|

#2

9th March 2016, 08:54 AM

| |||

| |||

| Re: Investment Plans for Short Term

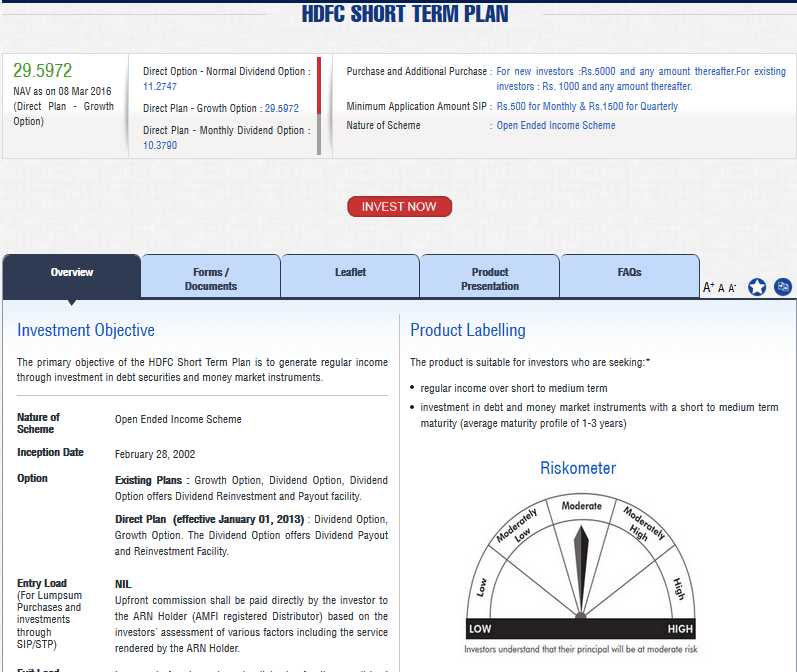

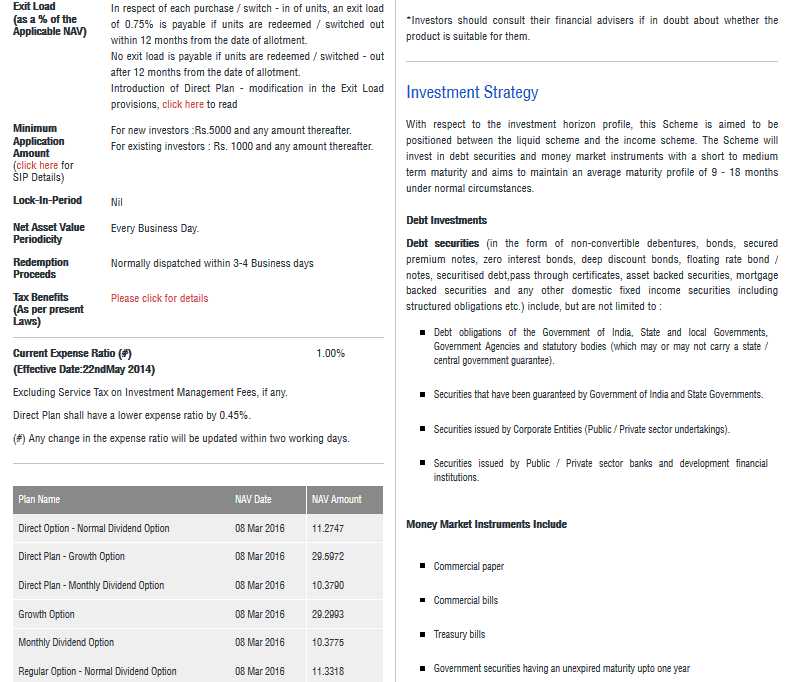

The primary objective of the HDFC Short Term Plan is to generate regular income through investment in debt securities and money market instruments. Nature of Scheme: Open Ended Income Scheme Inception Date: February 28, 2002 Option Existing Plans: Growth Option, Dividend Option, Dividend Option offers Dividend Reinvestment and Payout facility. Direct Plan (effective January 01, 2013) : Dividend Option, Growth Option. The Dividend Option offers Dividend Payout and Reinvestment Facility. Entry Load Upfront commission shall be paid directly by the investor to the ARN Holder (AMFI registered Distributor) based on the investors' assessment of various factors including the service rendered by the ARN Holder. Exit Load In respect of each purchase / switch - in of units, an exit load of 0.75% is payable if units are redeemed / switched out within 12 months from the date of allotment. No exit load is payable if units are redeemed / switched - out after 12 months from the date of allotment Minimum Application Amount For new investors: Rs.5000 and any amount thereafter. For existing investors: Rs. 1000 and any amount thereafter. Money Market Instruments Include -Commercial paper -Commercial bills -Treasury bills -Government securities having an unexpired maturity upto one year -CBLO (Collateralized Borrowing And Lending Obligation) -Certificate of deposit -Usance bills -Permitted securities under a repo / reverse repo agreement -Any other like instruments as may be permitted by RBI / SEBI from time to time   For getting more details about this Investment Plan here I am attaching an attachment: |