|

#2

6th August 2015, 08:42 AM

| |||

| |||

| Re: Punjab National Bank Deposit Rates

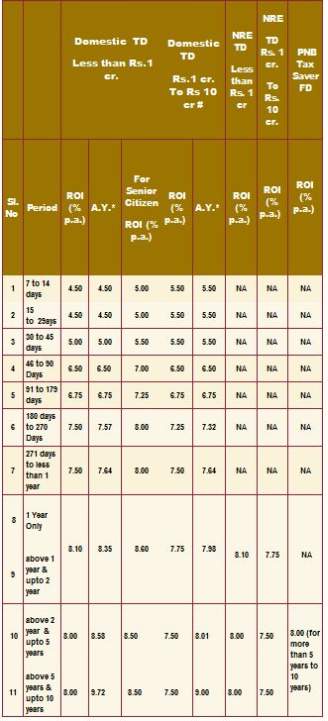

As you want to get the Punjab National Bank Lakhpati Deposit Scheme (Recurring and Fixed Deposit) so here is the information of the same for you: Period of Deposit (RD & FD): Total period of deposit is 120 months. RD period may be chose from 24, 36, 48 & 60 months. Amount of Recurring Deposit instalment: The amount of instalment may be chose from Rs 2100, Rs 1500, Rs 1200 & Rs 1000. Rate of interest is 9.00%. Maturity: The deposit shall mature on due date which shall be linked to the date of opening of the RD account. Reinvestment in FD scheme at maturity: The maturity proceeds will be reinvested under the FD Spectrum Scheme for one year only at applicable card rate of interest at the time of maturity, if not withdrawn by the account holder. Loan/overdraft facility is available under the scheme. Scheme shall remain operative till the time it is withdrawn by the bank. Interest Rates: Saving Account Interest Rates: 4.0 % p.a. (w.e.f. 3rd May 2011) Rate of Interest on Single Domestic Term Deposits (TD) and NRE Term Deposits of upto Rs.10 cr (w.e.f. 04.07.2015):  Contact Details: Punjab National Bank Sector 4 Market Sector 4, R.K. Puram New Delhi, Delhi 110022 India Map Location: [MAP]Punjab National Bank R.K. Puram New Delhi[/MAP] |