|

#2

29th July 2015, 03:18 PM

| |||

| |||

| Re: After Degree in CA without CPT

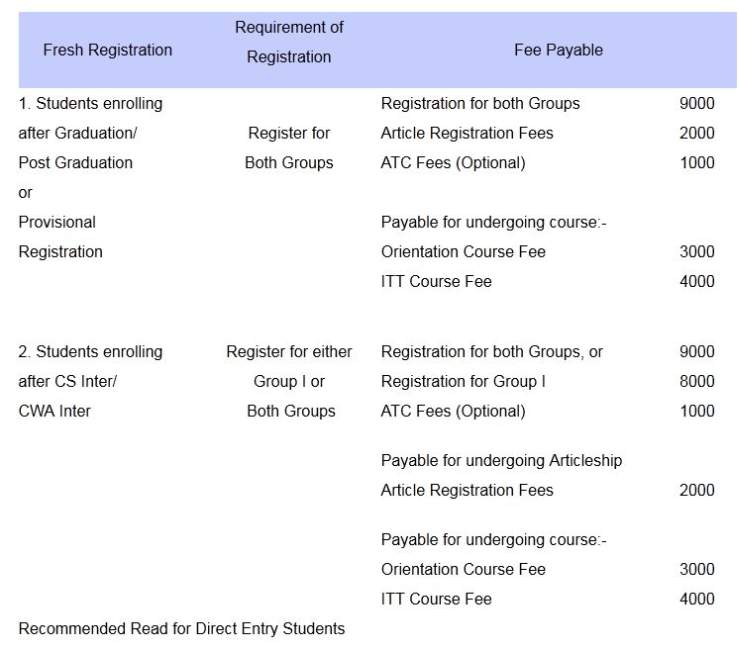

ICAI introduced the Direct Entry Scheme for those students who have completed their Graduation and are exempted from appearing for CPT Exams. Such students can directly appear for IPCC Exams i.e. the Intermediate Level. The following categories of students are exempted from appearing for CPT:- Graduates or Post Graduates in Commerce with 55% marks . Applicants must have studied any three papers of 100 marks each out of Mercantile Laws, Corporate Laws, Economics, Accounting, Auditing, Management (including Financial Management), Taxation (including Direct Tax Laws and Indirect Tax Laws), Costing, Business Administration or Management Accounting; OR Graduates or Post Graduates other than those falling under Commerce stream must have obtained 60% of marks. Candidates who have passed the CS Executive Exams conducted by the ICSI or Candidates who have cleared the CWA Inter Exams conducted by the ICAI . Commencement of Articleship training for Graduates under Direct Entry Scheme-- Students are required to complete a total of 3 years of articleship training under a CA (equivalent to internship). The articleship training period of 9 months . It is mandatory for all students to complete ITT and Orientation Program conducted by ICAI before starting Articleship. For fee details , here is the attachment CA CPT exam fee details  |