|

#2

12th December 2017, 01:59 PM

| |||

| |||

| Re: Third Party Transfer Form IDBI

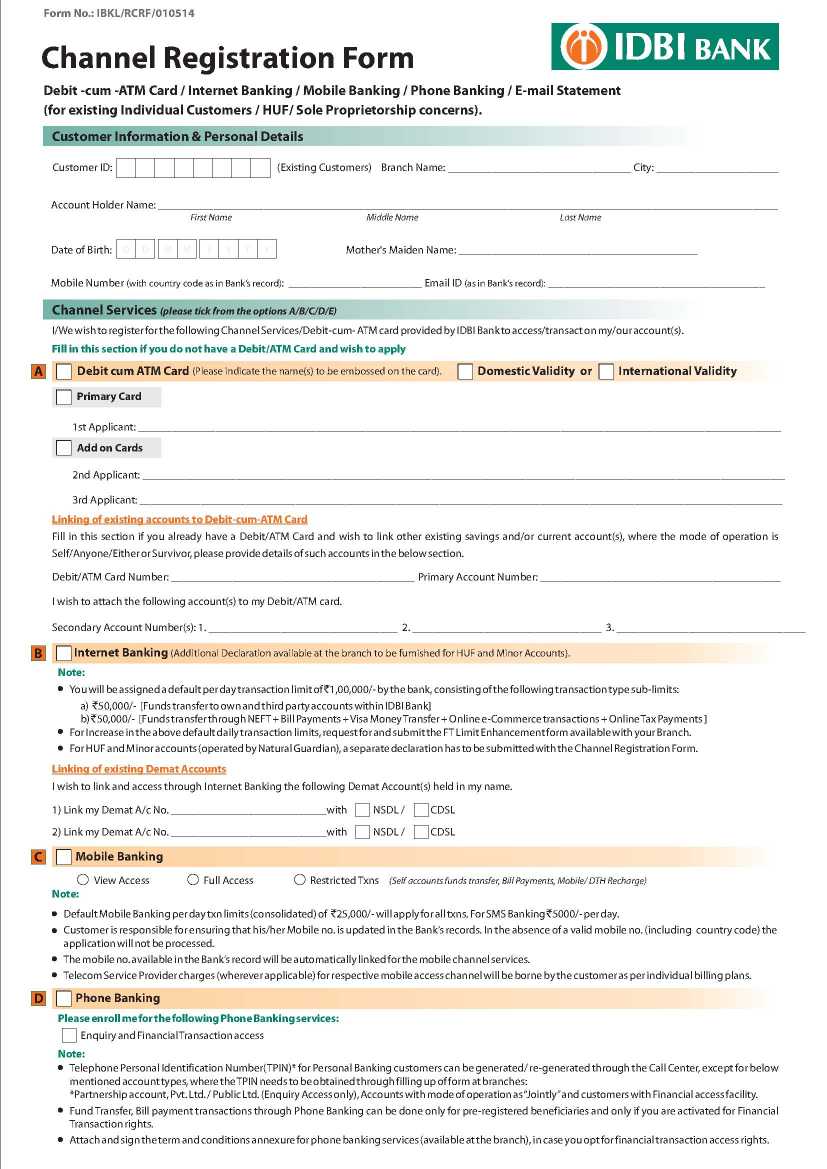

IDBI Bank was established in 1964 by an Act of Parliament to provide credit and other financial facilities for the development of the fledgling Indian industry.Central government is the owner of this bank and employees will be called as Central Govt staffs.It is one among the public sector banks in india. As you wants Application form for the Third Party Transfer of the IDBI Bank the Third Party Transfer Limit is as Follow You will be assigned the following default per day transaction limits for respective channels. Internet Banking: a) `50,000/- [F unds transfer to own and third party accounts within IDBI Bank]. b) `50,000/- [F unds transfer through NEFT + Bill Payments + Visa Money Transfer + Online e-commerce transactions + Online T ax Payments]. Phone Banking: a) `25,000/- [Funds transfer to own and third party accounts within IDBI Bank]. b) `25,000/- [Funds transfer through NEFT + Bill Payments]. Mobile Banking: `25000/- (consolidated limit) will apply for all type of transactions. F or SMS Banking `5000/- per day. The Application form for the Third Party Transfer of the IDBI Bank is given below Application form for the Third Party Transfer of the IDBI Bank     |