|

#2

15th February 2016, 09:36 AM

| |||

| |||

| Re: Axis Bank Mortgage Loan Interest Rate

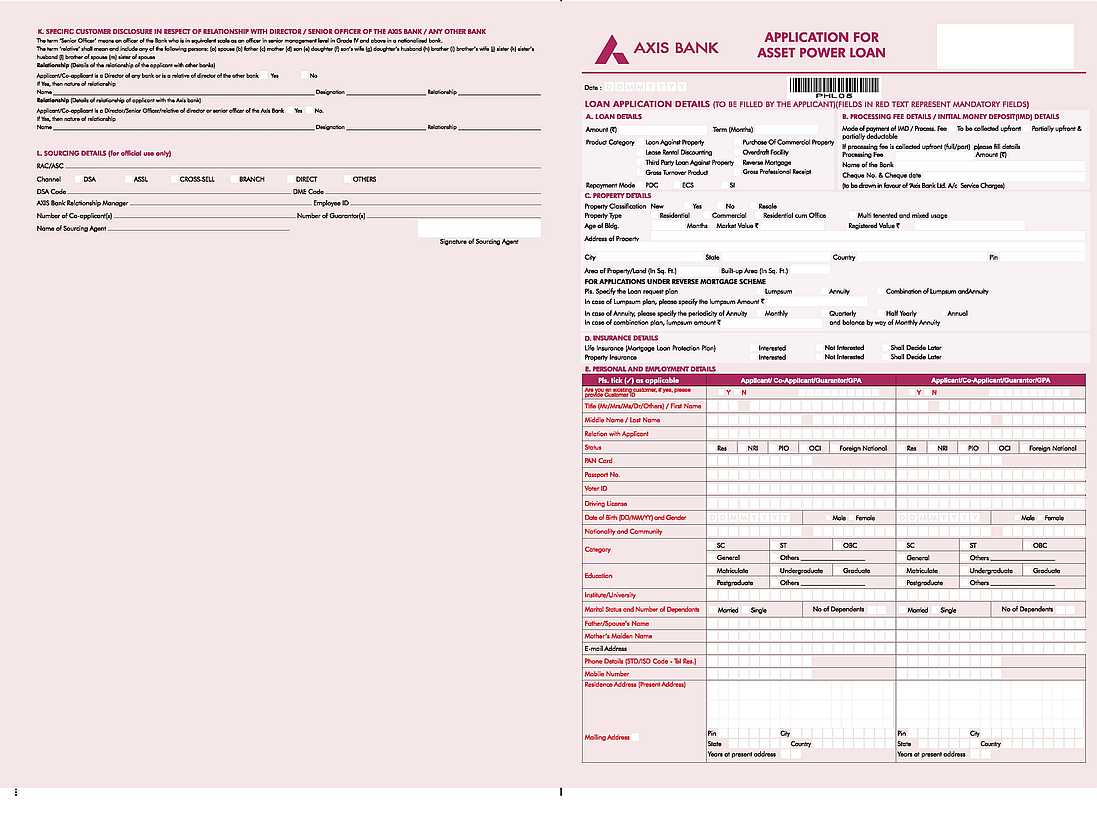

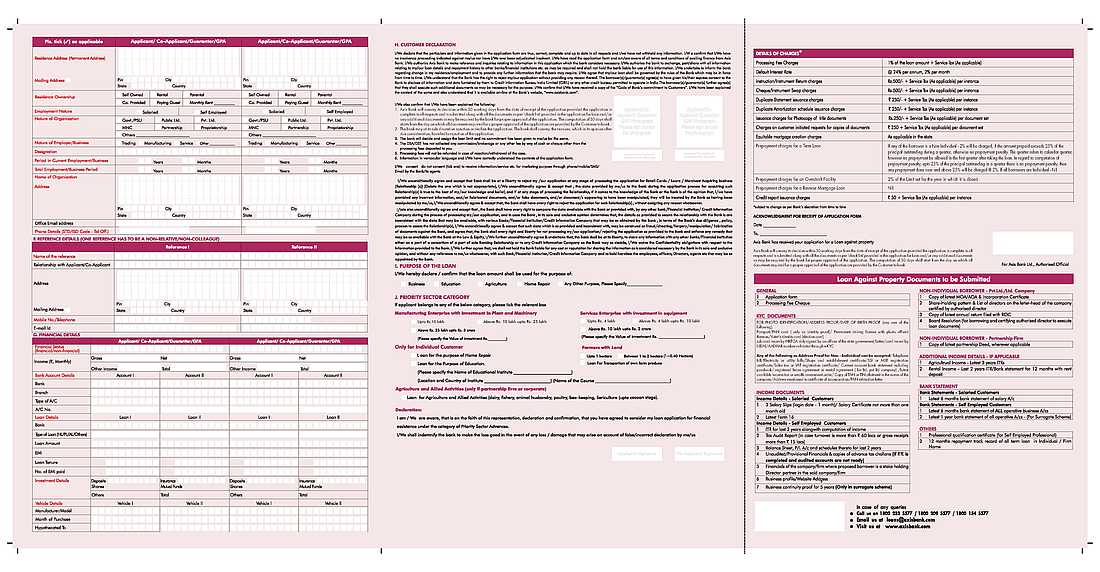

As you want to get the details of interest rates of Axis Bank Mortgage Loan so here is the information of the same for you: Axis Bank Mortgage Loan Interest Rates: Type of Loan Base Rate + Markup Effective ROI (floating) Loan Against Self-Occupied Residential Property (Standard Product) Base Rate + 2.25% 11.75% Loan Against Property -Residential (other than Self-occupied) & Commercial(Standard Product) Base Rate + 3.25% 12.75% Purchase Of Commercial Property (Standard Product) Base Rate + 3.25% 12.75% Reverse Mortgage Loan Base Rate + 3.25% 12.75% Lease Rental Discounting Base Rate + 3.25% 12.75% Overdraft Facility Against Property Base Rate + 4.00% 13.50% ** Base Rate - 9.50% Features: Attractive interest rates Doorstep service Loan against property - Residential Loan against property - Commercial Loan for purchase of commercial property Take-over of existing loan with additional refinance (Balance Transfer) Lease Rental Discounting (LRD) Benefits: Earn 500 points if your disbursal is less than or equal to 25 lacs Earn 1250 points if your disbursal is greater than 25 lacs but less than or equal to 75 lacs Earn 2500 points if your disbursal is greater than 75 lacs Axis Bank Mortgage Loan Application Form:   Eligibility Criteria: Salaried Individuals: Any individual who is in permanent service in government or a reputed company The applicant in all the cases should be above 24 years of age at the time of loan commencement and up to the age of superannuation Professionals: Professionals (ie, doctors, engineers, dentists, architects, chartered accountants, cost accountants, company secretary, and management consultants only) can apply The applicant should be above 24 years of age at the time of loan commencement and up to 65 years or less at the time of loan maturity Self-employed Individuals: Any individual filing Income Tax returns can apply The applicant in all the cases should be above 24 years of age at the time of loan commencement and up to 65 years or less at the time of loan maturity Lease Rental Discounting (LRD): All resident individuals can apply. The lessee must however be a company as defined under the Companies Act, 1956. Funding will be done only against ready commercial property. The same will be restricted to 85% of the net present value of the future rentals or 50% of the value of property, whichever is lower. Contact Details: Axis Bank Basement and Ground Floor, M-61 Guru Ravidas Marg Block M, Rampuri, Kalkaji New Delhi, Delhi 110019 India |