| Re: Executive Programme Module 1 previous Papers

Here you want to download question papers of CS Executive Programme Module 1, so I am providing question papers of CS Executive Programme Module 1:

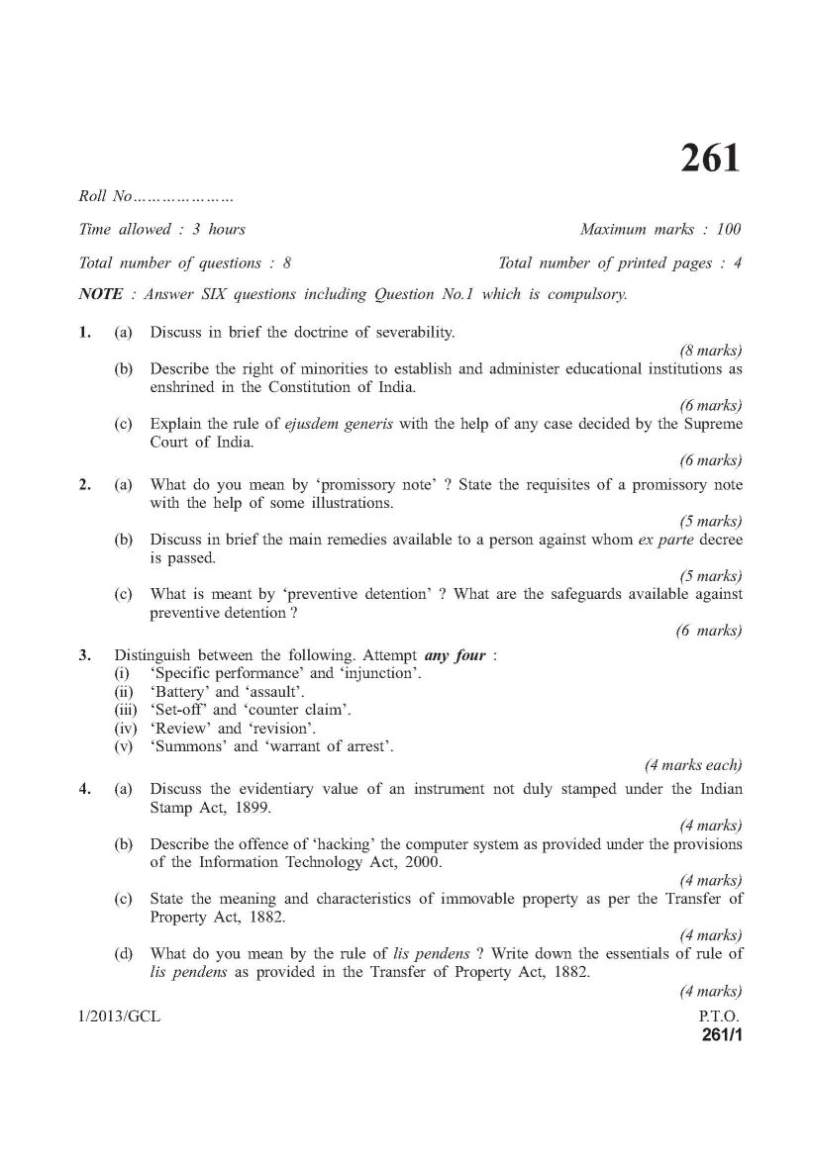

CS Executive Programme Module 1 Question Paper

(General And Commercial Laws)

1. (a) Discuss in brief the doctrine of severability.

(8 marks)

(b) Describe the right of minorities to establish and administer educational institutions as

enshrined in the Constitution of India.

(6 marks)

(c) Explain the rule of ejusdem generis with the help of any case decided by the Supreme

Court of India.

(6 marks)

2. (a) What do you mean by .promissory note. ? State the requisites of a promissory note

with the help of some illustrations.

(5 marks)

(b) Discuss in brief the main remedies available to a person against whom ex parte decree

is passed.

(5 marks)

(c) What is meant by .preventive detention. ? What are the safeguards available against

preventive detention ?

(6 marks)

3. Distinguish between the following. Attempt any four :

(i) .Specific performance. and .injunction..

(ii) .Battery. and .assault..

(iii) .Set-off. and .counter claim..

(iv) .Review. and .revision..

(v) .Summons. and .warrant of arrest..

(4 marks each)

4. (a) Discuss the evidentiary value of an instrument not duly stamped under the Indian

Stamp Act, 1899.

(4 marks)

(b) Describe the offence of .hacking. the computer system as provided under the provisions

of the Information Technology Act, 2000.

(4 marks)

(c) State the meaning and characteristics of immovable property as per the Transfer of

Property Act, 1882.

(4 marks)

(d) What do you mean by the rule of lis pendens ? Write down the essentials of rule of

lis pendens as provided in the Transfer of Property Act, 1882.

(4 marks)

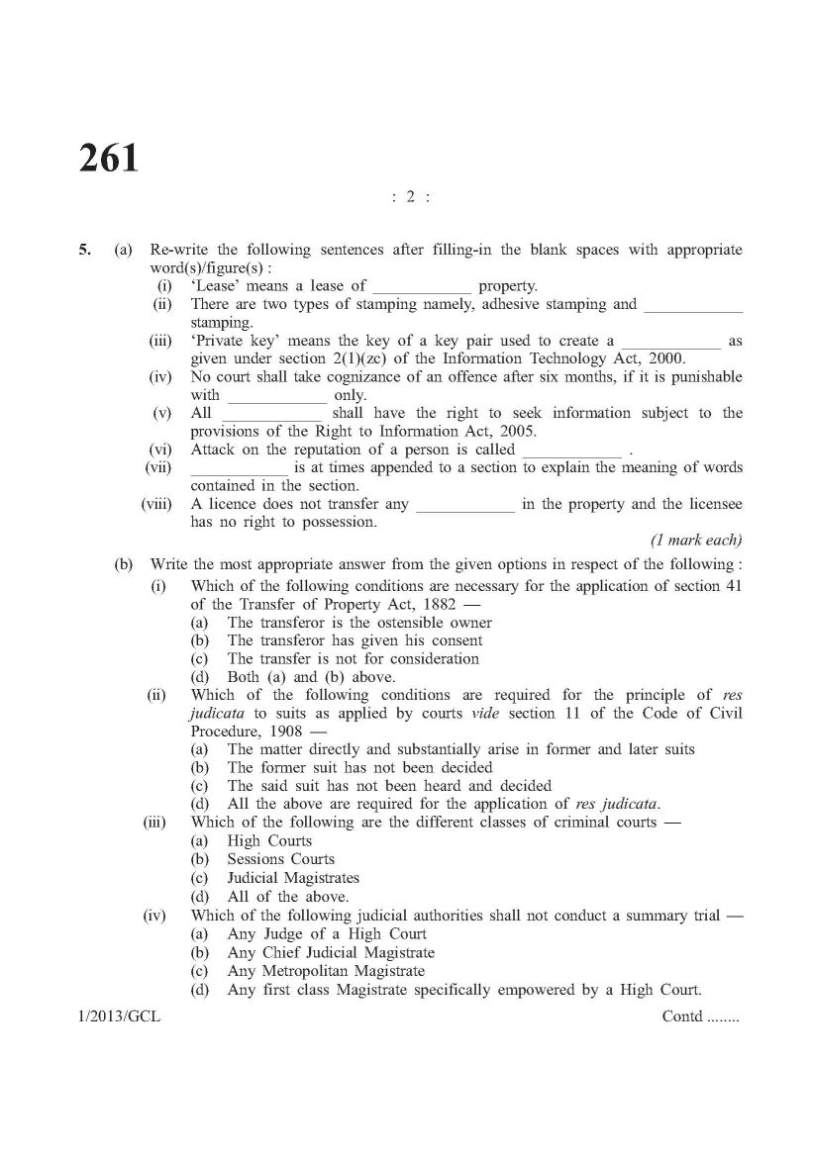

5. (a) Re-write the following sentences after filling-in the blank spaces with appropriate

word(s)/figure(s) :

(i) .Lease. means a lease of ____________ property.

(ii) There are two types of stamping namely, adhesive stamping and ____________

stamping.

(iii) .Private key. means the key of a key pair used to create a ____________ as

given under section 2(1)(zc) of the Information Technology Act, 2000.

(iv) No court shall take cognizance of an offence after six months, if it is punishable

with ____________ only.

(v) All ____________ shall have the right to seek information subject to the

provisions of the Right to Information Act, 2005.

(vi) Attack on the reputation of a person is called ____________ .

(vii) ____________ is at times appended to a section to explain the meaning of words

contained in the section.

(viii) A licence does not transfer any ____________ in the property and the licensee

has no right to possession.

(1 mark each)

(b) Write the most appropriate answer from the given options in respect of the following :

(i) Which of the following conditions are necessary for the application of section 41

of the Transfer of Property Act, 1882 .

(a) The transferor is the ostensible owner

(b) The transferor has given his consent

(c) The transfer is not for consideration

(d) Both (a) and (b) above.

(ii) Which of the following conditions are required for the principle of res

judicata to suits as applied by courts vide section 11 of the Code of Civil

Procedure, 1908 .

(a) The matter directly and substantially arise in former and later suits

(b) The former suit has not been decided

(c) The said suit has not been heard and decided

(d) All the above are required for the application of res judicata.

(iii) Which of the following are the different classes of criminal courts .

(a) High Courts

(b) Sessions Courts

(c) Judicial Magistrates

(d) All of the above.

(iv) Which of the following judicial authorities shall not conduct a summary trial .

(a) Any Judge of a High Court

(b) Any Chief Judicial Magistrate

(c) Any Metropolitan Magistrate

(d) Any first class Magistrate specifically empowered by a High Court.

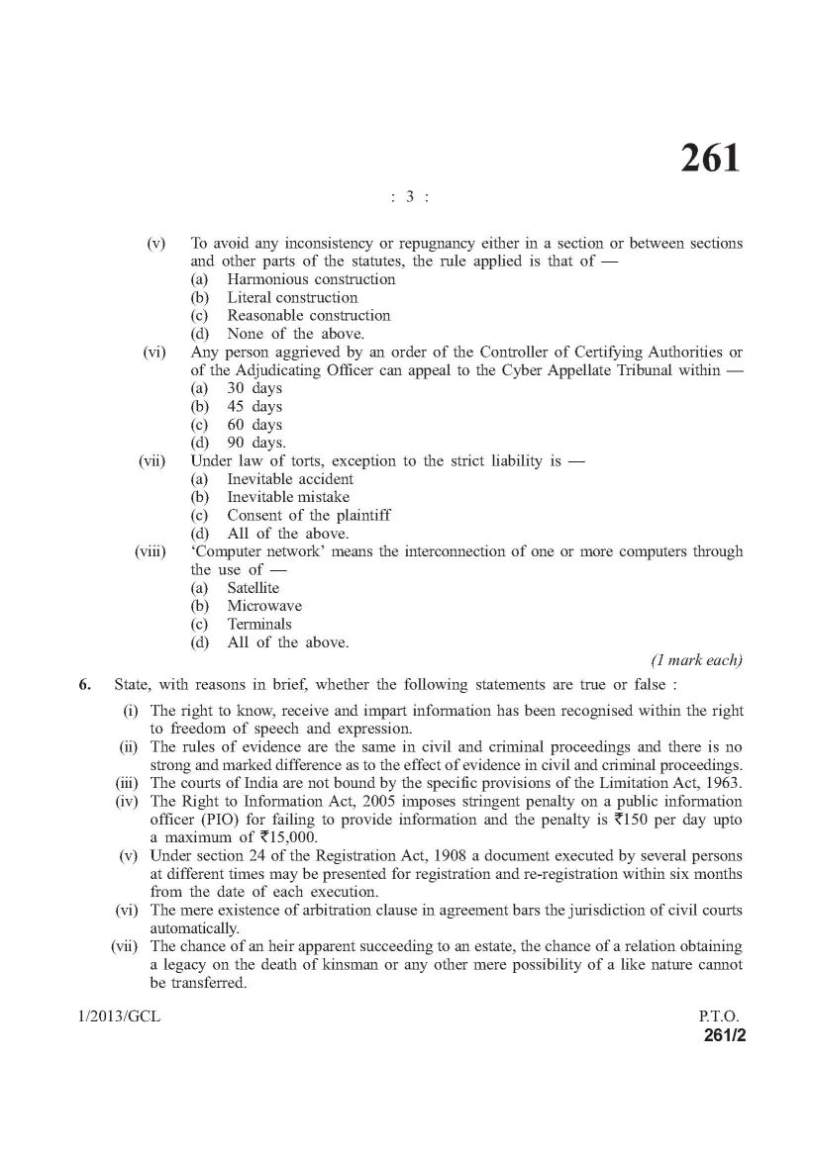

(v) To avoid any inconsistency or repugnancy either in a section or between sections

and other parts of the statutes, the rule applied is that of .

(a) Harmonious construction

(b) Literal construction

(c) Reasonable construction

(d) None of the above.

(vi) Any person aggrieved by an order of the Controller of Certifying Authorities or

of the Adjudicating Officer can appeal to the Cyber Appellate Tribunal within .

(a) 30 days

(b) 45 days

(c) 60 days

(d) 90 days.

(vii) Under law of torts, exception to the strict liability is .

(a) Inevitable accident

(b) Inevitable mistake

(c) Consent of the plaintiff

(d) All of the above.

(viii) .Computer network. means the interconnection of one or more computers through

the use of .

(a) Satellite

(b) Microwave

(c) Terminals

(d) All of the above.

(1 mark each)

6. State, with reasons in brief, whether the following statements are true or false :

(i) The right to know, receive and impart information has been recognised within the right

to freedom of speech and expression.

(ii) The rules of evidence are the same in civil and criminal proceedings and there is no

strong and marked difference as to the effect of evidence in civil and criminal proceedings.

(iii) The courts of India are not bound by the specific provisions of the Limitation Act, 1963.

(iv) The Right to Information Act, 2005 imposes stringent penalty on a public information

officer (PIO) for failing to provide information and the penalty is `150 per day upto

a maximum of `15,000.

(v) Under section 24 of the Registration Act, 1908 a document executed by several persons

at different times may be presented for registration and re-registration within six months

from the date of each execution.

(vi) The mere existence of arbitration clause in agreement bars the jurisdiction of civil courts

automatically.

(vii) The chance of an heir apparent succeeding to an estate, the chance of a relation obtaining

a legacy on the death of kinsman or any other mere possibility of a like nature cannot

be transferred.

(viii) Delay in registration of a deed of gift under the Transfer of Property Act, 1882 postpones

its operation.

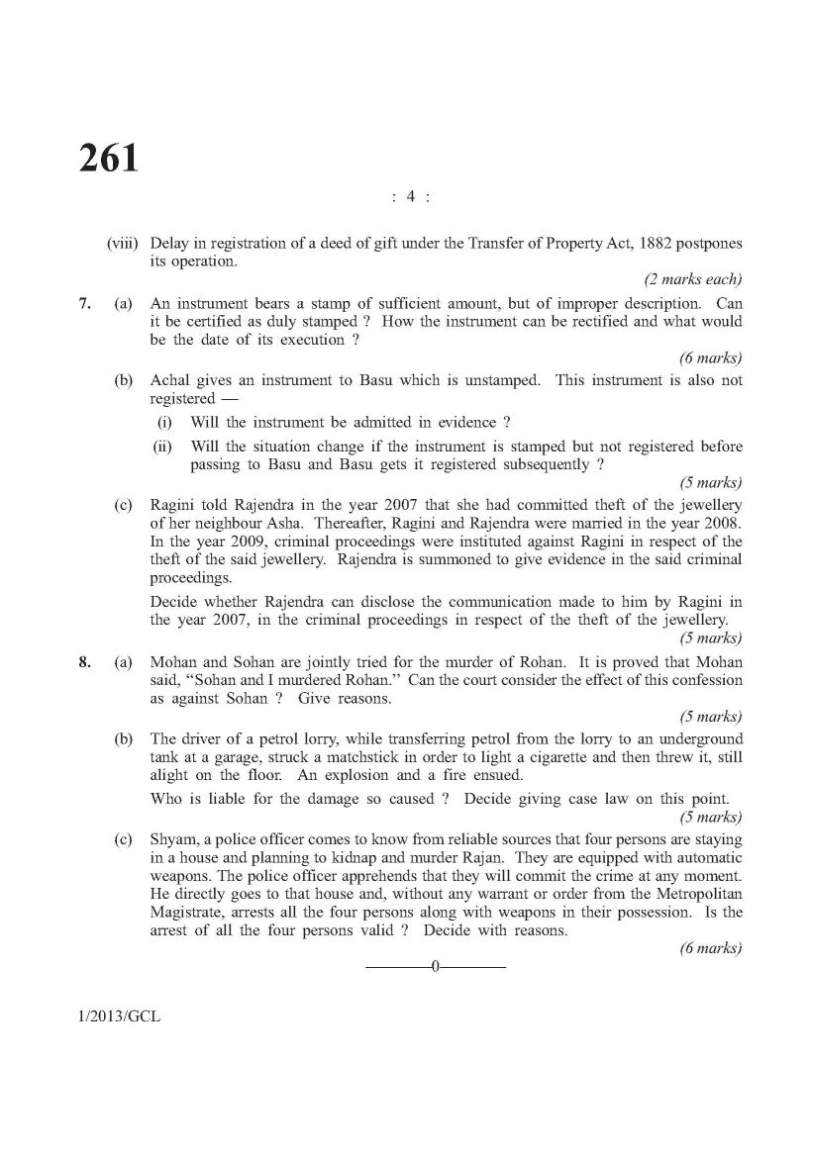

(2 marks each)

7. (a) An instrument bears a stamp of sufficient amount, but of improper description. Can

it be certified as duly stamped ? How the instrument can be rectified and what would

be the date of its execution ?

(6 marks)

(b) Achal gives an instrument to Basu which is unstamped. This instrument is also not

registered .

(i) Will the instrument be admitted in evidence ?

(ii) Will the situation change if the instrument is stamped but not registered before

passing to Basu and Basu gets it registered subsequently ?

(5 marks)

(c) Ragini told Rajendra in the year 2007 that she had committed theft of the jewellery

of her neighbour Asha. Thereafter, Ragini and Rajendra were married in the year 2008.

In the year 2009, criminal proceedings were instituted against Ragini in respect of the

theft of the said jewellery. Rajendra is summoned to give evidence in the said criminal

proceedings.

Decide whether Rajendra can disclose the communication made to him by Ragini in

the year 2007, in the criminal proceedings in respect of the theft of the jewellery.

(5 marks)

8. (a) Mohan and Sohan are jointly tried for the murder of Rohan. It is proved that Mohan

said, ..Sohan and I murdered Rohan... Can the court consider the effect of this confession

as against Sohan ? Give reasons.

(5 marks)

(b) The driver of a petrol lorry, while transferring petrol from the lorry to an underground

tank at a garage, struck a matchstick in order to light a cigarette and then threw it, still

alight on the floor. An explosion and a fire ensued.

Who is liable for the damage so caused ? Decide giving case law on this point.

(5 marks)

(c) Shyam, a police officer comes to know from reliable sources that four persons are staying

in a house and planning to kidnap and murder Rajan. They are equipped with automatic

weapons. The police officer apprehends that they will commit the crime at any moment.

He directly goes to that house and, without any warrant or order from the Metropolitan

Magistrate, arrests all the four persons along with weapons in their possession. Is the

arrest of all the four persons valid ? Decide with reasons.

(6 marks)

CS Executive Programme Module 1 Question Paper

(Company Accounts, Cost & Management Accounting)

1. (a) State, with reasons in brief, whether the following statements are true or false :

(i) The existing equity shareholders are necessarily to accept the rights offer.

(ii) Contingent liability in respect of a transaction between holding and wholly

owned subsidiary companies will not appear in the footnote of the consolidated

balance sheet.

(iii) In case of inter-company unrealised profits included in unsold goods, minority

shareholders are not affected in any way.

(iv) In case of inadequacy of profits, dividend can be paid out of capital reserve.

(v) Redemption of preference shares amounts to reduction in the capital of the

company.

(2 marks each)

(b) Write the most appropriate answer from the given options in respect of the following :

(i) Discount allowed on the re-issue of forfeited shares cannot exceed .

(a) 10% of paid-up capital

(b) 10% of the capital re-issued

(c) The amount received on forfeited shares

(d) Capital reserve account.

(ii) Sections 349 and 350 of the Companies Act, 1956 contain the provisions relating

to the manner of determination of net profit for the purpose of calculating the .

(a) Disposal of net profit

(b) Managerial remuneration

(c) Fair value of assets

(d) Fair value of shares.

(iii) As per Accounting Standard.28, an impairment loss should be recognised

whenever the recoverable amount of an asset is less than its .

(a) Original cost

(b) Opportunity cost

(c) Carrying amount

(d) None of the above.

(iv) When a company issues debentures at par or at a discount which are redeemable

at a premium, the premium payable on redemption of the debentures is to be

treated as .

(a) Revenue loss

(b) Capital loss

(c) Deferred revenue expenditure

(d) None of the above.

(v) Expenses incidental to the creation and floatation of a company are called .

(a) Underwriting expenses

(b) Preliminary expenses

(c) Trade expenses

(d) Establishment expenses.

(1 mark each)

(c) Re-write the following sentences after filling-in the blank spaces with appropriate

word(s)/figure(s) :

(i) Section 81 of the Companies Act, 1956, provides that where a public company

proposes to increase its subscribed capital at any time after the expiry of

___________ year(s) of its formation or at any time after the expiry of

___________ year(s) from the first allotment of shares whichever is earlier, it

should satisfy certain conditions.

(ii) Preliminary expenses being of capital nature may be written-off against

___________.

(iii) Goodwill is an intangible asset, but is not a ___________ asset.

(iv) Accumulated losses of the subsidiary company upto the date of acquisition of

shares by the holding company are called ___________ losses.

(v) International Accounting Standards are issued by the ___________.

(1 mark each)

2. (a) Calculate the value of one equity share from the following information :

(i) 60,000 equity shares of `10 each, `7 paid-up.

(ii) `2,00,000, 10% preference shares of `100 each, fully paid-up.

(iii) Expected annual profits before tax `4,00,000.

(iv) Tax rate 35%.

(v) Transfer to general reserve 20% of profits every year.

(vi) Normal rate of return 20%.

(6 marks)

262/2

(b) KBC Ltd. issued 50,000 equity shares. The whole of the issue was underwritten as

follows :

Underwriter . K : 40%

Underwriter . B : 30%

Underwriter . C : 30%

Applications for 40,000 shares were received in all, out of which applications for

10,000 shares had the stamp of Underwriter . K; those for 5,000 shares that of

Underwriter . B; and those for 10,000 shares for Underwriter . C.

The remaining applications for 15,000 shares did not bear any stamp.

Determine the liability of the underwriters.

(5 marks)

(c) Write a note on 'buy-back of shares'.

(4 marks)

3. (a) The following are the balance sheets of H Ltd. and its subsidiary S Ltd. as on

31st March, 2012 :

Equity and Liabilities H Ltd. S Ltd.

(`) (`)

Shareholders' funds :

Share capital

Shares of `100 each fully paid 5,00,000 2,00,000

Reserves and surplus :

General reserve 1,00,000 .

Profit and loss account 80,000 (.)1,00,000

Non-current liabilities :

6% Debentures . 1,00,000

Current liabilities :

Trade payables 75,000 45,000

7,55,000 2,45,000

Assets

Non-current assets :

Fixed assets 3,50,000 1,50,000

Non-current investments :

6% Debentures in S Ltd. (acquired at cost) 60,000 .

1,500 Shares in S Ltd. at `80 each 1,20,000 .

Current assets :

Inventories 90,000 40,000

Trade receivables 60,000 30,000

Cash 75,000 25,000

7,55,000 2,45,000

H Ltd. acquired the shares on 1st August, 2011. The profit and loss account of S Ltd.

showed a debit balance of `1,50,000 on 1st April, 2011. During June, 2011 goods

of S Ltd. costing `6,000 were destroyed by fire against which insurer paid

only `2,000. Trade payables of S Ltd. include `20,000 for goods supplied by H Ltd.

on which H Ltd. made a profit of `2,000. Half of the goods were still in stock on

31st March, 2012.

Prepare a consolidated balance sheet and show the complete working.

(9 marks )

(b) Shreya Ltd. had an issue of 1,000, 12% redeemable preference shares of `100 each,

repayable at a premium of 10%. These shares are to be redeemed now out of the

accumulated reserves, which are more than the necessary sum required for redemption.

Show the necessary entries in the books of the company, assuming that the premium

on redemption of shares has to be written off against the company's securities premium

reserve account.

(6 marks)

4. (a) A limited company issued a prospectus inviting applications for 30,000 shares of `10

each at a premium of `2 per share. The amount was payable as follows :

`

On application . 2

On allotment . 5 (including premium)

On first call . 3

On second and final call . 2

Applications were received for 45,000 shares and allotment was made on pro-rata basis

to the applicants of 36,000 shares. Money overpaid on applications was employed on

account of sum due on allotment.

Ramesh, to whom 600 shares were allotted, failed to pay the allotment money and on

his subsequent failure to pay the first call, his shares were forfeited. Mohan, the holder

of 900 shares failed to pay the two calls and his shares were forfeited after the second

and final call.

Of the shares forfeited, 1,200 shares were sold to Krishna credited as fully paid for

`9 per share, the whole of Ramesh's share being included.

Show journal and cash book entries and prepare the balance sheet.

(12 marks)

(b) Explain the nature of profit or loss prior to incorporation. How is it treated in the

books of accounts ?

(3 marks)

PART . B

(Answer Question No.5 which is compulsory

and any two of the rest from this part.)

5. (a) State, with reasons in brief, whether the following statements are true or false :

(i) Cost sheet is the same as statement of cost and profit.

(ii) Zero base budgeting is based on incremental approach.

(iii) When a factory operates at full capacity, fixed cost also becomes relevant for

make or buy decisions.

(iv) Marginal costing is different from direct costing.

(v) Management accounting is based on double entry system.

(2 marks each)

(b) Write the most appropriate answer from the given options in respect of the following :

(i) The rate of change of labour force in an organisation during a specified period

is called .

(a) Labour efficiency

(b) Labour turnover

(c) Labour productivity

(d) None of the above.

(ii) Differential cost analysis is incorporated in the .

(a) Cost books

(b) Financial books

(c) Statutory books

(d) None of the above.

(iii) Marginal costing is a very useful technique to management for .

(a) Cost control

(b) Profit planning

(c) Decision making

(d) All of the above.

(iv) When prices of materials have a rising trend, then the suitable method for issuing

the materials will be .

(a) FIFO

(b) LIFO

(c) HIFO

(d) Standard cost price.

(v) Cash flow statement is required for the financial planning of .

(a) Short range

(b) Long range

(c) Medium range

(d) Very long range.

(1 mark each)

(c) Re-write the following sentences after filling-in the blank spaces with appropriate

word(s)/figure(s) :

(i) A document which provides for assembly of different costs in respect of a cost

centre or a cost unit is called _____________.

(ii) Economic order quantity depends on _____________ and _____________ costs.

(iii) In case the amount of overheads recovered from production is more than the

actual overheads, there is said to be _____________ of overheads.

(iv) Abnormal idle time cost should be charged to _____________.

(v) Bin card shows ____________ at any moment of time.

(1 mark each)

6. (a) From the following particulars relating to Genius Ltd., prepare balance sheet as on

31st March, 2013 :

Fixed assets/turnover ratio (based on sale) 1:2

Debt collection period 2 months

Gross profit 25%

Consumption of raw materials 40% of cost of goods sold

Stock of raw materials 4 months consumption

Finished goods 20% of turnover at cost

Fixed assets to current assets 1:1

Current ratio 2

Long-term loan to current liability 1:3

Capital to reserve 5:2

Cost of fixed assets `10,50,000

(12 marks)

(b) Marginal costing rewards sales whereas absorption costing rewards production. Comment.

(3 marks)

7. (a) From the information given below prepare cash flow statement for Smile Ltd. :

Balance Sheets

As on As on

31-03-2012 31-03-2013

(` in '000) (` in '000)

Equity and liabilities

Shareholders' funds :

Share capital 1,800 2,000

Reserves and surplus :

General reserve 50 30

Profit and loss account 140 160

Non-current liabilities :

Loan on mortgage @ 8%

(taken on 1st July, 2012) . 50

Current liabilities :

Bank overdraft 115 114

Trade payables 22 40

Short-term provisions :

Provision for final dividend 90 80

2,217 2,474

Assets

Non-current assets :

Freehold building 1,000 1,160

Machinery and plant 340 490

Furniture and fittings 7 6

Goodwill 150 130

Investment in shares 100 120

Preliminary expenses 15 5

Current assets :

Inventories 440 422

Trade receivables 160 134

Prepaid expenses 4 5

Cash in hand 1 2

2,217 2,474

Additional information :

(i) Depreciation on freehold building @ 2½% on cost `12,00,000; on machinery

and plant @ 10% on cost `5,00,000; on furniture and fitting @ 5% on cost

`10,000.

(ii) Dividend received `6,000 was used in writing down the book value of investment

in shares.

(iii) Goodwill was written off out of general reserve.

(iv) The proposed dividend for the year ended 31st March, 2012 was paid off and

interim dividend of `60,000 was paid out of profit and loss account.

(12 marks)

(b) Distinguish between 'production account' and 'cost sheet'.

(3 marks)

8. (a) The following data are available in a manufacturing company for a year period :

(` in lakhs)

Fixed expenses :

Wages and salaries 9.50

Rent, rates and taxes 6.60

Depreciation 7.40

Sundry administrative expenses 6.50

Semi-variable expenses (at 50% capacity) :

Maintenance and repairs 3.50

Indirect labour 7.90

Sales department salaries, etc. 3.80

Sundry administrative expenses 2.80

Variable expenses (at 50% of capacity) :

Materials 21.70

Labour 20.40

Other expenses 7.90

98.00

Assume that fixed expenses remain constant for all levels of production, semi-variable

expenses remain constant between 45% and 65% of capacity and increasing by 10%

between 65% and 80% capacity and by 20% between 80% and 100% capacity.

Sales at various levels are . at 50% capacity : `100 lakh; at 60% capacity : `120

lakh; at 75% capacity : `150 lakh; at 90% capacity : `180 lakh; and at 100% capacity :

`200 lakh.

Prepare a flexible budget for the year and forecast the profits at 60%, 75%, 90% and

100% of capacity.

(9 marks)

(b) A company has fixed expenses of `90,000 with sales of `3,00,000 and a profit

of `60,000 during the first half year. If in the next half year, the company suffered

a loss of `30,000.

Calculate .

(i) P/V ratio, break-even point and margin of safety for the first half year.

(ii) Expected sales volume for next half year assuming that selling price and fixed

expenses remain unchanged.

(iii) The break-even point and margin of safety for the whole year.

(6 marks)

CS Executive Programme Module 1 Question Paper

(Tax Laws)

1. (a) Write the most appropriate answer from the given options in respect of the following

having regard to the provisions of the relevant direct tax laws :

(i) Past untaxed profit of the financial year 2002-03 brought to India in 2012-13 is

chargeable to tax in the assessment year 2013-14 in the hands of .

(a) All the assessees

(b) Resident and ordinarily resident in India

(c) Non-resident in India

(d) None of the above.

(ii) The maximum amount of compensation received at the time of voluntary

retirement exempt from tax is .

(a) `2,00,000

(b) `5,00,000

(c) `10,00,000

(d) The actual amount received as compensation.

(iii) The amount of wealth-tax, interest, penalty, fine or any other sum payable, and

the amount of refund due, under the provisions of the Wealth-tax, Act, 1957

shall be rounded off to the .

(a) Nearest rupee

(b) Nearest multiple of ten rupees

(c) Nearest multiple of one hundred rupees

(d) Nearest multiple of one thousand rupees.

(iv) Total income of a person is determined on the basis of his .

(a) Residential status in India

(b) Citizenship in India

(c) Both (a) and (b) above

(d) None of the above.

(v) Which of the following taxes are allowed as deduction while computing the

business income .

(a) Wealth-tax

(b) Income-tax

(c) Sales tax

(d) None of the above.

(1 mark each)

(b) Re-write the following sentences after filling-in the blank spaces with appropriate word(s)/

figure(s) :

(i) Speculative business losses can be carried forward for _____________ assessment

years, immediately succeeding the assessment year for which the loss was first

computed.

(ii) In case of winnings from horse races, payments exceeding `_____________ are

subject to tax deducation at source at the rate of _____________%.

(iii) The time limit for rectification of mistakes is a period of _____________ from

the end of the financial year in which the order sought to be amended was

passed.

(iv) The maximum amount of standard deduction in case of family pension is

_____________.

(v) _____________ of advance tax is paid upto 15th September in previous year by

a Hindu Undivided Family.

(1 mark each)

(c) Ram purchases a house property for `7,600 on 30th June, 1967. The following expenses

were incurred by him for making addition/alteration to the house property :

`

Cost of construction of first floor in 1975-76 11,000

Cost of construction of second floor in 1983-84 34,000

Alteration/reconstruction of the property in 1992-93 29,000

Fair market value of the property on 1st April, 1981 45,000

The house property is sold by him on 15th June, 2012 for `6,95,000 (expenses incurred

on transfer `5,000).

Compute the amount of capital gains chargeable to tax for the assessment year

2013-14.

Cost inflation indices : 1981-82:100; 1983-84:116; 1992-93:223 and 2012-13:852.

(5 marks)

263/2

2. (a) State, with reasons in brief, whether the following statements are true or false :

(i) Money/property received on the occasion of the marriage of the individual is

taxable under the head income from other sources.

(ii) Tax return preparers (TRPs) are employees of income-tax department.

(iii) Allowances payable to Central Government employees for serving outside India

are fully taxable as salary.

(iv) Assets of personal use are also considered as capital assets.

(v) Income from lease of land for grazing of cattle required for agricultural pursuits

is agricultural income.

(1 mark each)

(b) A partnership firm has two partners X and Y. They have contributed `6,00,000 each

as capital and `2,00,000 each as loan. Partnership deed allows payment of interest on

loan as well as on capital @16% p.a. and remuneration of `5,00,000 to each acting

partner.

If profits of the firm after paying interest but before deducting remuneration of partners

are `7,60,000, determine the total income of the firm.

(6 marks)

(c) Under what circumstances the Assessing Officer is empowered to reopen the assessment

made by him ? Give examples.

(4 marks)

3. (a) Sarita, aged 50 years received the following amounts during the financial year

2012-13 :

`

Gross salary 5,50,000

Family pension (`6,000 p.m. × 12) 72,000

She gets a gift of `75,000 from her maternal uncle on her birthday. She also gets gift

of `60,000 from her office colleagues on the same day. She deposited `50,000 in public

provident fund account.

Compute her tax liability for the assessment year 2013-14.

(5 marks)

(b) Explain the deduction in respect of royalty income of authors under section 80QQB.

(4 marks)

(c) Enlist the deductors for whom the e-filing of the statement of TDS is mandatory.

(3 marks)

(d) Write a brief note on deduction under section 80D.

(3 marks)

4. (a) Smt. Juhi (resident in India and aged 82 years) has estimated the following taxable

incomes for the financial year 2012-13 :

`

Income from business 12,00,000

Long-term capital gains on 10th October, 2012 80,000

Interest (gross) from a branch of Syndicate Bank (FDR) 20,000

Dividend 30,000

Interest on savings bank a/c 8,000

13,38,000

. She paid life insurance premium on her own life 25,000

. She made deposit in public provident fund 70,000

. Paid to Prime Minister's National Relief Fund 30,000

. Health insurance premium paid in cash 12,000

Determine the amount payable as advance tax on prescribed dates during the financial

year 2012-13 (assessment year 2013-14).

(5 marks)

(b) Deepak, a reputed trader, furnished the following particulars regarding his business for

the financial year 2012-13 :

`

Loss from business 8,00,000

Loss from specified business 2,80,000

Depreciation allowance for the current year 1,60,000

Income from house property (computed) 6,00,000

Items brought forward from the earlier years :

Business loss for the assessment year 2011-12 2,40,000

Depreciation allowance (unabsorbed) for the

assessment year 2012-13 1,00,000

Compute gross total income of Deepak for the assessment year 2013-14.

(4 marks)

(c) Mohit purchased an asset for scientific research in the previous year 2005-06 for

`30,00,000. During the previous year 2012-13 the said asset ceased to be used for

scientific research. The following information is also submitted to you :

`

Profit from business before depreciation 10,00,000

Written down value of block of assets 15% as

on 1st April, 2012 20,00,000

The scientific research asset if used for business shall be eligible for depreciation @15%.

The cost inflation index for 2005-06 is 497 and for 2012-13 is 852.

Compute the total income if the scientific research asset is sold for `60,00,000 during

2012-13, assuming that :

(i) It is sold without using for business; and

(ii) It is sold after using for business.

(6 marks)

5. (a) Dev is an Indian citizen and resident in India. His assets and liabilities as on

31st March, 2013 are as follows :

. Self-occupied residential house in Delhi `60,00,000.

. Self-occupied residential house in foreign country `90,00,000. [For the construction

of this house, he borrowed `30,00,000 in the foreign country which is due on

31st March, 2013.]

. He has National Savings Certificates VIII issue `1,00,000.

. He has jewellery worth `60,00,000 out of which ornaments worth `18,00,000

are meant for daily use by his wife.

. He has motor car for his personal use valued at `7,70,000.

. In December, 2011 he has transferred his house to his married daughter without

consideration. The value of the house is `24,00,000.

. The house given to the daughter was purchased in 2010 for which a loan of

`10,00,000 was taken. Out of this loan `2,00,000 is outstanding.

Compute the net wealth and wealth-tax of Dev.

(6 marks)

(b) In each of the following cases what amount will be allowed as expenditure for a business

for the assessment year 2013-14. Explain with reasons :

(i) Purchase of raw materials `2,00,000. It includes a payment of `24,000 which

has been made in cash.

(ii) `1,42,000 were paid to national laboratory to undertake a scientific research for

an approved programme.

(2 marks each)

(c) Explain the incomes which are deemed to accrue or arise in India.

(5 marks)

6. (a) Distinguish between the following. Attempt any two :

(i) 'Belated return of income' and 'revised return of income'.

(ii) 'Short-term capital gains' and 'long-term capital gains'.

(iii) 'Statutory provident fund' and 'recognised provident fund'.

(3 marks each)

(b) Explain the procedure regarding refund of excess tax paid by the assessee to the

department.

(5 marks)

(c) Write short notes on the following. Attempt any two :

(i) Amortisation of telecom licence fee

(ii) Income of political parties under section 13A

(iii) 'Pay-as-you-earn' scheme.

(2 marks each)

PART . B

7. Attempt any four of the following :

(i) Define the meaning of 'services' under the service tax.

(5 marks)

(ii) Service tax is now levied on all services except the services specified in the negative

list. Enumerate any five services which are covered in the negative list.

(5 marks)

(iii) The Central Government vide Notification No. 25/2012 has exempted certain services

from the whole of service tax leviable thereon. Enumerate any five services which are

covered in the mega exemption notification.

(5 marks)

(iv) R Ltd., gives the following particulars relating to the services provided by it to its various

clients for the month ending 31st July, 2012 :

. Total bills raised for `17,50,000 out of which bill for `1,50,000 was raised on

a Diplomatic Mission and payments of bills for `2,00,000 were not received until

31st July, 2012. Service tax is separately charged on the bills raised.

. Amount of `1,12,360 (including service tax) was received as an advance

from XYZ Ltd. on 25th July, 2012 to whom the services were provided in

August, 2012.

Compute .

(a) Value of taxable services

(b) Amount of service tax payable

(c) Last date of service tax payable.

(5 marks)

(v) Every person providing taxable services is liable to pay service tax. Are there any cases

where service tax is to be paid by the service recipient ? If yes, give any three such

cases.

(5 marks)

PART . C

8. Attempt any four of the following :

(i) State, with reasons in brief, whether the following statements are true or false :

(a) Input VAT credit is available in respect of goods purchased for manufacture of

export goods.

(b) Under consumption variant, deduction is allowed for all business purchases

excluding capital assets.

(c) Introduction of composition scheme will obstruct the flow of audit trail and this

scheme can be mis-utilised by unscrupulous dealers.

(d) If an assessee (who is otherwise required to get registration) fails to obtain

registration under the VAT, he/it may be registered compulsorily by the

Commissioner.

(e) A special VAT rate of 2% is applicable only for gold and silver ornaments, etc.

(1 mark each)

(ii) What is meant by 'exempted goods' under the VAT ? Give at least four examples of

such goods.

(5 marks)

(iii) What is input VAT credit ? Will the input VAT credit be available in case of purchase

of capital goods ? Explain.

(5 marks)

(iv) Amit, a manufacturer, sold Product X to Bimal of Delhi @ `1,000 per unit. He has

charged CST @ 2% on the said product and paid `80 as freight. Bimal of Delhi sold

goods to Charan of Delhi @ `1,250 per unit and charged VAT @ 12.5%. Charan

of Delhi sold goods to Deepak, a consumer @ `1,500 per unit and charged VAT @

12.5%.

Compute the net VAT payable per unit.

(5 marks)

(v) (a) Compute the invoice value to be charged and amount of tax payable under VAT

by a dealer who had purchased goods for `1,20,000 and after adding for

expenses of `10,000 and profit of `15,000 had sold out the same.

The rate of VAT on purchases and sales is 12.5%.

(3 marks)

(b) "VAT avoids cascading effect." How ?

(2 marks)

|