|

#2

17th June 2016, 02:02 PM

| |||

| |||

| Re: Unit Trust of India MBA

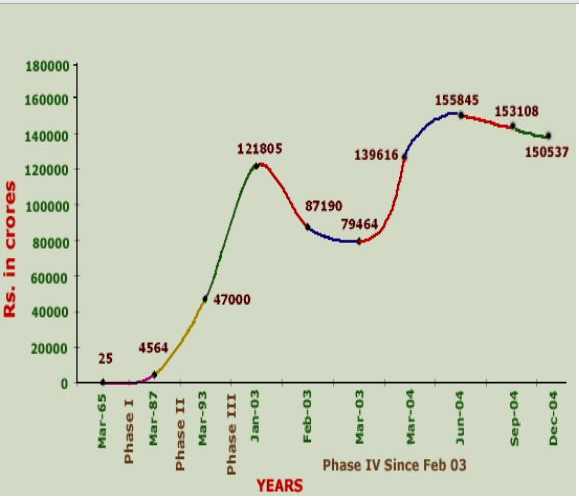

The mutual fund industry began in India smallly with the UTI Act making what was viably a little reserve funds division inside the RBI. Over a time of 25 years this became reasonably effectively and gave speculators a decent return, and along these lines in 1989, as the following coherent stride, open segment banks and monetary establishments were permitted to glide common assets and their prosperity encouraged the administration to permit the private part to raid into this range. The underlying years of the business likewise saw the developing years of the Indian value market, when various mix-ups were made and thus the shared asset plans, which put resources into lesser-known stocks and at abnormal states, got to be misfortune pioneers for retail speculators. Growth of UTI UTI sole player in the industry, created by an Act of Parliament, 1963 The first product launched by UTI was Unit Scheme 1964 UTI creates products such as ULIP (1971), MIP’s, Children Plans (1986), Offshore Funds etc. MASTERSHARE (1987) 1st Diversified Equity Investment Scheme in India. INDIA Fund 1st Indian offshore fund launched in August 1986. Emergence of Private Funds In 1993, Mutual Fund Industry was open to private players. SEBI’s first set of regulations for the industry formulated in 1993 Significant innovations, mostly initiated by private players Industry Profile The Indian common asset industry is one of the quickest developing parts in the Indian capital and budgetary markets. The common asset industry in India has seen sensational enhancements in amount and in addition nature of item and administration offerings lately. Shared assets resources under administration developed by 96% between the end of 1997 and June 2003 and accordingly it ascended from 8% of GDP to 15%. The business has developed in size and oversees complete resources of more than $30351 million. Of the different divisions, the private area represents about 91% of the assets activated demonstrating their staggering strength in the business sector. People constitute 98.04% of the aggregate number of financial specialists and contribute US $12062 million, which is 55.16% of the net resources under administration. The Following Graph Indicates the Growth Of Assets Over the Years:  Enduring development of shared asset business in India in the four decades from 1964, when UTI was set up is given in the table Period (Year) Aggregate Investment in Crores of Rupees 1964-69 65 1969-74 172 1974-79 402 1979-84 1261 1986-87 4563.68 1987-88 6738.81 1988-89 13455.65 1989-90 19110.92 1990-91 23060.45 1991-92 37480.20 1992-93 46988.02 1993-94 61301.21 1994-95 75050.21 1995-96 81026.52 1996-97 80539 1997-98 68984 1998-99 63472 1999-00 107966.1 2000-01 90587 2001-02 94571 |