|

#2

19th September 2017, 11:45 AM

| |||

| |||

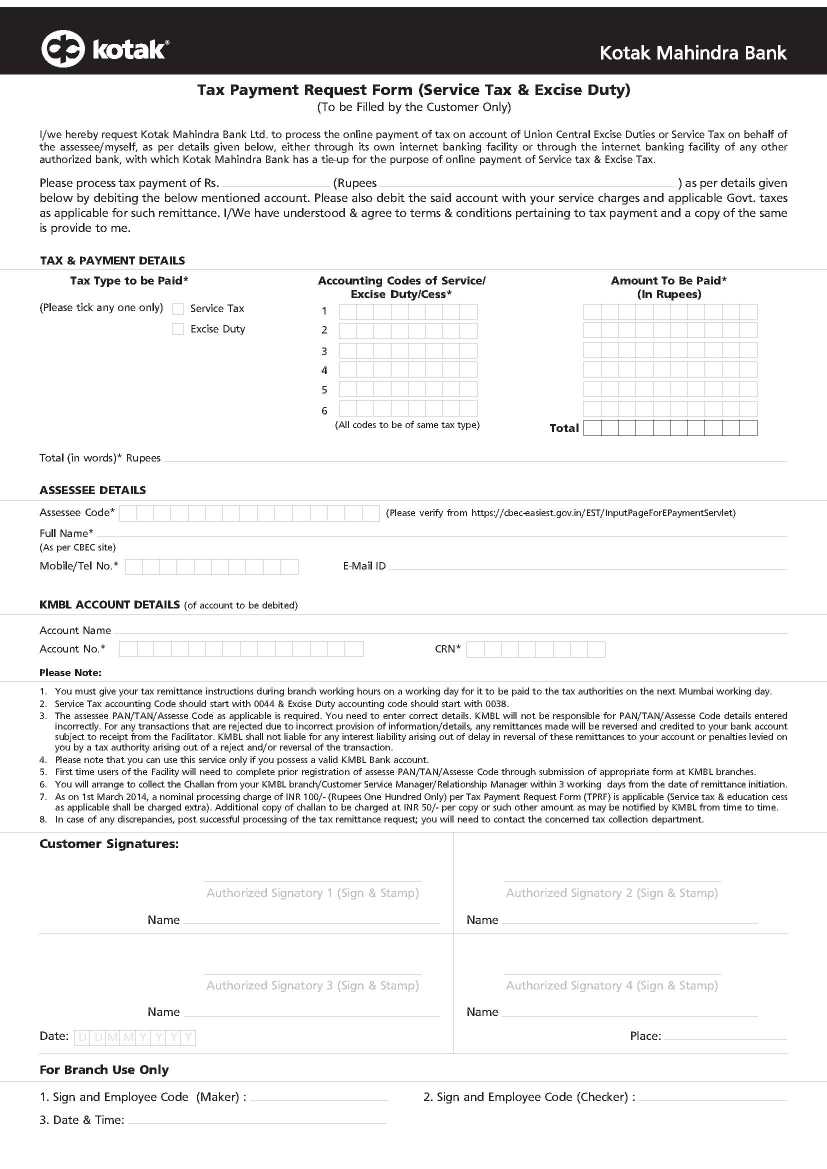

| Re: Kotak Mahindra Bank Service Tax Payment

I am providing you the Tax Payment Request Form (Service Tax & Excise Duty) of Kotak Mahindra Bank. Kotak Mahindra Bank Tax Payment Request Form (Service Tax & Excise Duty)   To be Filled by the Customer Only You must give your tax remittance instructions during branch working hours on a working day for it to be paid to the tax authorities on the next Mumbai working day. Service Tax accounting Code should start with 0044 & Excise Duty accounting code should start with 0038. The assessee PAN/TAN/Assesse Code as applicable is required. You need to enter correct details. KMBL will not be responsible for PAN/TAN/Assesse Code details entered incorrectly. Please note that you can use this service only if you possess a valid KMBL Bank account. First time users of the Facility will need to complete prior registration of assesse PAN/TAN/Assesse Code through submission of appropriate form at KMBL branches. You will arrange to collect the Challan from your KMBL branch/Customer Service Manager/Relationship Manager within 3 working days from the date of remittance initiation. A nominal processing charge of INR 100/- (Rupees One Hundred Only) per Tax Payment Request Form (TPRF) is applicable Additional copy of challan to be charged at INR 50/- per copy or such other amount as may be notified by KMBL from time to time. Contact- Registered Office Kotak Mahindra Bank 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051 |