|

#2

26th August 2014, 10:48 AM

| |||

| |||

| Re: CPT Admission

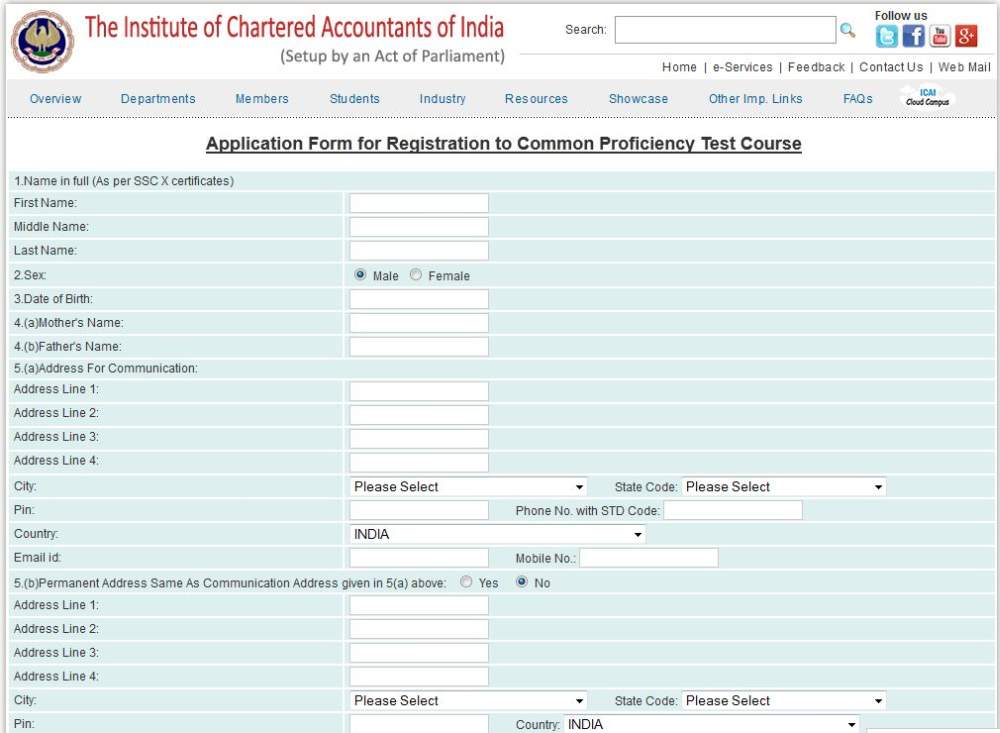

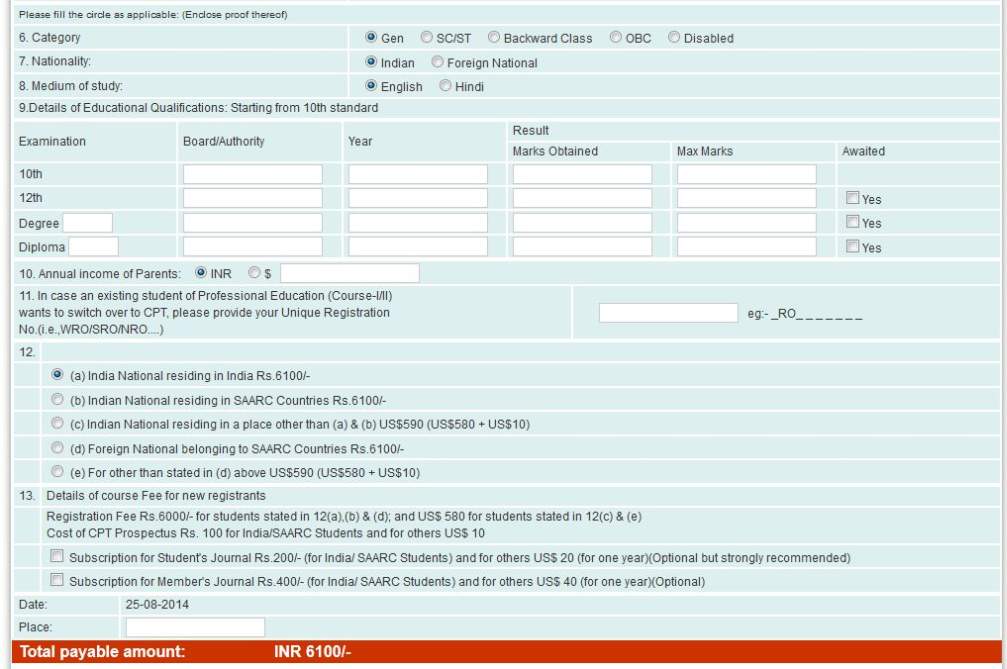

Details about the Common Proficiency Test (CPT) Admission Process in Institute of Chartered Accountants of India are as follows: Candidate can pursue chartered accountancy course either through Common Proficiency Test (CPT) route or through Direct Entry Scheme. The Common Proficiency Test (CPT) is open only to candidates registered with the Institute of Chartered Accountants of India for the Common Proficiency Course on or before 1st October, 2014 and fulfills the requisite eligibility conditions. CA CPT Registration 2014 for the Common Proficiency Test shall commence on 7-October-2014. The last date to apply is 28-October-2014. Before applying for the exam, candidate must register for the Common Proficiency Test Course before 1-October-2014. Students must enroll with the Institute for Common Proficiency Course (CPC) after passing class 10th examination conducted by an examining body constituted by law in India or an examination recognized by the Central Government as equivalent thereto. Candidates who have appeared and passed in the class 12th or equivalent exam can then apply for the CA CPT exam. The fee for new registrants for the Chartered Accountancy course is as follows. (a) India National residing in India Rs.6100/- (b) Indian National residing in SAARC Countries Rs.6100/- (c) Indian National residing in a place other than (a) & (b) US$590 (US$580 + US$10) (d) Foreign National belonging to SAARC Countries Rs.6100/- (e) For other than stated in (d) above US$590 (US$580 + US$10) Admission Form:    Contact Detail: Institute of Chartered Accountants of India Bahadur Shah Zafar Marg, Ito, IP Estate, New Delhi, DL 110002 Map: [MAP]https://www.google.co.in/maps?q=Institute+of+Chartered+Accountants+of+India ++++Photo+Bahadur+Shah+Zafar+Marg,+Ito,+IP+Estate, +New+Delhi,+DL+110002&hl=en&sll=28.664852,77.21990 3&sspn=0.164781,0.295601&hq=Institute+of+Chartered +Accountants+of+India++++Photo+Bahadur+Shah+Zafar+ Marg,+Ito,+IP+Estate,+New+Delhi,+DL+110002&radius= 15000&t=m&z=13[/MAP] |