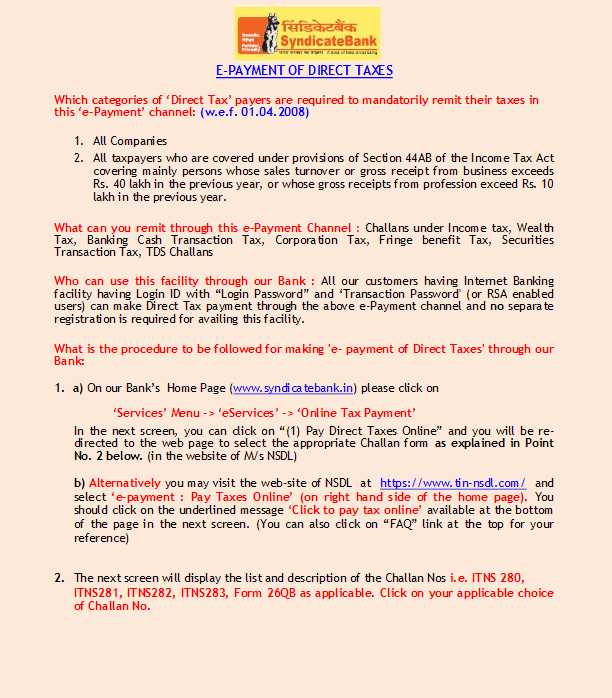

As per your concern I will get information of Syndicate Bank, procedure to make TDS payment so that you can get idea. Here is the procedure Which categories of „Direct Tax‟ payers are required to mandatorily remit their taxes in this „e-Payment‟ channel All Companies All taxpayers who are covered under provisions of Section 44AB of the Income Tax Act covering mainly persons whose sales turnover or gross receipt from business exceeds Rs. 40 lakh in the previous year, or whose gross receipts from profession exceed Rs. 10 lakh in the previous year What can you remit through this e-Payment Channel : Challans under Income tax, Wealth Tax, Banking Cash Transaction Tax, Corporation Tax, Fringe benefit Tax, Securities Transaction Tax, TDS Challans Who can use this facility through our Bank : All our customers having Internet Banking facility having Login ID with “Login Password” and „Transaction Password' (or RSA enabled users) can make Direct Tax payment through the above e-Payment channel and no separate registration is required for availing this facility. Procedure of TDS payment    Address:- Syndicate Bank Door No. 16/355 & 16/365A Manipal - 576 104 Udupi District Karnataka State (India) Phone:- 0820-2571181 to 2571196 |