|

#4

23rd March 2015, 03:15 PM

| |||

| |||

| Re: Delhi University M.Com Entrance Exam Paper

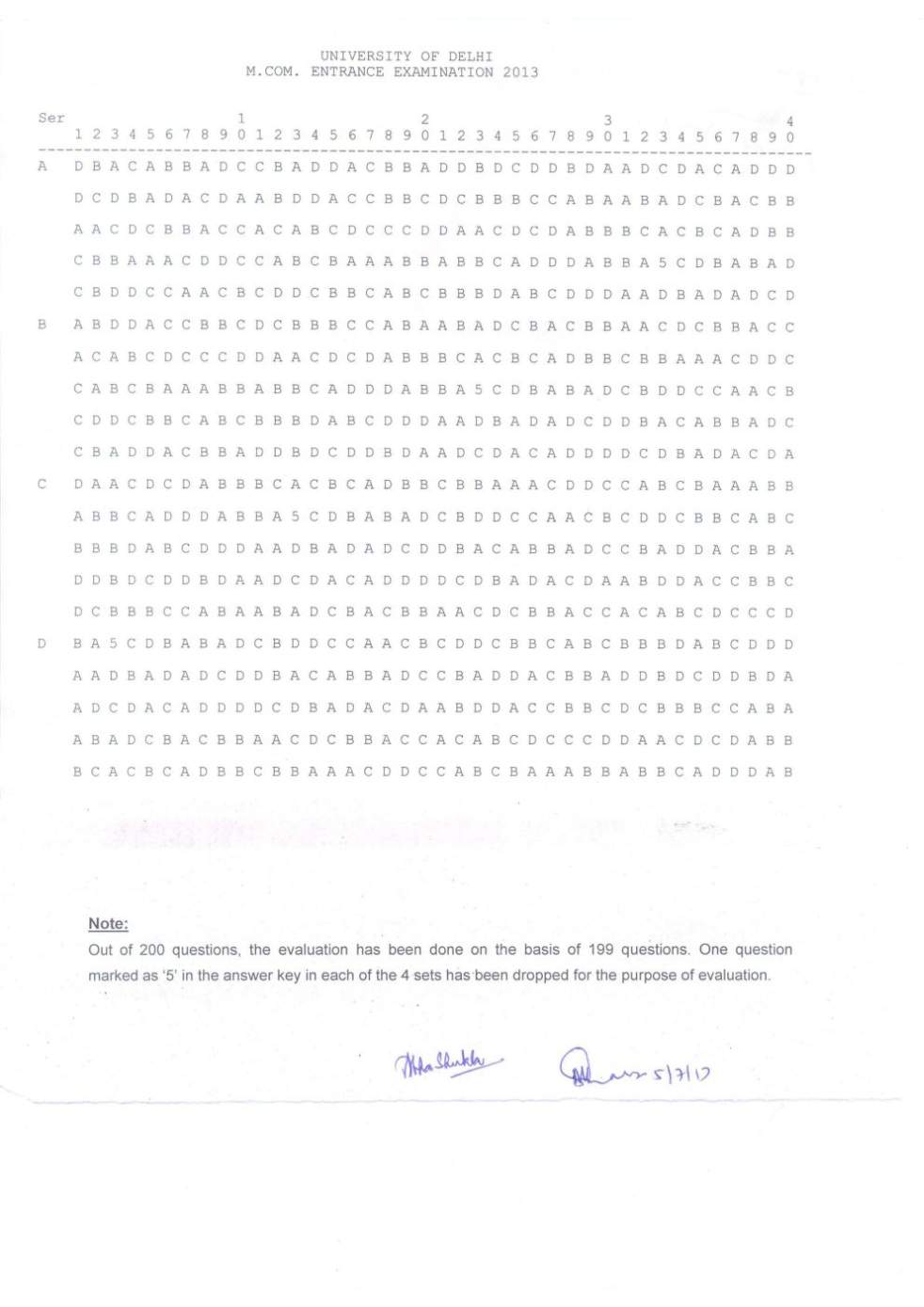

As you want I am here providing you answer key of M.Com Entrance Exam 2013 paper of Delhi University . Answer key of M.Com Entrance Exam 2013 paper  DU M.Com Entrance Test pattern: Entrance Test is of 3 hours duration and shall carry 200 marks. The written test shall contain 200 objective type questions. Questions from units: Economics (including Micro Economics, Macro Economics, and Problems of Indian Economy) Accounting (including Financial Accounting, Corporate Accounting, Cost Accounting, and Management Accounting) Business Statistics and Mathematics Business Organization, Management, Business Law, Company Law and Income Tax Law General Knowledge and Current Affairs Address: University of Delhi New Delhi, Delhi 110021 011 2700 6900 Map: [MAP]University of Delhi[/MAP] |