|

#2

26th November 2014, 12:47 PM

| |||

| |||

| Re: CBSE 12th Accountancy question paper

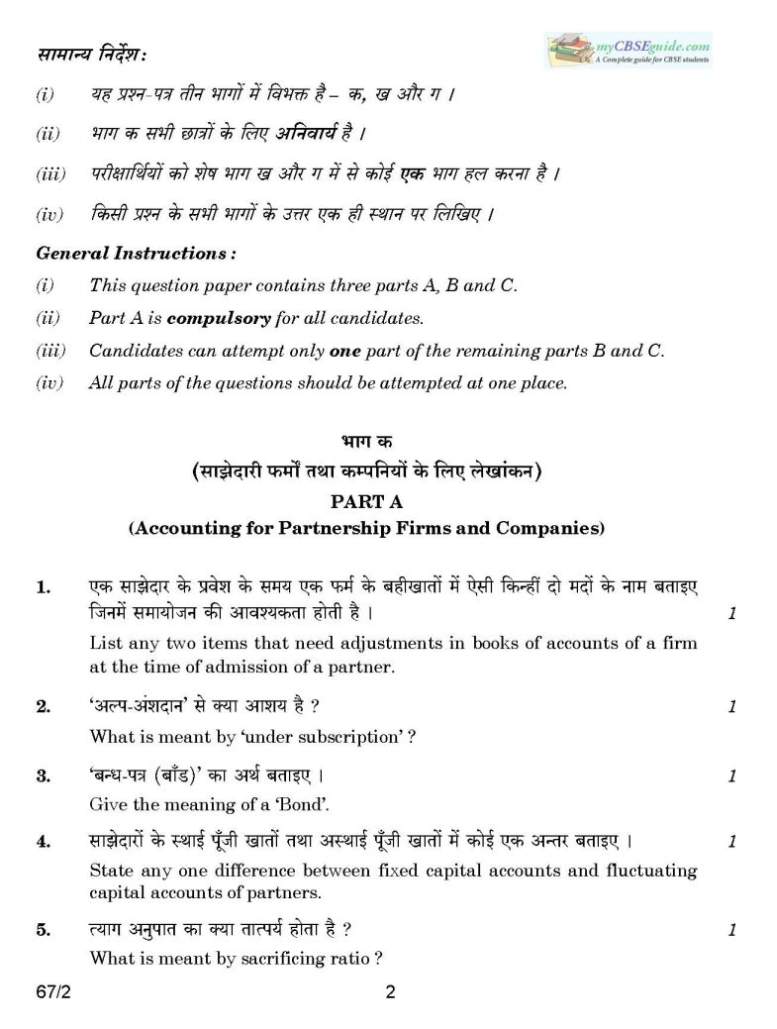

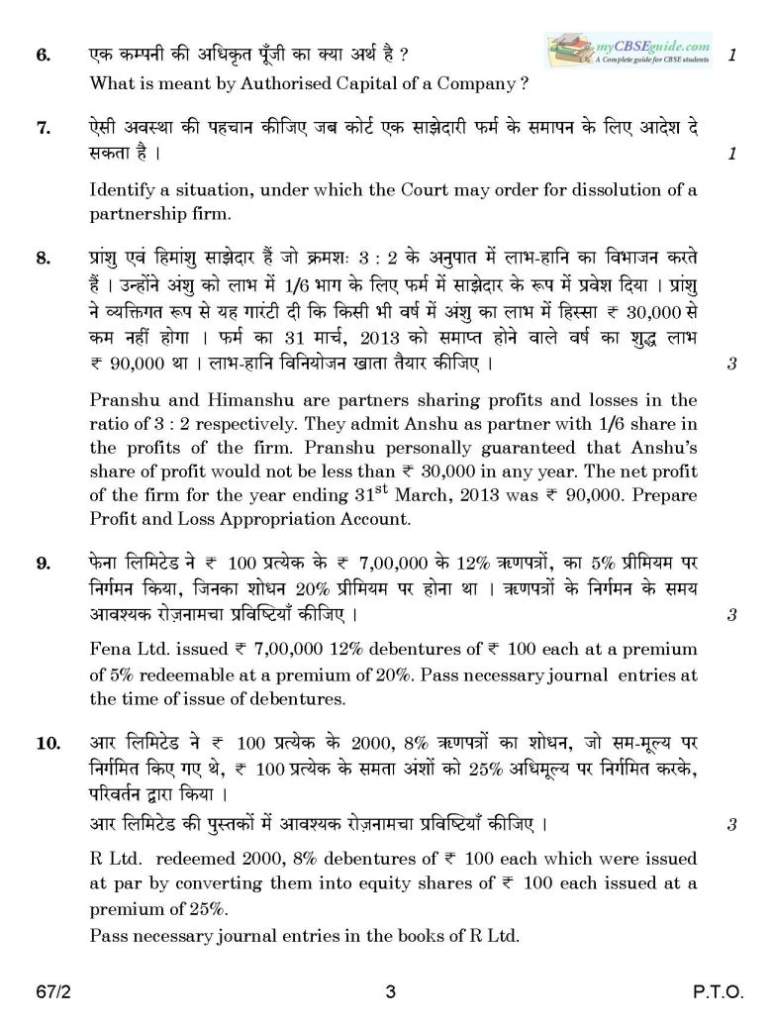

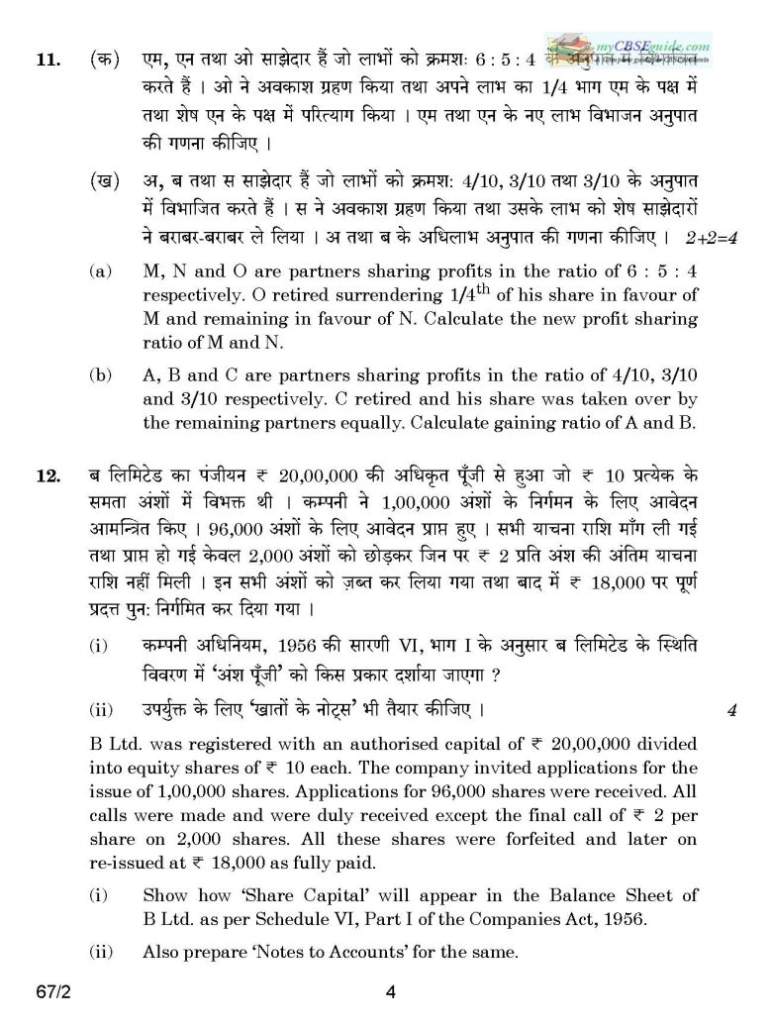

Ok, as you want the question paper of CBSE 12th class of Accountancy so here I am providing you CBSE 12th Accountancy question paper 1. What is meant by over-subscription ? 2. Give the meaning of a ‘Bond’. 3. Identify a situation for the compulsory dissolution of a partnership firm. 4. Name the accounts which are maintained for the partners when capitals of the partners are fixed. 5.List any two items that need adjustments in books of accounts of a firm at the time of admission of a partner. 6. What is meant by ‘paid up capital’ ? 7. What is meant by sacrificing ratio ? 8. Mukesh and Ramesh are partners sharing profits and losses in the ratio of 2 : 1 respectively. They admit Rupesh as partner with 1/4 share in profits with guarantee that his share of profit shall be at least < 55,000. The net profit of the firm for the year ending 31st March, 2013 was < 1,60,000. Prepare Profit and Loss Appropriation Account. 9. P Ltd. redeemed 10,000, 8% debentures of < 100 each which were issued at par, by converting them into equity shares of < 100 each issued at a premium of 25%. Pass necessary journal entries in the books of P Ltd. 10.Fena Ltd. issued < 7,00,000 12% debentures of < 100 each at a premium of 5% redeemable at a premium of 20%. Pass necessary journal entries at the time of issue of debentures. 11.X Ltd. purchased a running business from G Ltd. for a sum of < 18,00,000 payable by issue of equity shares of < 100 each at a premium of < 20 per share. The assets and liabilities consisted of the following : Plant – < 3,50,000 : Land – < 6,00,000 Stock – < 4,50,000 and Creditors – < 1,00,000 Pass necessary journal entries in the books of X Ltd. for the above transactions. 12. Priya and Divya were partners in a firm sharing profits in the ratio of 7 : 3 respectively. Their capitals were < 1,60,000 and < 1,00,000 respectively. They admitted Hina in the firm on 1st January, 2013 as a new partner for 1/5 share in the future profits. Hina brought < 1,20,000 as her capital. Calculate the value of goodwill of the firm and record necessary journal entries on Hina’s admission. 13.(a) K, L and Z are partners sharing profits in the ratio of 4 : 3 : 2 respectively. L retired and surrendered 1/9th of his share of profit to K and remaining in favour of Z. Calculate the new profit sharing ratio of K and Z. (b) Arun, Varun and Charan are partners sharing profits in the ratio of 1/2, 3/10 and 1/5 respectively. Varun retired from the firm and Arun and Charan decided to share future profits in 3 : 2 ratio. Calculate gaining ratio of Arun and Charan. 12th CBSE accountancy question paper     Half question paper is in pdf file........................... |