|

#2

5th December 2014, 08:14 AM

| |||

| |||

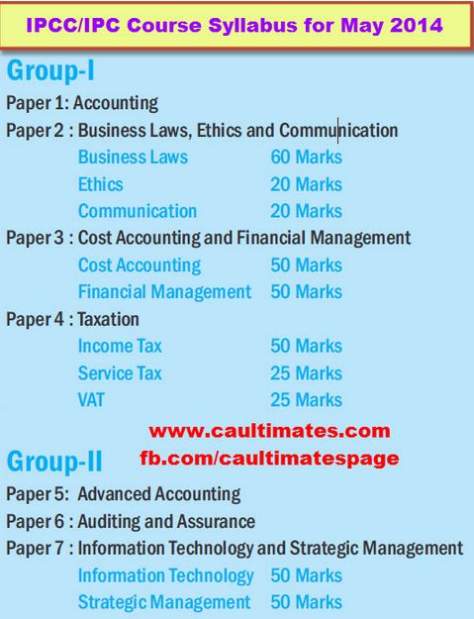

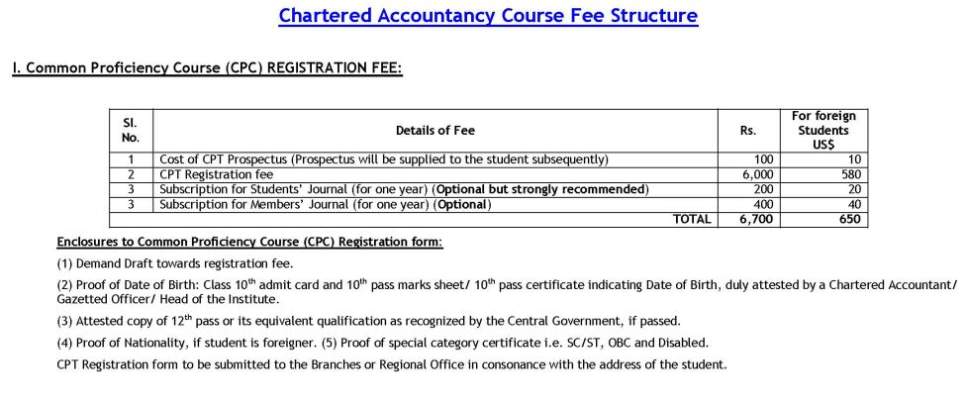

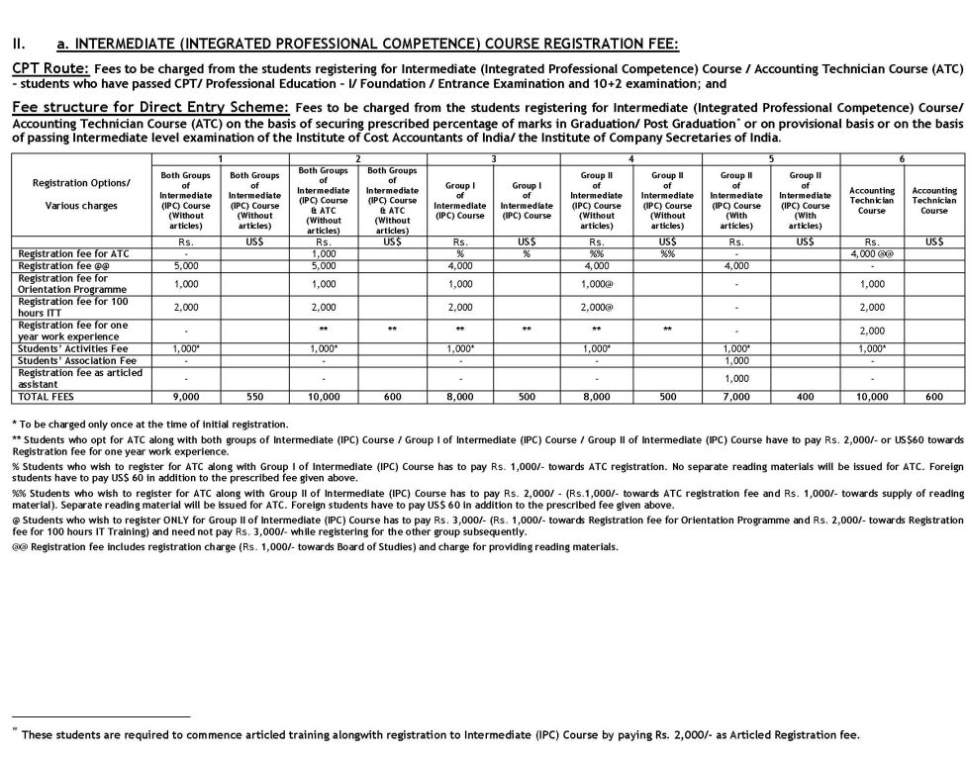

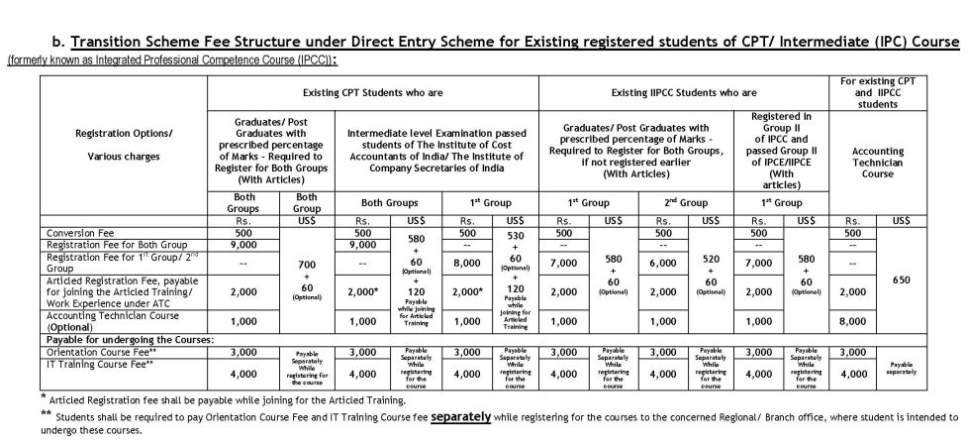

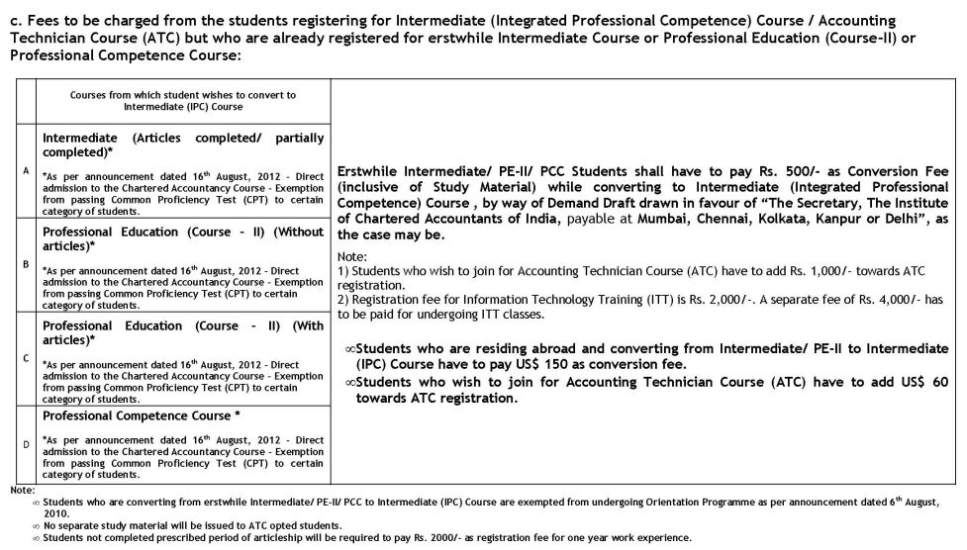

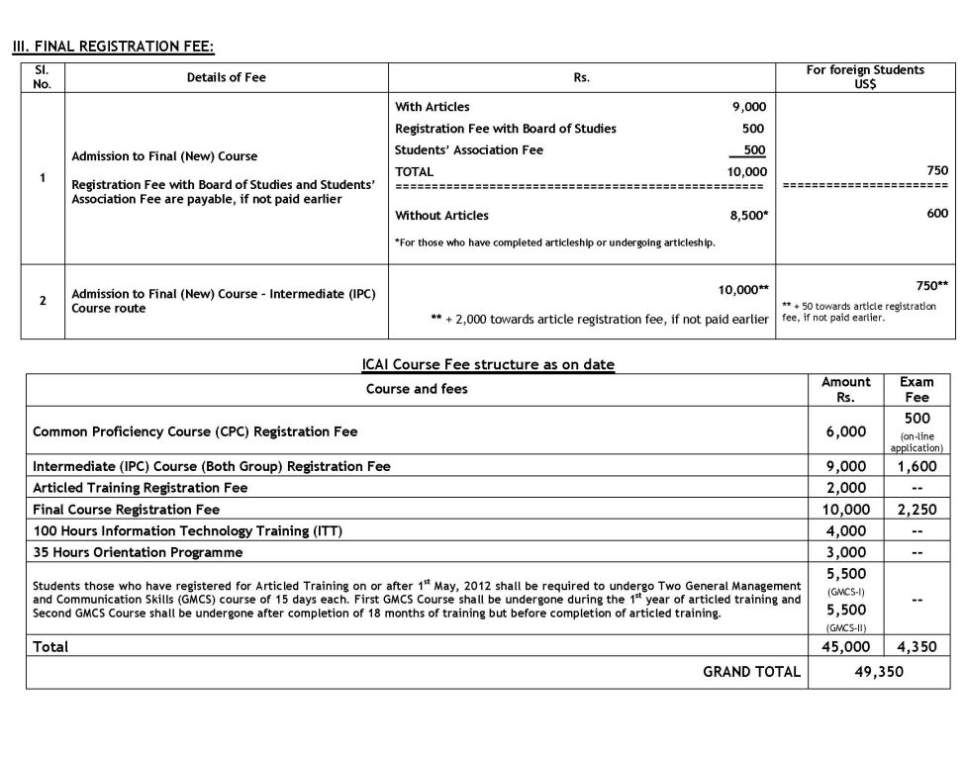

| Re: Admission in CA after B.com

CA or Chartered Accountant Entrance Exam is conducted all over India to enroll the students with ICAI. It is one of the most popular Entrance Exams in India especially for commerce students. Admission in CA after B.com As you are still in 2nd year of your B Com, so firstly you need to complete your Graduation and then you can take admission directly in 2nd stage of CA course which is IPC. Chartered Accountant Eligibility Students who are Graduates/ Post Graduates in Commerce having secured in aggregate a minimum of 55% of the total marks or other than those falling under Commerce stream having secured in aggregate a minimum of 60% of the total marks or its equivalent grade in the examination conducted by any recognized University (including Open University) and Candidates who have passed the Intermediate level examination conducted by The Institute of Cost Accountants of India or by The Institute of Company Secretaries of India are exempted from qualifying Common Proficiency Test (CPT) and can register directly in the Intermediate (IPC) Course. CA Course Details ICAI - Institute of Chartered Accountants of India CA - Chartered Accountancy » PE I : Professional Examination I » PE II : Professional Examination II - Group I » PE II : Professional Examination II - Group II » Final - Group I » Final - Group II CA - Chartered Accountancy » Integrated Professional Competence Course Examination - Group I » Integrated Professional Competence Course Examination - Group II » Common Proficiency Test » Professional Competence Course Examination - Group I » Professional Competence Course Examination - Group II » Final - Group I » Final - Group II Fee Structure      Chartered Accountant Salary Chartered accountant can get anything between Rs. 25,000 to Rs. 30,000 to start with and with some experience and expertise can get as high as Rs.1,00,000 per month. There is no upper limit for those, who have opted for private practice. |