|

#2

25th January 2018, 02:48 PM

| |||

| |||

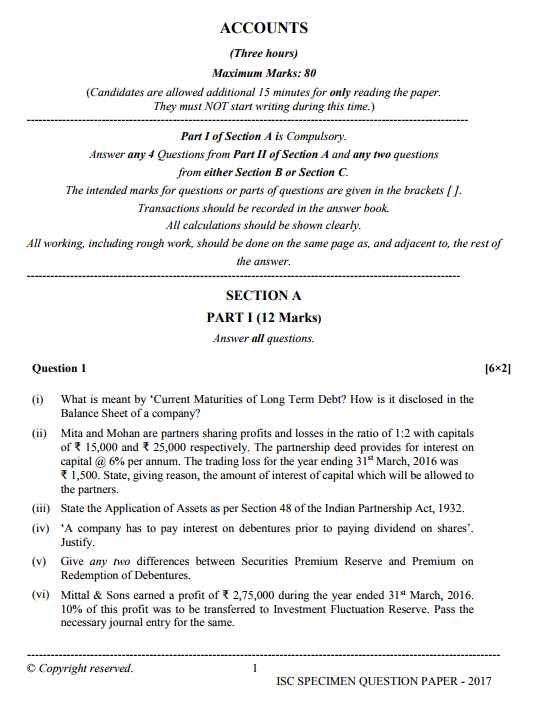

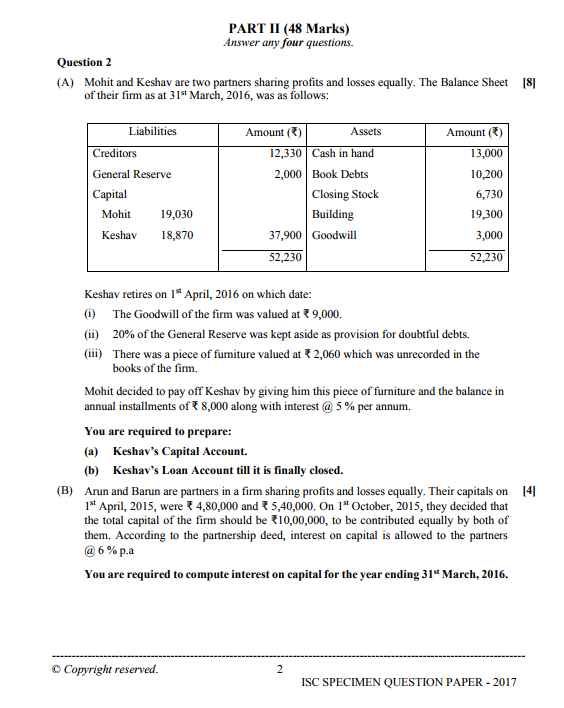

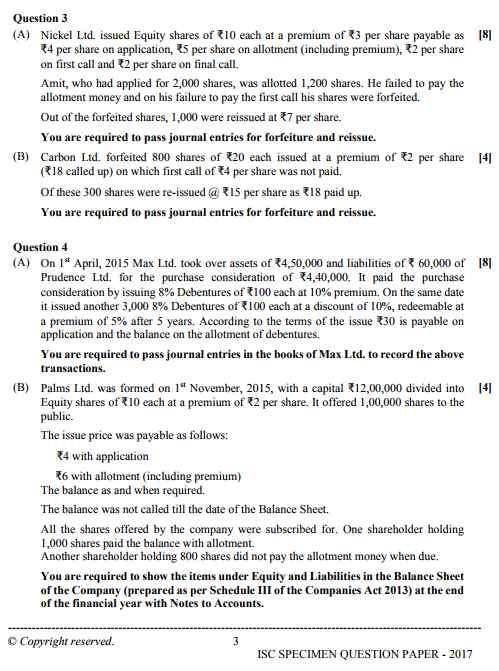

| Re: ISC Accounts Paper

As you Asking for the Question Paper of the ISC Class 12th Exam Accounts the Question Paper is given below SECTION A PART I (12 Marks) Answer all questions. Question 1 (i) What is meant by Current Maturities of Long Term Debt? How is it disclosed in the Balance Sheet of a company? (ii) Mita and Mohan are partners sharing profits and losses in the ratio of 1:2 with capitals of ₹ 15,000 and ₹ 25,000 respectively. The partnership deed provides for interest on capital @ 6% per annum. The trading loss for the year ending 31st March, 2016 was ₹ 1,500. State, giving reason, the amount of interest of capital which will be allowed to the partners. (iii) State the Application of Assets as per Section 48 of the Indian Partnership Act, 1932. (iv) A company has to pay interest on debentures prior to paying dividend on shares . Justify. (v) Give any two differences between Securities Premium Reserve and Premium on Redemption of Debentures. (vi) Mittal & Sons earned a profit of ₹ 2,75,000 during the year ended 31st March, 2016. 10% of this profit was to be transferred to Investment Fluctuation Reserve. Pass the necessary journal entry for the same. Arun and Barun are partners in a firm sharing profits and losses equally. Their capitals on 1 st April, 2015, were ₹ 4,80,000 and ₹ 5,40,000. On 1st October, 2015, they decided that the total capital of the firm should be ₹10,00,000, to be contributed equally by both of them. According to the partnership deed, interest on capital is allowed to the partners @ 6 % p.a You are required to compute interest on capital for the year ending 31st March, 2016 Question 3 (A) Nickel Ltd. issued Equity shares of ₹10 each at a premium of ₹3 per share payable as ₹4 per share on application, ₹5 per share on allotment (including premium), ₹2 per share on first call and ₹2 per share on final call. Amit, who had applied for 2,000 shares, was allotted 1,200 shares. He failed to pay the allotment money and on his failure to pay the first call his shares were forfeited. Out of the forfeited shares, 1,000 were reissued at ₹7 per share. You are required to pass journal entries for forfeiture and reissue. (B) Carbon Ltd. forfeited 800 shares of ₹20 each issued at a premium of ₹2 per share (₹18 called up) on which first call of ₹4 per share was not paid. Of these 300 shares were re-issued @ ₹15 per share as ₹18 paid up. You are required to pass journal entries for forfeiture and reissue. Question 4 (A) On 1st April, 2015 Max Ltd. took over assets of ₹4,50,000 and liabilities of ₹ 60,000 of Prudence Ltd. for the purchase consideration of ₹4,40,000. It paid the purchase consideration by issuing 8% Debentures of ₹100 each at 10% premium. On the same date it issued another 3,000 8% Debentures of ₹100 each at a discount of 10%, redeemable at a premium of 5% after 5 years. According to the terms of the issue ₹30 is payable on application and the balance on the allotment of debentures. For more Information you may Consider the below Attachement that is Free to Download Question Paper of the ISC Class 12th Exam Accounts    |