|

#2

29th November 2014, 09:40 AM

| |||

| |||

| Re: Temporary Admission EU

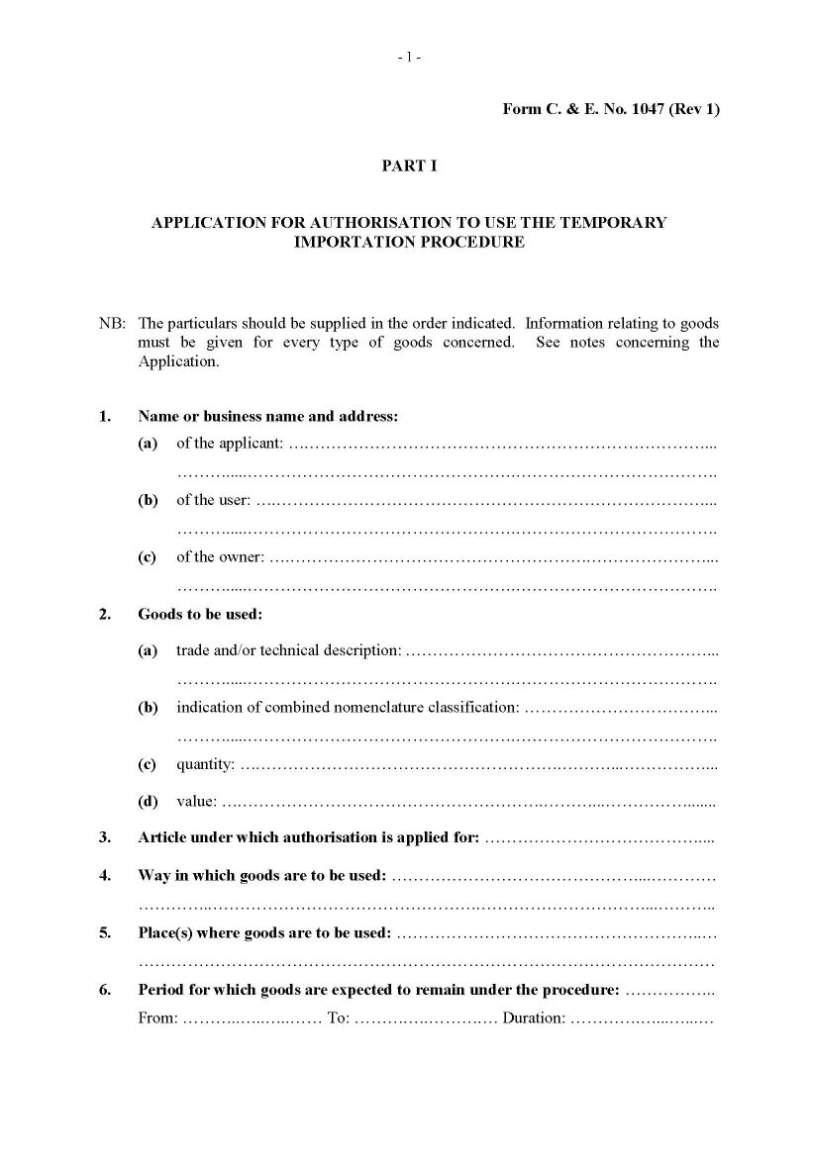

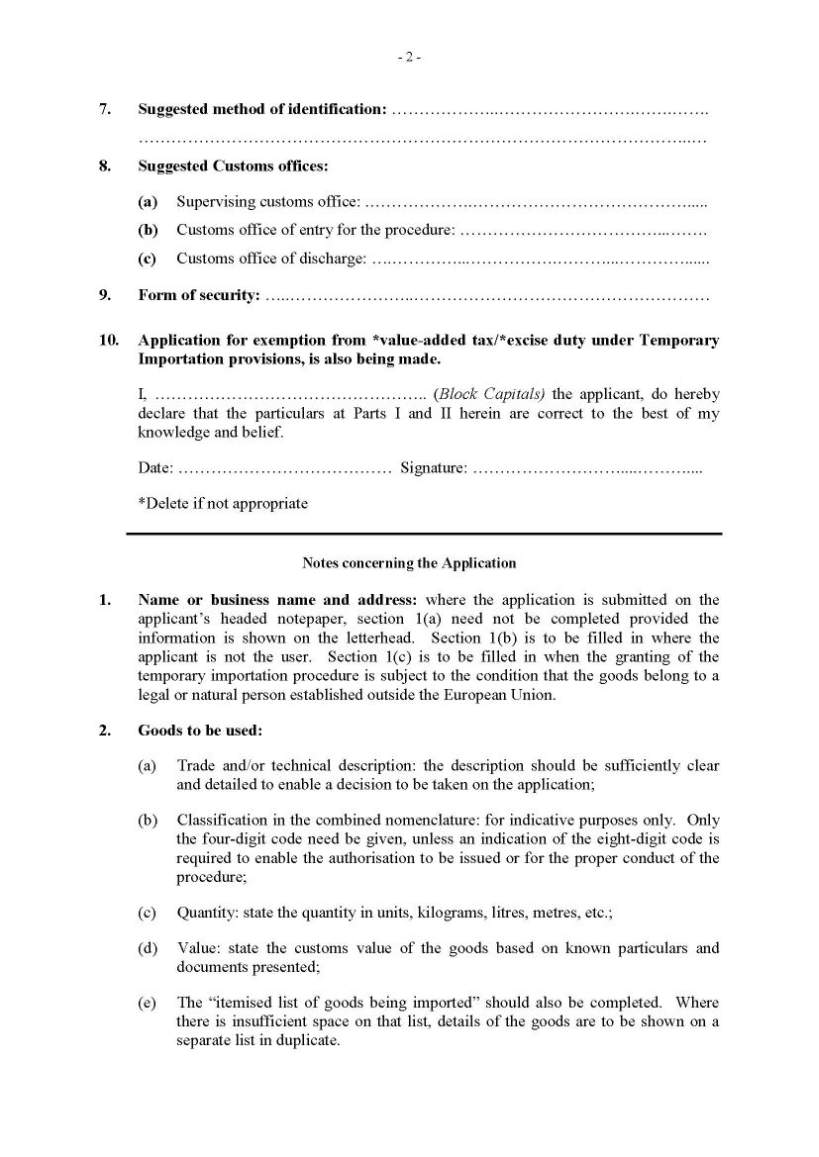

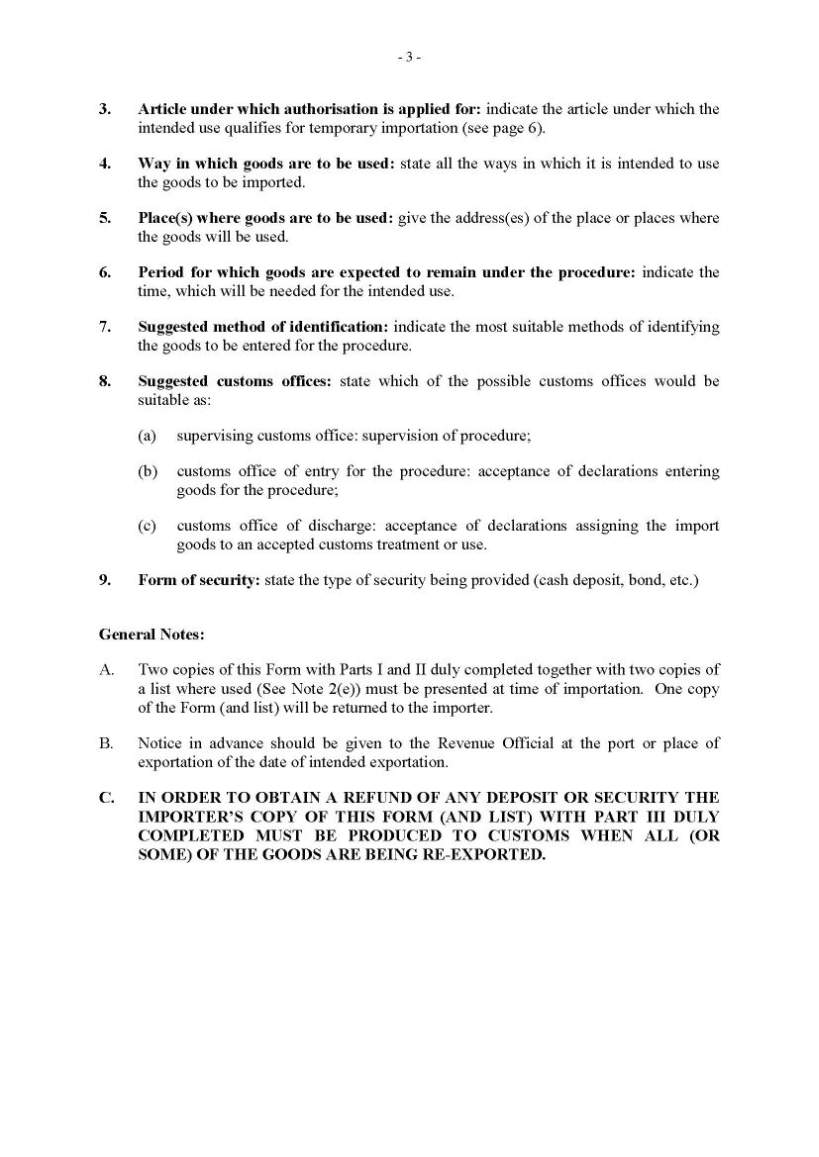

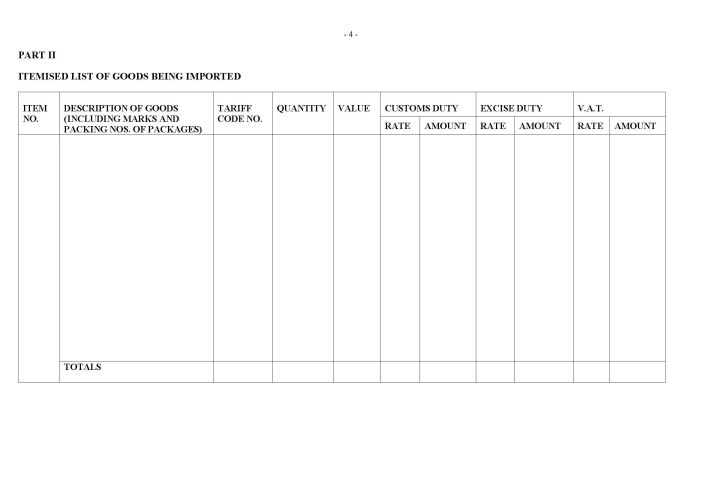

Temporary Admission from a country outside the European Union (EU) For temporary admission keep following points in mind. General : You Can’t take admission without payment of the import charges(Custom Duty and VAT). Conditions: conditions are following. Ownership : The goods referred must be owned by a person established outside the EU. Security: Security must be provided in the form of cash and bond. Period allowed: The goods are re-export with limited time period. Identification : Procedure at Importation: The goods should be presented to Revenue at importation. You should fill the complete form for Temporary Importation facilities. Consider the PDF. Application for Temporary Importation facilities     Procedure at Re-Exportation : The goods and documentation should be presented to Revenue at the Export Station in sufficient time to allow for examination before the period for temporary admission expires. Transfer of Authorisation: Temporary admission facilities may be transferred to another person subject to certain conditions. Requests for such transfers should be made to Revenue at the place of importation. Partial Relief from Customs Duty : Goods that not meet sufficient condition may charge. Further Information : for any query you can contact on local phone numbers. Which is 1890 444 425 etc. pdf file atteched for more deatail............ |