|

#4

3rd August 2015, 05:08 PM

| |||

| |||

| Re: Punjab National Bank Fixed Deposit rates

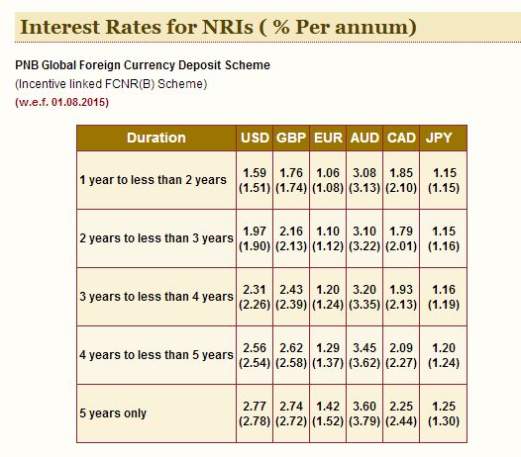

As you want to get the details of Punjab National Bank Fixed Deposit interest rates so here is the information of the same for you: PNB TAX SAVER FIXED DEPOSIT SCHEME: Brief features of the product: Individuals (including illiterate, blind persons), singly or jointly, and HUF Minimum Deposit Rs100/- or in multiples thereof, subject to maximum deposit of Rs. 1.50 lac per financial year Terms & Conditions: Min deposit period 5 years & Max deposit period 10 years. Rebate on income tax under Sec. 80 c Nomination facility Available Lock in period of 5 years. Loan available after lock in period of 5 years against Deposit Premature withdrawals are allowed after the completion of 5 years of deposit. Interest on deposits is payable either monthly at discounted value or quarterly or compounded quarterly (i.e., reinvestment of interest) or on the date of maturity at the option of the depositor as applicable under particular deposit scheme. Interest on overdue deposit is paid if the deposit is renewed, as decided by the Bank from time to time. Interest on bank deposits is exempt from income tax up to a limit specified by Income Tax authorities from time to time. The Bank will issue TDS Certificate for the tax deducted. Documents required: The Bank requires a satisfactory introduction of the person/s opening the account by a person acceptable to the Bank. The Bank is required to obtain two recent photographs of the person/s opening the account, as per RBI directives. The Bank is required to obtain Permanent Account Number (PAN) or General Index Register (GIR) Number or alternatively obtain declaration in Form No.60 or 61 as per the Income Tax Act (vide Section 139A) from the person/s opening the account. Interest Rates:  Contact Details: Punjab National Bank Sector 4 Market Sector 4, R.K. Puram New Delhi, Delhi 110022 India Map Location: [MAP]Punjab National Bank[/MAP] |