|

#2

5th June 2016, 04:04 PM

| |||

| |||

| Re: Municipal Corporation Amritsar Property Tax

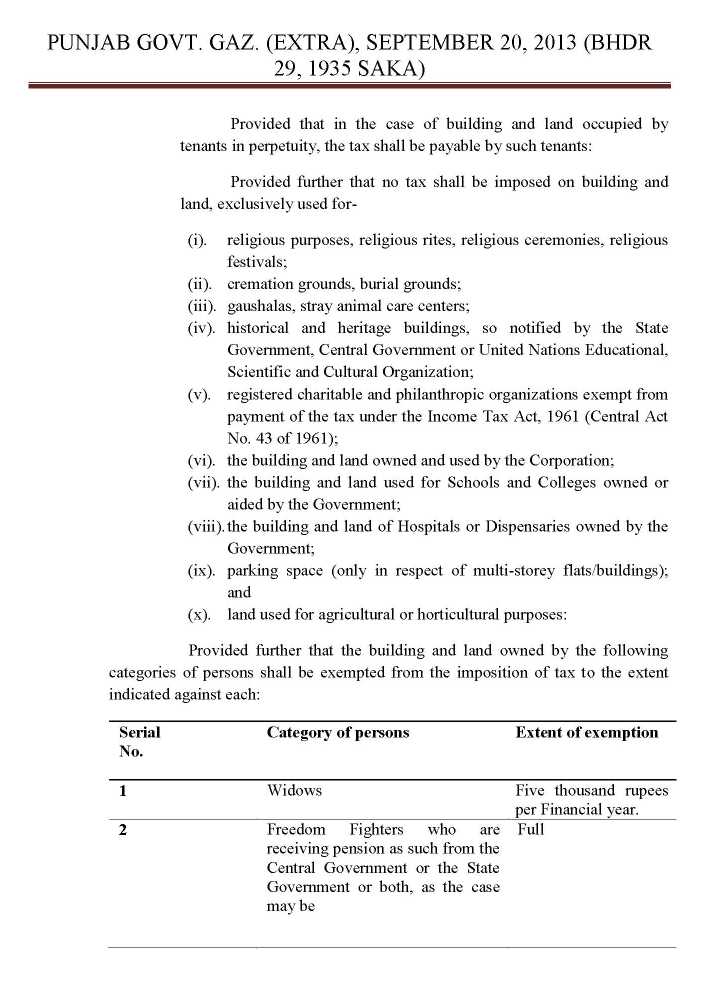

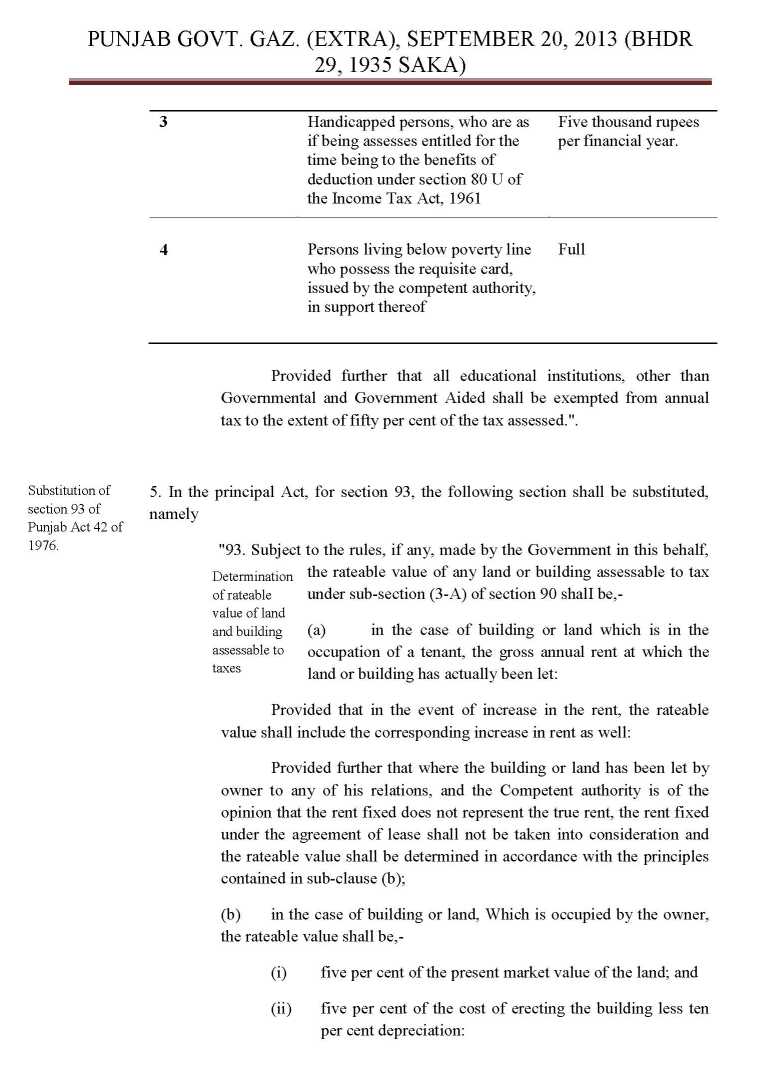

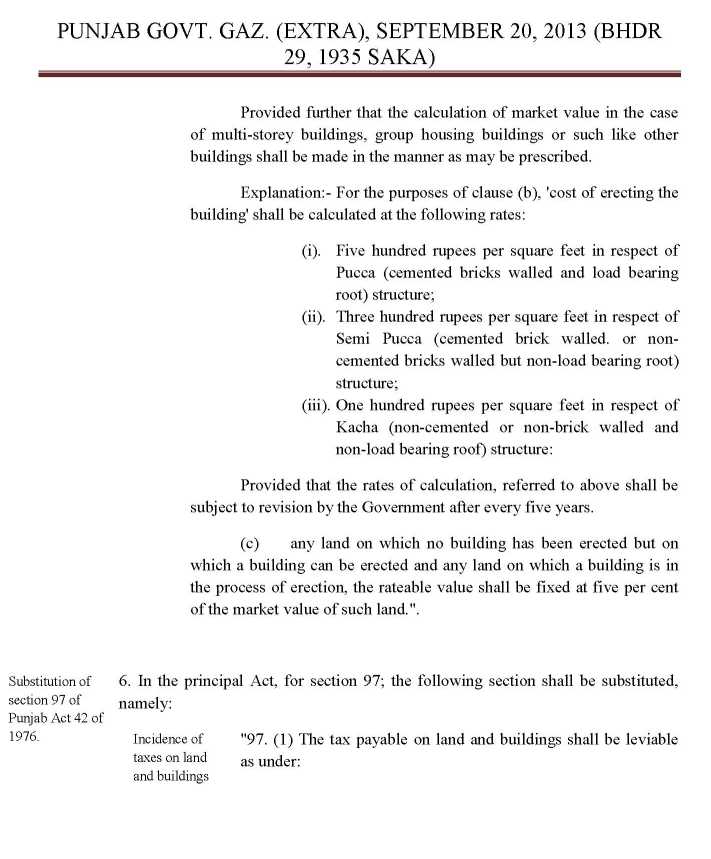

As you have asked about the property tax in Municipal Corporation Amritsar, I am giving you information about it, check below for the details Self occupied residential building Rate of tax: (i) Fifty rupees in case rand area is fifty square yards or below, having covered area not more than 450 square feet; (ii) One hundred and fifty rupees in case land area is one hundred square yards or below, having covered area not more than 900 square feet; iii) Half percent of the rateable value in case the land area is fifty square yards or below OR One hundred square yards or below, but the covered area exceeds the stipulation (iv) Half percent of the rateable value, in case the land area is five hundred square yards or below; and (v) One per cent of the rateable value, in case the land area is more than five hundred square yards Residential building under the occupation of tenant(s): Seven and half per cent of the rateable value; Property tax Municipal Corporation Amritsar)      For more, you can refer to the attached file |