|

#2

4th August 2014, 04:16 PM

| |||

| |||

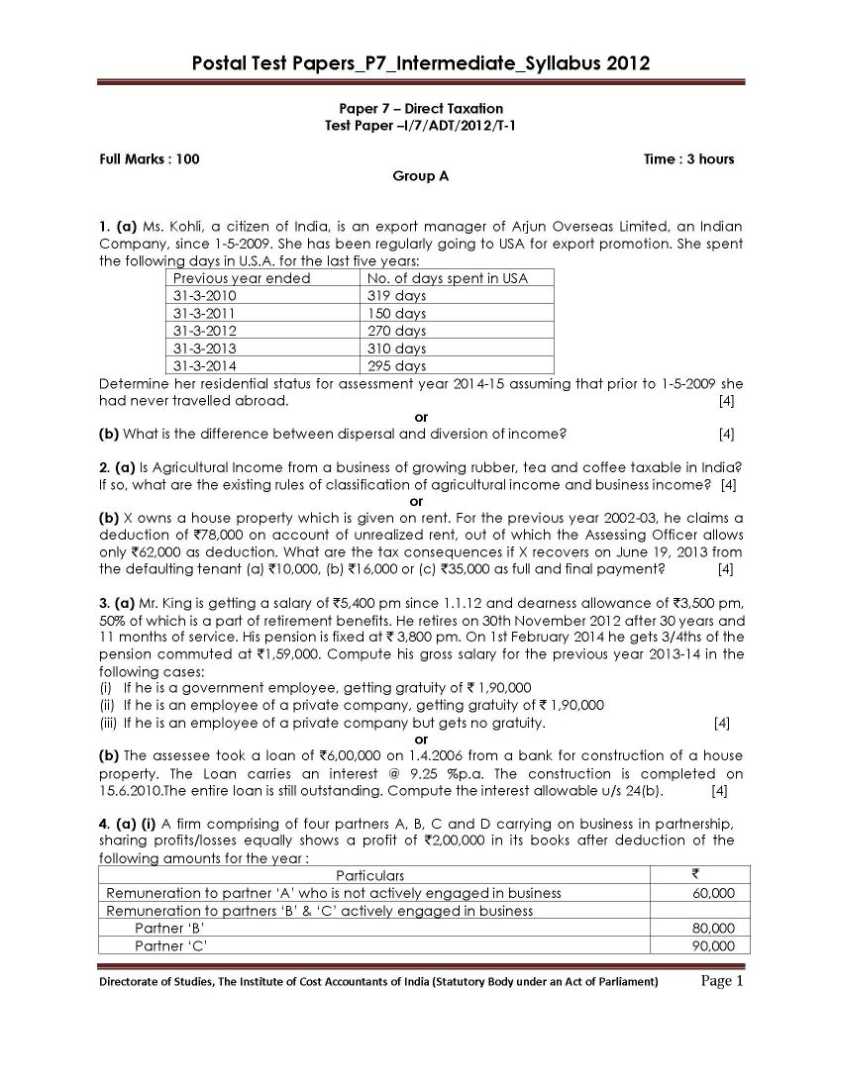

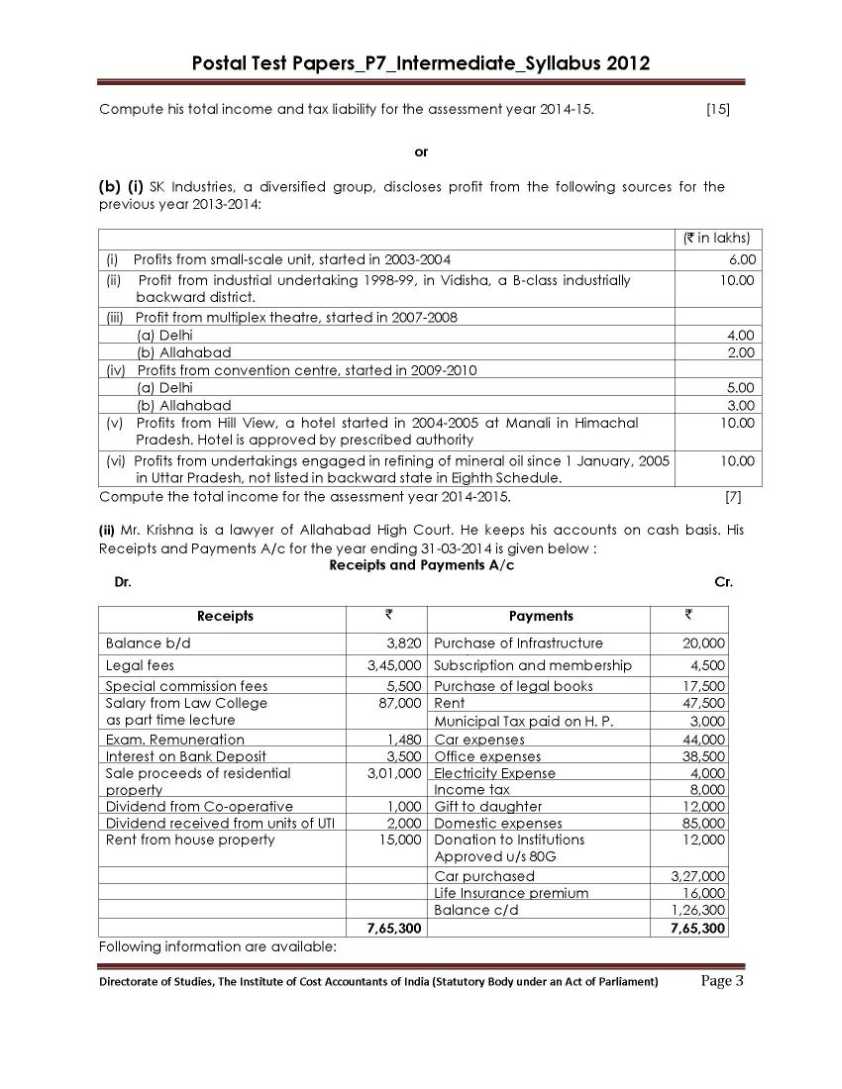

| Re: Institute of Cost Accountants of India Intermediate last year papers of Direct Ta

As you want to get the Institute of Cost Accountants of India Intermediate last year papers of Direct Taxation so here it is for you: Some content of the file has been given here: 1. (a) Ms. Kohli, a citizen of India, is an export manager of Arjun Overseas Limited, an Indian Company, since 1-5-2009. She has been regularly going to USA for export promotion. She spent the following days in U.S.A. for the last five years: Previous year ended No. of days spent in USA 31-3-2010 319 days 31-3-2011 150 days 31-3-2012 270 days 31-3-2013 310 days 31-3-2014 295 days Determine her residential status for assessment year 2014-15 assuming that prior to 1-5-2009 she had never travelled abroad. [4] or (b) What is the difference between dispersal and diversion of income? [4] 2. (a) Is Agricultural Income from a business of growing rubber, tea and coffee taxable in India? If so, what are the existing rules of classification of agricultural income and business income? [4] or (b) X owns a house property which is given on rent. For the previous year 2002-03, he claims a deduction of `78,000 on account of unrealized rent, out of which the Assessing Officer allows only `62,000 as deduction. What are the tax consequences if X recovers on June 19, 2013 from the defaulting tenant (a) `10,000, (b) `16,000 or (c) `35,000 as full and final payment? [4] 3. (a) Mr. King is getting a salary of `5,400 pm since 1.1.12 and dearness allowance of `3,500 pm, 50% of which is a part of retirement benefits. He retires on 30th November 2012 after 30 years and 11 months of service. His pension is fixed at ` 3,800 pm. On 1st February 2014 he gets 3/4ths of the pension commuted at `1,59,000. Compute his gross salary for the previous year 2013-14 in the following cases: (i) If he is a government employee, getting gratuity of ` 1,90,000 (ii) If he is an employee of a private company, getting gratuity of ` 1,90,000 (iii) If he is an employee of a private company but gets no gratuity. [4] or (b) The assessee took a loan of `6,00,000 on 1.4.2006 from a bank for construction of a house property. The Loan carries an interest @ 9.25 %p.a. The construction is completed on 15.6.2010.The entire loan is still outstanding. Compute the interest allowable u/s 24(b). [4] 4. (a) (i) A firm comprising of four partners A, B, C and D carrying on business in partnership, sharing profits/losses equally shows a profit of `2,00,000 in its books after deduction of the following amounts for the year : Particulars ` Remuneration to partner ‗A‘ who is not actively engaged in business 60,000 Remuneration to partners ‗B‘ & ‗C‘ actively engaged in business Partner ‗B‘ 80,000 Partner ‗C‘ 90,000 Interest to partner ‗D‘ on loan of `1,50,000 36,000 The deed of partnership provides for the payment of above remuneration and interest to partners. You are required to work out the taxable income of the firm as well as partners for assessment year 2014-15. [7] (ii) Vineet had been working with M Ltd., in a tribal area since 1-10-1999. He was entitled to the following emoluments: (1) Basic salary w.e.f. 1-1-2013 ` 6,000 p.m. (2) Dearness allowance 50% of basic salary (40% of which forms part of salary for retirement benefits) (3) Medical allowance ` 1500 p.m., (entire amount is spent on his own medical treatment). (4) Entertainment allowance ` 400 p.m. (5) Children education allowance ` 80 p.m. per child for three children. (6) Hostel expenditure allowance ` 100 p.m. per child for three children. (7) Uniform allowance ` 250 p.m. (He spends ` 1,500 on the purchase and maintenance of uniform) (8) House rent allowance ` 750 per month. He pays ` 1,000 per month as rent. (9) He contributes ` 900 per month to a recognised provident fund to which his employer contributes an equal amount. He resigned from his job on 1.1.2014 and shifted to Delhi. He was entitled to the following benefits at the time of his retirement: (a) Gratuity ` 1,35,000 (b) Pension from 1.1.2014 ` 3,000 p.m. (c) Payment from recognised provident fund ` 3,00,000 (d) Encashment of earned leave for 150 days ` 36,000 He was entitled to 40 days leave for every completed year of service. He got 50% of his pension commuted in lump sum w.e.f. 1.3.2014 and received ` 1,20,000 as commuted pension. He joined K Ltd. at Mumbai w.e.f 1-2-2014 and was entitled to the following emoluments: (1) Basic salary ` 5,000 p.m. (2) Dearness allowance (forming part of salary) 20% of basic salary (3) Rent-free unfurnished accommodation in Delhi which is owned by the employer and whose fair rental value is `48,000 p.a. He was also given the following facilities by the employer: (a) Motor car (1.4 ltr. engine capacity) with driver, which he uses partly for official and partly for personal purposes. (b) The monthly expenses incurred by ‗A‘ on gas and electricity were ` 500 which were reimbursed by the employer. (c) Reimbursement of educational expenses of his two children which amounted to ` 350 p.m. (d) On 4.3.2012 his wife fell ill and the employer reimbursed the expenditure of medical treatment amounting to ` 17,500. (e) A watchman, a sweeper, a cook and a gardener have been provided to whom the company pays a salary of ` 400 p.m. each. (f) Loan of ` 1,00,000 @ 8% p.a. for construction of his house was given by the company. SBI rate of interest is 7% p.a. He made the following payments during the previous year: (1) Professional tax ` 500 (2) Premium on Life Insurance Policy of his own, ` 1,00,000 amounting to ` 15,000. (3) Deposit in PPF account ` 50,000.    For more detailed information I am uploading a PDF file which is free to download: Contact Details: The Institute Of Cost Accountants Of India Patrakar Puram Rd, Vikas Khand 1, Vikas Khand, Gomti Nagar, Lucknow, Uttar Pradesh 226010 India Map Location: [MAP]https://www.google.co.in/maps?q=The+Institute+Of+Cost+Accountants+Of+India, +Patrakar+Puram+Road,+Vikas+Khand+1,+Vikas+Khand,+ Gomti+Nagar+Extension,+Lucknow,+Uttar+Pradesh,+Ind ia&hl=en&ll=26.853192,80.995653&spn=0.009668,0.013 046&sll=13.067418,80.283237&sspn=0.010556,0.013046 &oq=The+Institute+of+Cost+Accountants+of+India&hq= The+Institute+Of+Cost+Accountants+Of+India,+Patrak ar+Puram+Road,+Vikas+Khand+1,+Vikas+Khand,+Gomti+N agar+Extension,+Lucknow,+Uttar+Pradesh,+India&t=m& z=16&iwloc=A[/MAP] |