|

#4

23rd March 2015, 01:56 PM

| |||

| |||

| Re: UGC NET Exam Solved Economic II paper

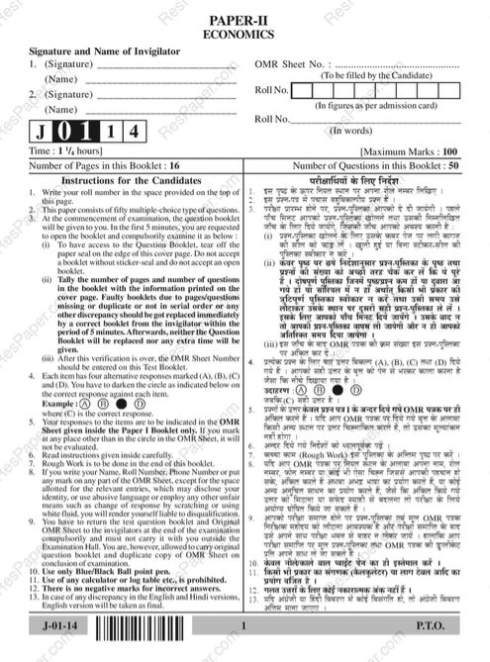

The UGC NET (University Grants Commission National Eligibility Test) Exam Economic II previous year question paper as you need it for preparation is as follows: UGC NET Exam Economic II paper      .respaper.com/ugc_net/814/1047-pdf.html Syllabus UGC NET Exam Economic II paper 1. Micro – Economic Analysis Demand Analysis – Marshallian, Hicksian and Revealed preference approaches. Theory of Production and Costs. Pricing and output under different forms of market structure. Factor Pricing analysis. Elements of general equilibrium and new welfare economics. 2. Macro – Economic Analysis Determination of output and employment – Classical approach, Keynesian approach, Consumption hypotheses. Demand for Money – Fisher and Cambridge versions, Approaches of Keynesian, Friedman, Patinkin, Baumol and Tobin. Supply of Money, Determinants of money supply, High – powered money, Money multiplier. Phillips Curve analysis. Business cycles – Models of Samuelson, Hicks and Kaldor. Macro – economic Equilibrium – Relative roles of monetary and fiscal policies 3. Development and Planning Economic Growth, Economic Development and sustainable Development – Importance of institutions – Government and markets – Perpetuation of underdevelopment – Vicious circle of poverty, circular causation, structural view of underdevelopment – Measurement of development conventional, HDI and quality of life indices. Theories of Development – Classical, Marx and Schumpeter; Economic Growth – Harrod – Domar model, instability of equilibrium, Neoclassical growth – Solow’s model, steady state growth. Approaches to development : Balanced growth, critical minimum effort, big push, unlimited supply of labour, unbalanced growth, low income equilibrium trap. Indicators and measurement of poverty. Importance of agriculture and industry in economic development – choice of techniques and appropriate technology – Investment criteria – Elementary idea of cost – benefit analysis. Trade and Aid – International trade as ‘engine of growth’ – Globalization and LDC’s Objectives and role of monetary and fiscal policies in economic development Techniques of planning; Plan Models in India; planning in a market – oriented economy. 4. Public Finance Role of the Government in Economic activity – Allocation, distribution and stabilization functions; Private, Public and Merit goods. The Public Budgets – Kinds of Budgets, Zero – base budgeting, different concepts of budget deficits; Budgets of the Union Government in India Public Expenditure – Hypotheses; effects and evaluation. Public Revenue – Different approaches to the division of tax burden, incidence and effects of taxation; elasticity and buoyancy; taxable capacity Public Debt – Sources, effects, burden and its management. Fiscal Federalism – Theory and problems; Problems of Centre – State Financial relations in India. Fiscal Policy – Neutral and compensatory and functional finance; balanced budget multiplier. 5. International Economics Theories of International Trade : Empirical verification and Relevance International Trade under Imperfect competition Terms of Trade and Economic Growth – Secular Deterioration of Terms of Trade Hypothesis – a critical review. Equilibrium / disequilibrium in Balance of Payment – Traditional, Absorption and Monetary approaches for adjustment in the Balance of Payments, Foreign Trade multiplier. Impact of Tariffs, Partial and general equilibrium analysis; Political economy of Non-Tariff Barriers. Theory of regionalism at Global level – Collapse of Bretton – Wood System – Recent. Monetary reforms. Trade Policy and Reforms in India. 6. Indian Economy Basic Economic indicators – National income, performance of different sectors Trends in prices and money supply. Agriculture – Institutional and technological aspects, new agricultural policy Industry – New industrial policy and liberalization. Money and banking – Concepts of money supply, inflation, monetary policy and financial sector reforms. Public finance – Trends in revenue and expenditures of the Central and State Governments, Public debt; analysis of the Union Budget. Foreign trade – Trends, Balance of payments and trade reforms. Poverty, unemployment, migration and environment. 7. Statistical Methods Measures of Central tendency, dispersion, skewness and kurtosis. Elementary theory of probability – Binomial, Poisson and Normal distributions. Simple correlation and regression analysis. Statistical inferences – Applications, sampling distributions (t, x2 and F tests ) sampling of attributes, testing of Hypothesis. Index numbers and time series analysis. Sampling and census methods, types of sampling and errors. |