|

#3

2nd December 2015, 01:42 PM

| |||

| |||

| Re: South Indian Bank Pension Scheme

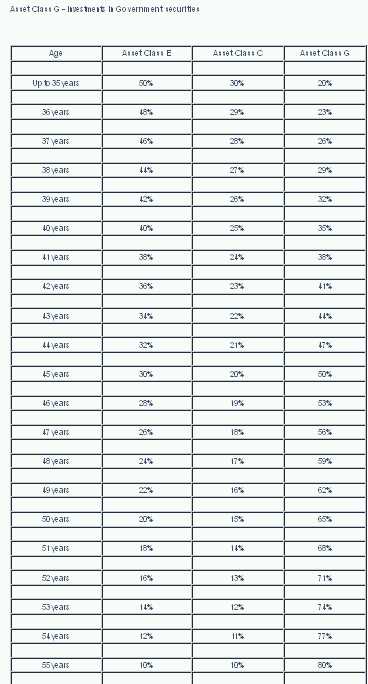

New Pension System (NPS) – South Indian Bank acts as Point of Presence (POP) In south Indian bank its new Pension System has been launched across the country with effect from 1st May 2009, by Pension Fund Regulatory and Development Authority (PFRDA).this bank was appointed by PFRDA. Couth Indian bank is one of the single old generation private sector banks that have been permitted by PFRDA among other POPs. It have 750 designated branches across the nation. The Pension scheme is available for the India citizen. SIB pension scheme has been available in three distinct models: these all model are based on SIB pension scheme model: All Citizens Model - Available to all citizens of India (Age: 18years to 60years), including NRIs. Corporate Model - Any corporate entity can opt for this model to disburse the benefits of NPS to its employees. NPS Lite - Making pension possible for small investors - Available to all citizens of India (Age: 18years to 60years) belonging to unorganized sector. Key Features: according to South Indian bank nhas decided some key features for Pension scheme: It is a pension scheme for non-government employees or individual. This is open to anyone who is between 18-60 years of age including NRIs There is no limit on maximum contribution. Subscriber has the option to choose auto or manual choice for distribution of his contributions. Investor can make the contributions till 60 years. Pension will start at the age of 60. Tax benefit under section 80C for the investments. The SIB pension Scheme can also join by any citizen of India, whether Resident or Non-Resident, other than Central & State Government employees: Age should must between 18 – 60 years as on the date of submission of his/her application to SIB bank. Customer should comply with the Know Your Customer (KYC) norms. For more detail about SIB pension scheme you can visit on its official site: Here I’m providing you rules and regulation of Sib pension scheme: (Image: Pension scheme SIB)  |