|

#4

22nd August 2014, 12:41 PM

| |||

| |||

| Re: Duration for ICWA course

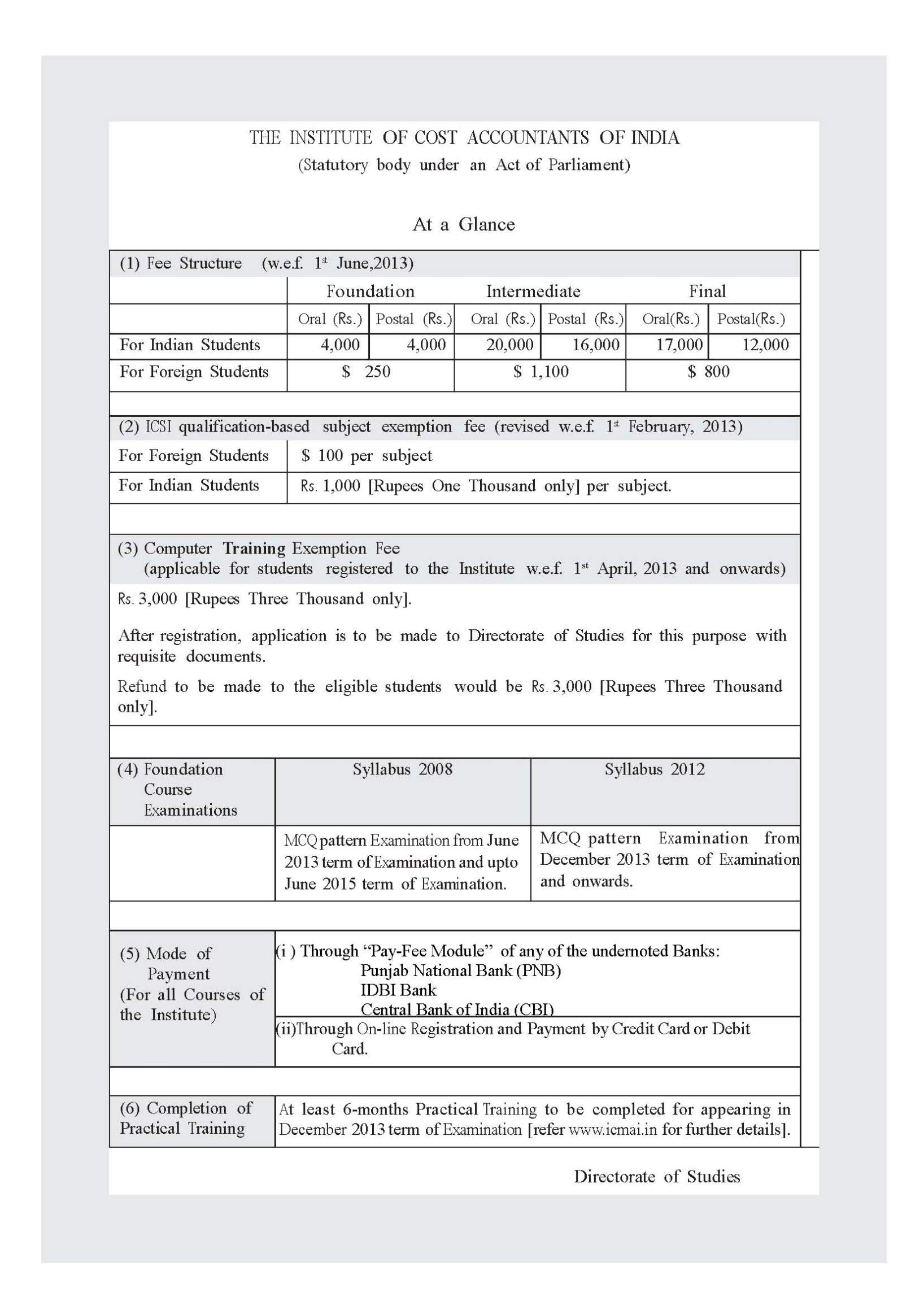

Here I am giving you information about duration and required qualifications for admission in ICWA Course offered by The Institute of Cost Accountants of India (ICAI) ICWAI is divided into following stages Duration: Foundation Program- 6 months Intermediate Program- 12 months Management Training- 36 months Final Course- 12 months Eligibility Criteria for ICWAI Eligibility to Pursue Intermediate Course of ICWAI: -Aspirants who have finished the foundation course are eligible for the intermediate course. -The students who have done graduation many not have to pass the foundation course. They can directly enroll in to the intermediate course. -The candidate must also be above 18 years of age. Eligibility to Pursue Foundation Course of ICWAI: You Must have passed 10+2 from a recognized board of India to apply for the foundation course Age limit : The candidates must also be above 17 years of age. Eligibility to Pursue Final Course of ICWAI: You Must have successfully completed all the 8 papers in the intermediate course of ICWAI to apply for the Final Course. Fees: Foundation Course- Rs. 4000 for both Oral as well as Postal mode. Intermediate Course- Rs. 16000 for Postal mode and Rs. 20,000 for Oral coaching mode Final Course- Rs.12000 for postal mode and Rs. 17000 for oral coaching mode Exam fee : EXAMINATION GROUP AMOUNT (INR) Foundation - 1000/- ICWA Course fee  Syllabus : Foundation Course Paper 1: Fundamentals of Economics and Management Paper 2: Fundamentals of Accounting Paper 3: Fundamentals of Laws and Ethics Paper 4: Fundamentals of Business Mathematics & Statistic Intermediate Course New Paper 5 : Financial Accounting Paper 6 : Laws, Ethics and Governance Paper 7 : Direct Taxation Paper 8 : Cost Accounting and Financial Management Paper 9 : Operation Management & Information System Paper 10: Cost and Management Accountancy Paper 11 : Indirect Taxation Paper 12 : Company Accounts and Audit Final Course New Paper 13- Corporate Laws and Compliance Paper 14- Advanced Financial Management Paper 15- Business Strategy & Strategic Cost Management Paper 16- Tax Management and Practice Paper 17 : Strategic Performance Management Paper 18- Corporate Financial Reporting Paper 19- Cost and Management Audit Paper 20- Financial Analysis & Business Valuation Contact Details: Western India Regional Council "Rohit Chambers",4th Floor Janmabhoomi Marg,Fort Mumbai - 400 001 Ph : 022-22872010/ 22841138/ 22043406/ 22043416 Fax : 91- 022- 22870763 Email :wirc@icmai.in |