As per your request here I am providing you JAIIB Indian Institute of Banking and Finance clerk exam syllabus.

Syllabus of JAIIB Indian Institute of Banking and Finance

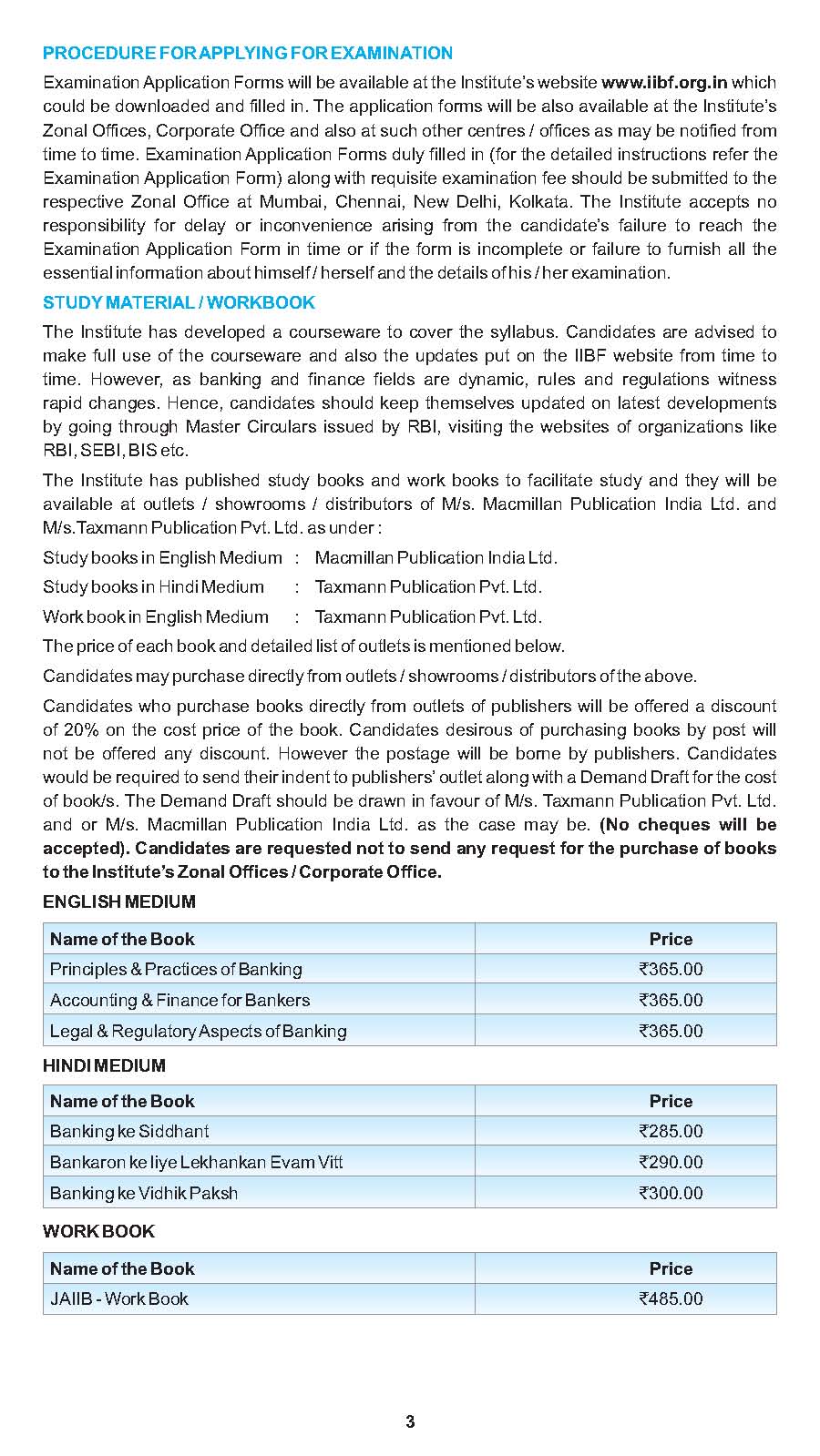

SYLLABUS

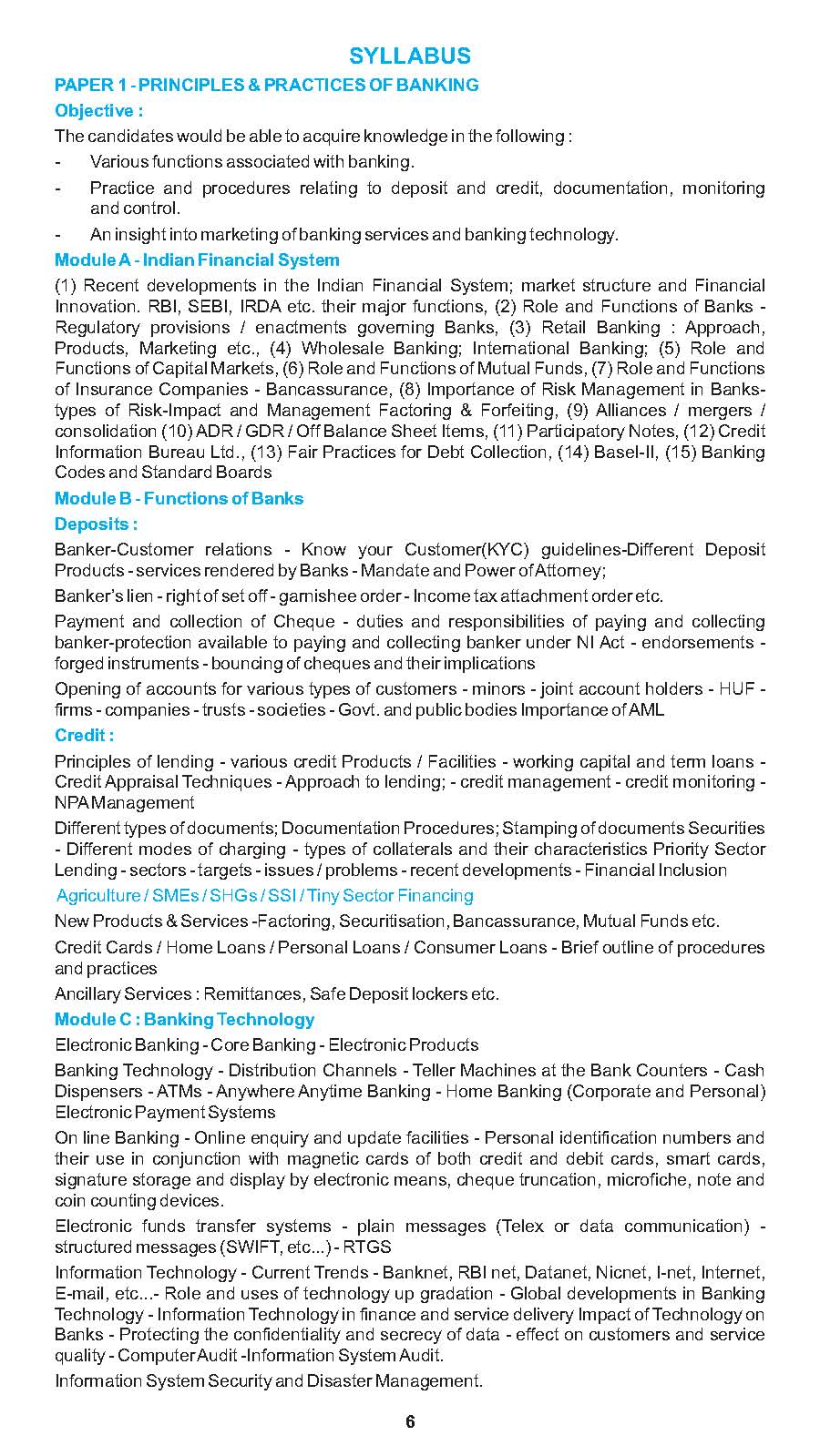

PAPER 1 - PRINCIPLES & PRACTICES OF BANKING

Objective :

Module A - Indian Financial System

Module B - Functions of Banks

Deposits :

Credit :

Agriculture / SMEs / SHGs / SSI / Tiny Sector Financing

Module C : Banking Technology

Regulatory provisions / enactments governing Banks,

(3) Retail Banking : Approach,

Products, Marketing etc.,

(4) Wholesale Banking; International Banking;

(5) Role and

Functions of Capital Markets,

(6) Role and Functions of Mutual Funds,

(7) Role and Functions

of Insurance Companies - Bancassurance,

(8) Importance of Risk Management in Bankstypes

of Risk-Impact and Management Factoring & Forfeiting,

(9) Alliances / mergers /

consolidation

(10) ADR / GDR / Off Balance Sheet Items,

(11) Participatory Notes,

(12) CreditInformation Bureau Ltd.,

(13) Fair Practices for Debt Collection,

(14) Basel-II,

(15) Banking

Codes and Standard Boards

Banker-Customer relations - Know your Customer(KYC) guidelines-Different Deposit

Products - services rendered by Banks - Mandate and Power of Attorney;

Banker’s lien - right of set off - garnishee order - Income tax attachment order etc.

Payment and collection of Cheque - duties and responsibilities of paying and collecting

banker-protection available to paying and collecting banker under NI Act - endorsements -

forged instruments - bouncing of cheques and their implications

Opening of accounts for various types of customers - minors - joint account holders - HUF -

firms - companies - trusts - societies - Govt. and public bodies Importance of AML

Principles of lending - various credit Products / Facilities - working capital and term loans -

Credit Appraisal Techniques - Approach to lending; - credit management - credit monitoring -

NPA Management

Different types of documents; Documentation Procedures; Stamping of documents Securities

- Different modes of charging - types of collaterals and their characteristics Priority Sector

7

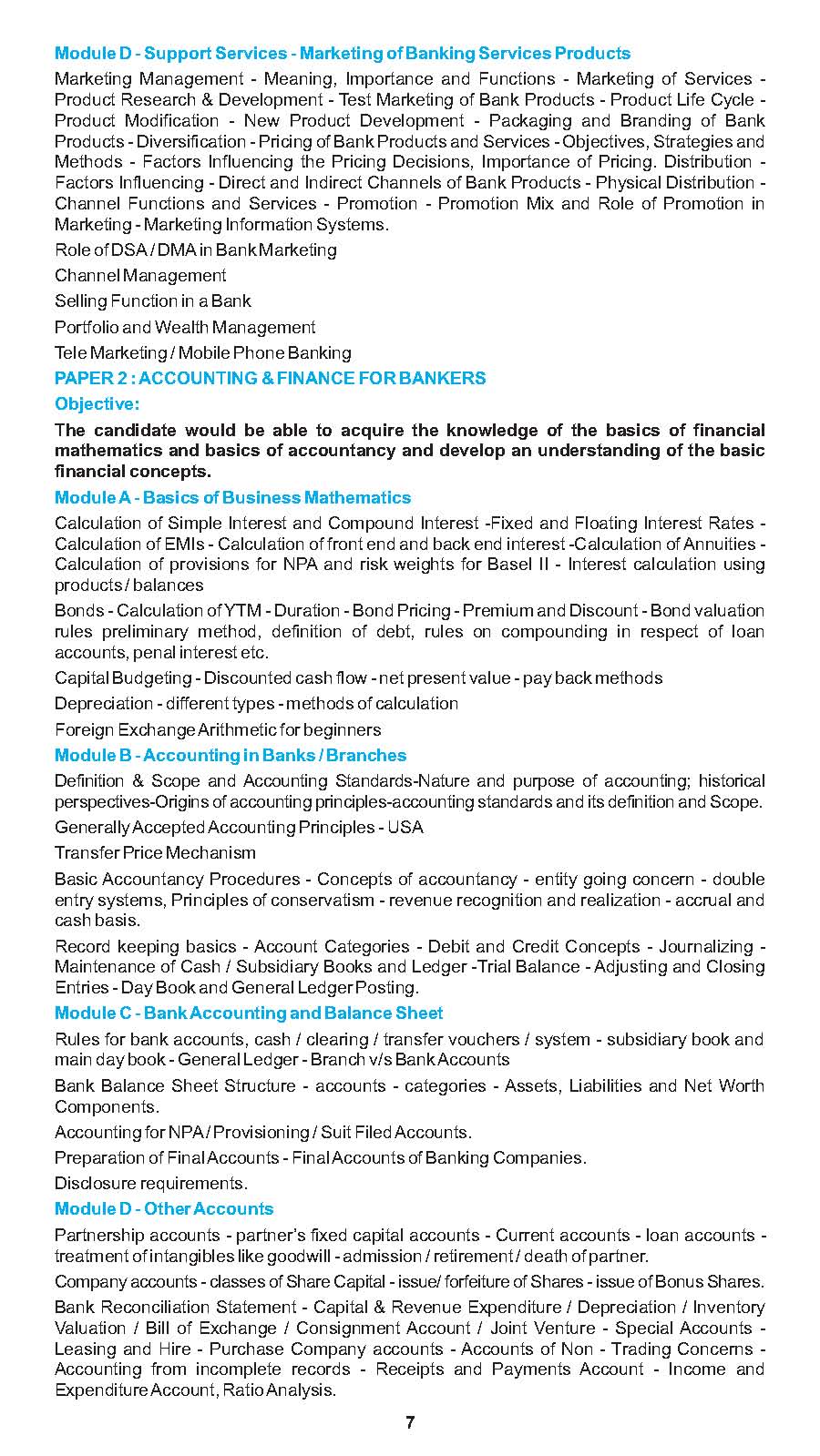

Module D - Support Services - Marketing of Banking Services Products

PAPER 2 : ACCOUNTING & FINANCE FOR BANKERS

Objective:

Module A - Basics of Business Mathematics

Module B - Accounting in Banks / Branches

Module C - Bank Accounting and Balance Sheet

Module D - Other Accounts

Marketing Management - Meaning, Importance and Functions - Marketing of Services -

Product Research & Development - Test Marketing of Bank Products - Product Life Cycle -

Product Modification - New Product Development - Packaging and Branding of Bank

Products - Diversification - Pricing of Bank Products and Services - Objectives, Strategies and

Methods - Factors Influencing the Pricing Decisions, Importance of Pricing. Distribution -

Bonds - Calculation of YTM - Duration - Bond Pricing - Premium and Discount - Bond valuation

rules preliminary method, definition of debt, rules on compounding in respect of loan

8

Module E - Computerized Accounting

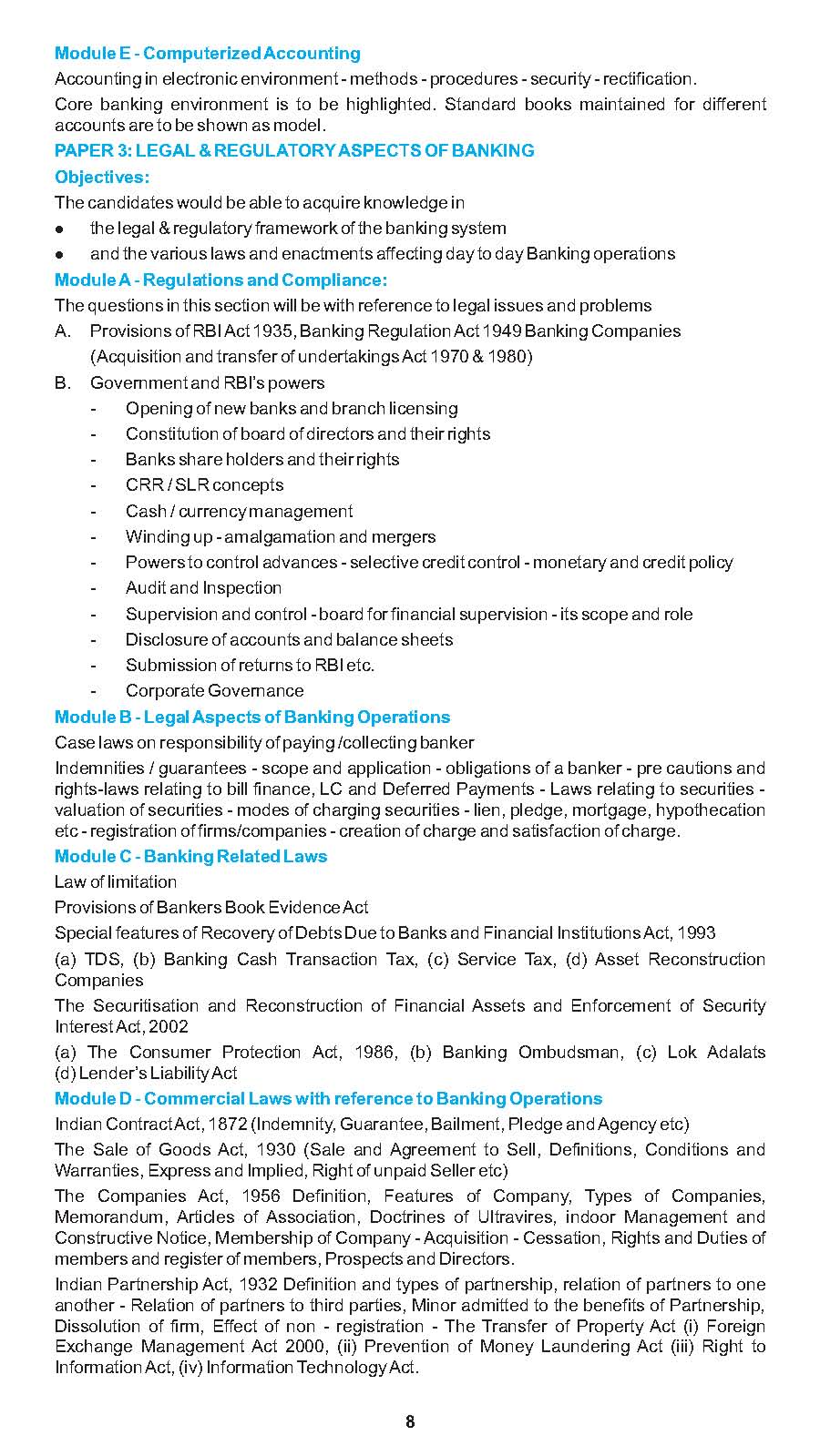

PAPER 3: LEGAL & REGULATORY ASPECTS OF BANKING

Objectives:

Module A - Regulations and Compliance:

Module B - Legal Aspects of Banking Operations

Module C - Banking Related Laws

Module D - Commercial Laws with reference to Banking Operations

Accounting in electronic environment - methods - procedures - security - rectification.

Core banking environment is to be highlighted. Standard books maintained for different

B. Government and RBI’s powers

- Opening of new banks and branch licensing

- Constitution of board of directors and their rights

- Banks share holders and their rights

- CRR / SLR concepts

- Cash / currency management

- Winding up - amalgamation and mergers

- Powers to control advances - selective credit control - monetary and credit policy

- Audit and Inspection

- Supervision and control - board for financial supervision - its scope and role

- Disclosure of accounts and balance sheets

- Submission of returns to RBI etc.

- Corporate Governance

Syllabus of JAIIB Indian Institute of Banking and Finance