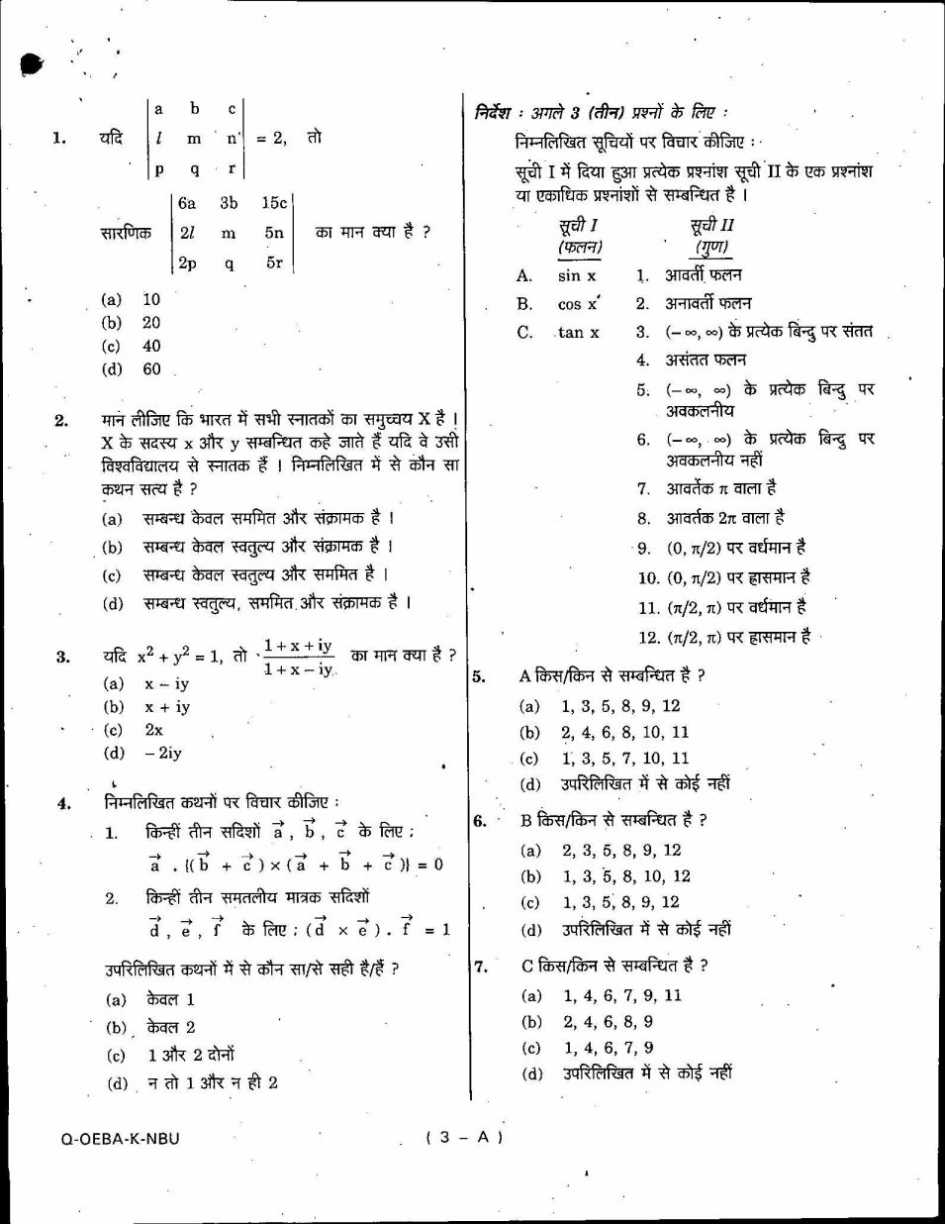

|

#2

6th August 2014, 08:27 AM

| |||

| |||

| Re: Union Bank of India probationary officers exam last year question papers

As you want to get the Union Bank of India probationary officers exam last year question papers so here it is for you: Directions—(Q. 1–15) Read the following passage carefully and answer the questions given below it. Certain words have been printed in bold to help you locate them while answering some of the questions. Over the past few decades, many Asian nations transformed from poverty into global competitors. From 2003 to 2007, Asian economies expanded at an average annual rate of 8•1%, triple that of advanced economies. Over the same period, inflation in Asia averaged only about 3•5%. But Asia could be facing turbulent economic times. In May, the average inflation rate throughout the region reached nearly 7%, led by spikes in oil and food prices. In India, inflation jumped to an 11•6% annual rate in June, according to the latest government figures, the highest in 13 years. Policymakers and central bankers are forced to raise interest rates and limit credit to get inflation under control. But these same measures suppress the investment and consumption that generates growth. The combination of slowing growth and soaring inflation makes economic policy-making tricky. Inflation stirs up the middle classes because it can quickly erase years of hardwon personal gains. Inflation is cruel to the poor, because families have to spend a larger share of their meagre incomes on necessities. In the Philippines, farmers, unable to afford fuel for tractors, use water buffaloes to plough their fields. But to avoid unrest, leaders cannot blindly adopt rigid anti-inflation measures. Voters won’t hesitate to remove from office any politician who doesn’t deliver the goods. So they cannot overreact to the inflation threat and scale down economic growth in the process. Developing nations need to grow quickly to create jobs and increase incomes for their large populations. With prices soaring, doing nothing is not an option. Most central banks in Asia have started raising interest rates. The Reserve Bank of India increased its benchmark rate twice last month to a six year high of 8•5%. The challenge is especially difficult because currently, inflation is not of domestic origin. Prices are being driven higher by a global surge in oil and food prices, which individual governments can do little to control. Of course, inflation is not just a problem in Asia. World Bank President Robert Zoellick called rising food and oil prices a man-made ‘catastrophe’ that could quickly reverse the gains made in overcoming poverty over the past seven years. For now, though, there is more talk than action on the international front, so Asian governments are on their own. Even though inflation throughout the region is likely to continue to rise in coming months, no one is expecting an economic calamity. According to the Asian Development Bank Asian countries have large hard currency reserves and relatively healthy banks, and so are far better prepared to absorb external shocks than they were during the region’s last recession ten years ago. Asian policymakers have learned their lessons and are more alert. 1. Which of the following can be said about Asian economies during the period from 2003- 2007 ? 1. Though inflation was rising at the time politicians did not pay much attention. 2. Many of the poor countries were able to compete internationally. 3. The growth rate of Asian countries was facilitated by growth in advanced countries. (A) All 1, 2, and 3 (B) Only 1 (C) Only 2 (D) Both 1 and 2 (E) None of these 2. Which of the following is not an anti-inflation measure being used by Asian countries ? 1. Increase in benchmark interest rate by a central bank. 2. Checks on lending. 3. Subsidising fuel for farmers. (A) Only 3 (B) Both 1 and 2 (C) Both 2 and 3 (D) Only 2 (E) None of these 3. What makes it difficult for Asian countries to control inflation ? (A) Restrictions by organizations like the Asian Development Bank (B) Governments are indecisive and adopt counterproductive measures (C) The problem is global in nature, not restricted to their individual countries (D) Countries have never faced a financial crisis (E) Economic growth rate cannot occur in the absence of inflation 4. Why are experts not very concerned about the impact of inflation on Asian economies ? 1. Asian countries have not maintained substantial hard currency reserves. 2. The condition of Asian banks is currently both stable and strong. 3. The Asian Development Bank will bail them out of any trouble. (A) Only 1 (B) Both 1 and 3 (C) Both 1 and 2 (D) Only 2 (E) None of these 5. What is the author’s advice to politicians regarding the handling of inflation ? (A) They should focus on preventing agitations among their citizens not implementing antiinflation measures (B) They ought to implement anti-inflation measures even at the cost of losing office (C) They must focus on maintaining high economic growth rate as inflation will taper off on its own (D) Countries should handle the problem independently and not collectively (E) None of these 6. What could the impact of stringent inflation measures be ? (A) Increased consumption as families spend a larger part of their income on essential goods (B) Politicians may be voted out of power (C) Economic growth rate remains constant (D) Oil prices within the country remain stable despite high global prices (E) None of these 7. Why is high economic growth necessary for developing countries ? (A) To catch up with the growth rate of the advanced countries (B) To sustain their economies despite the ill effects of inflation (C) To provide better educational opportunities to their citizens (D) To create employment opportunities for citizens (E) None of these 8. Why has inflation been referred to as a ‘catastrophe’ ? (A) Prices of essential commodities are unaffordable for all (B) Our past efforts to reduce poverty will be nullified (C) Governments are unstable and do not take stringent decisions (D) It has divided countries rather than ensuring co-operation among them (E) None of these 9. Which of the following can be inferred from the passage ? 1. Growth rate in advanced countries was low so the effects of inflation were not felt. 2. Closing the economy to global markets will reduce inflation. 3. India has been the most severely affected by inflation. (A) None (B) Only 1 (C) Only 2 (D) Both 2 and 3 (E) All 1, 2 and 3 10. Which of the following factors was responsible for inflation in India ? (A) Reserve Bank India raising the interest rates very frequently (B) High population growth (C) Sudden rise in prices of oil worldwide (D) Reckless competition with China (E) None of these      For more detailed information I am uploading a PDF file which is free to download: |