|

#2

4th August 2014, 04:16 PM

| |||

| |||

| Re: Company Secretary Executive Tax Laws previous year question papers

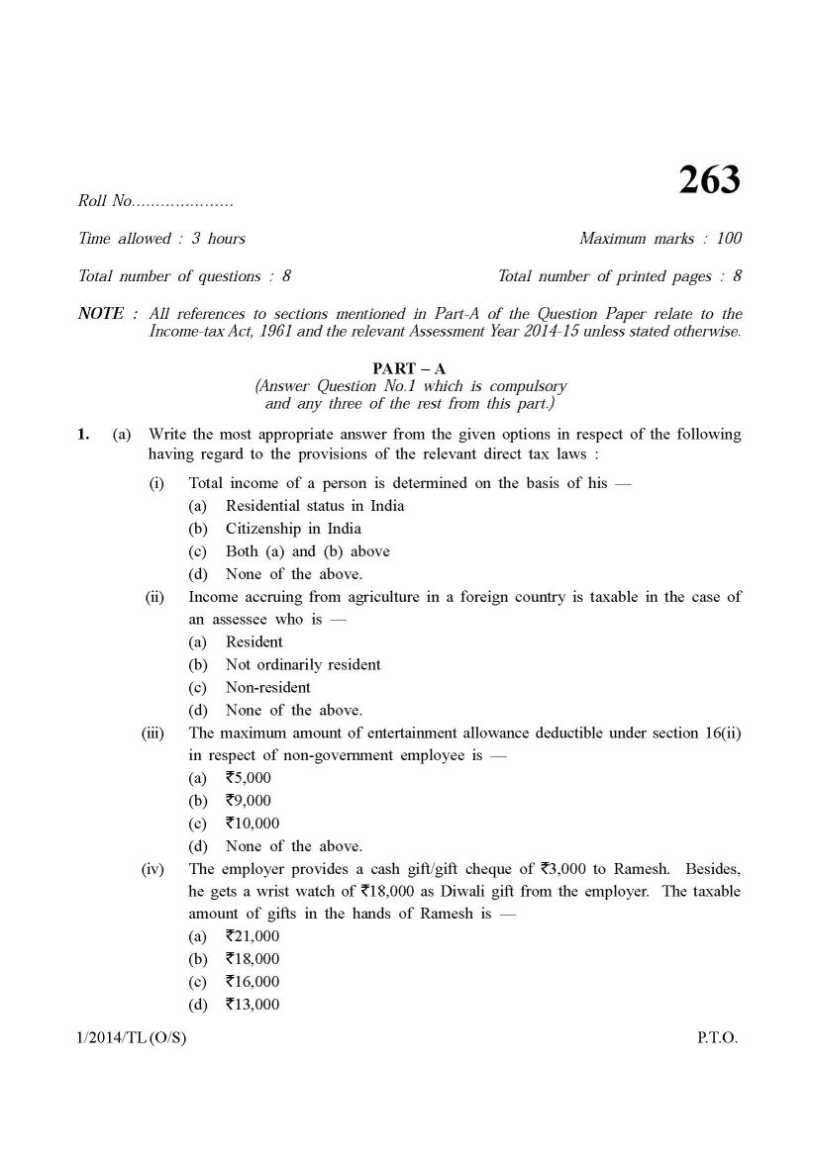

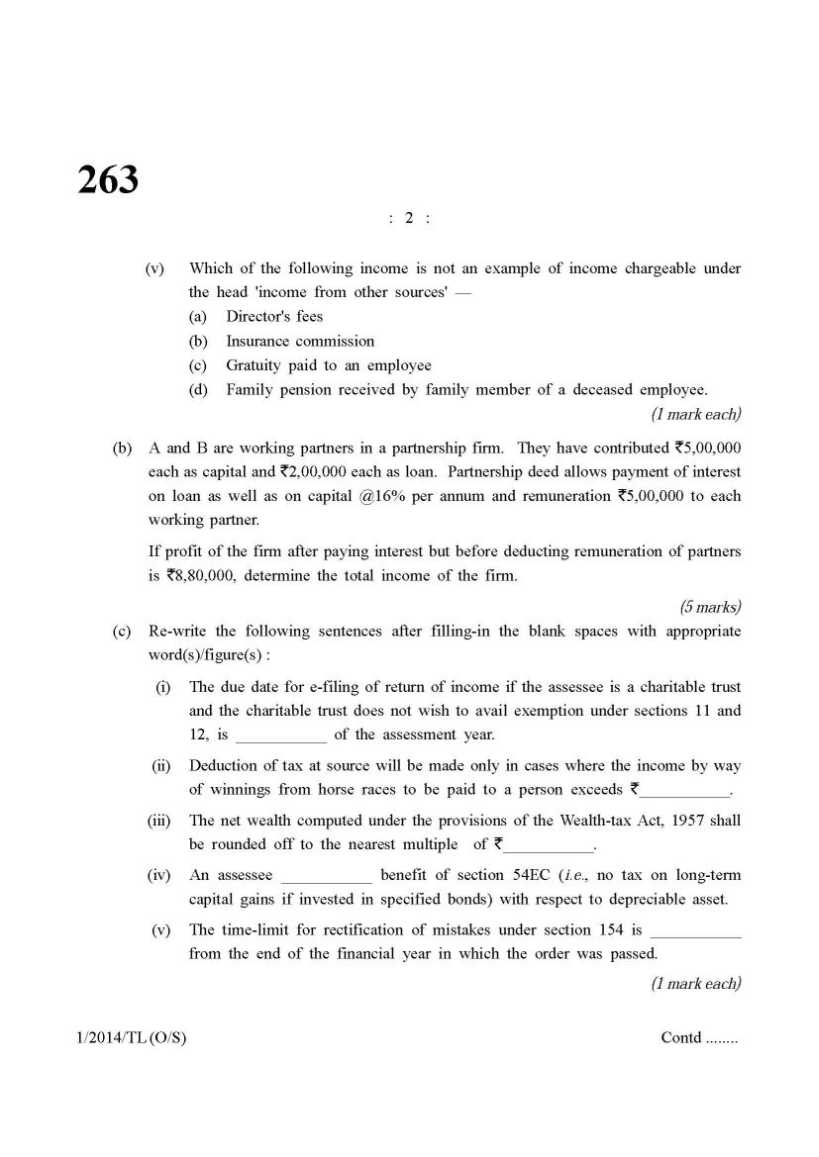

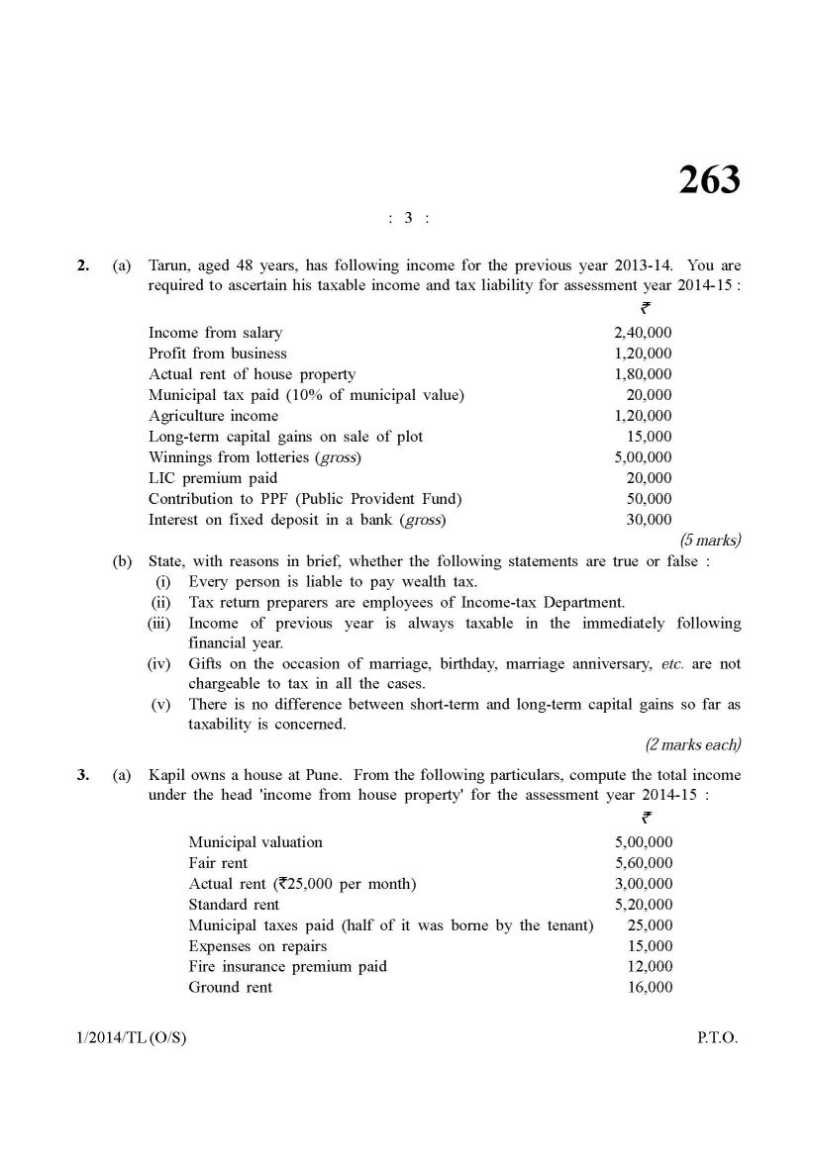

As you want to get the Company Secretary Executive Tax Laws previous year question papers so here it is for you: Some content of the file has been given here: 1. (a) Write the most appropriate answer from the given options in respect of the following having regard to the provisions of the relevant direct tax laws : (i) Total income of a person is determined on the basis of his — (a) Residential status in India (b) Citizenship in India (c) Both (a) and (b) above (d) None of the above. (ii) Income accruing from agriculture in a foreign country is taxable in the case of an assessee who is — (a) Resident (b) Not ordinarily resident (c) Non-resident (d) None of the above. (iii) The maximum amount of entertainment allowance deductible under section 16(ii) in respect of non-government employee is — (a) 5,000 (b) 9,000 (c) 10,000 (d) None of the above. (iv) The employer provides a cash gift/gift cheque of 3,000 to Ramesh. Besides, he gets a wrist watch of 18,000 as Diwali gift from the employer. The taxable amount of gifts in the hands of Ramesh is — (a) 21,000 (b) 18,000 (c) 16,000 (d) 13,000 (v) Which of the following income is not an example of income chargeable under the head 'income from other sources' — (a) Director's fees (b) Insurance commission (c) Gratuity paid to an employee (d) Family pension received by family member of a deceased employee. (1 mark each) (b) A and B are working partners in a partnership firm. They have contributed 5,00,000 each as capital and 2,00,000 each as loan. Partnership deed allows payment of interest on loan as well as on capital @16% per annum and remuneration 5,00,000 to each working partner. If profit of the firm after paying interest but before deducting remuneration of partners is 8,80,000, determine the total income of the firm. (5 marks) (c) Re-write the following sentences after filling-in the blank spaces with appropriate word(s)/figure(s) : (i) The due date for e-filing of return of income if the assessee is a charitable trust and the charitable trust does not wish to avail exemption under sections 11 and 12, is ___________ of the assessment year. (ii) Deduction of tax at source will be made only in cases where the income by way of winnings from horse races to be paid to a person exceeds ___________. (iii) The net wealth computed under the provisions of the Wealth-tax Act, 1957 shall be rounded off to the nearest multiple of ___________. (iv) An assessee ___________ benefit of section 54EC (i.e., no tax on long-term capital gains if invested in specified bonds) with respect to depreciable asset. (v) The time-limit for rectification of mistakes under section 154 is ___________ from the end of the financial year in which the order was passed. (1 mark each)     For more detailed information I am uploading PDF files which are free to download: Contact Details: The Institute of Company Secretaries of India C-37, Sector 62, Noida, Uttar Pradesh 201301 0120 452 2058 India Map Location: [MAP]https://www.google.co.in/maps?q=The+Institute+of+Company+Secretaries+of+Ind ia,+Noida,+Uttar+Pradesh,+India&hl=en&ll=28.612292 ,77.367804&spn=0.009513,0.013046&sll=18.934729,72. 837059&sspn=0.002562,0.003262&oq=The+Institute+of+ Company+Secretaries+of+India&hq=The+Institute+of+C ompany+Secretaries+of+India,+Noida,+Uttar+Pradesh, +India&t=m&z=16&iwloc=A[/MAP] |