|

#2

15th July 2015, 10:29 AM

| |||

| |||

| Re: South Indian Bank Car Loan

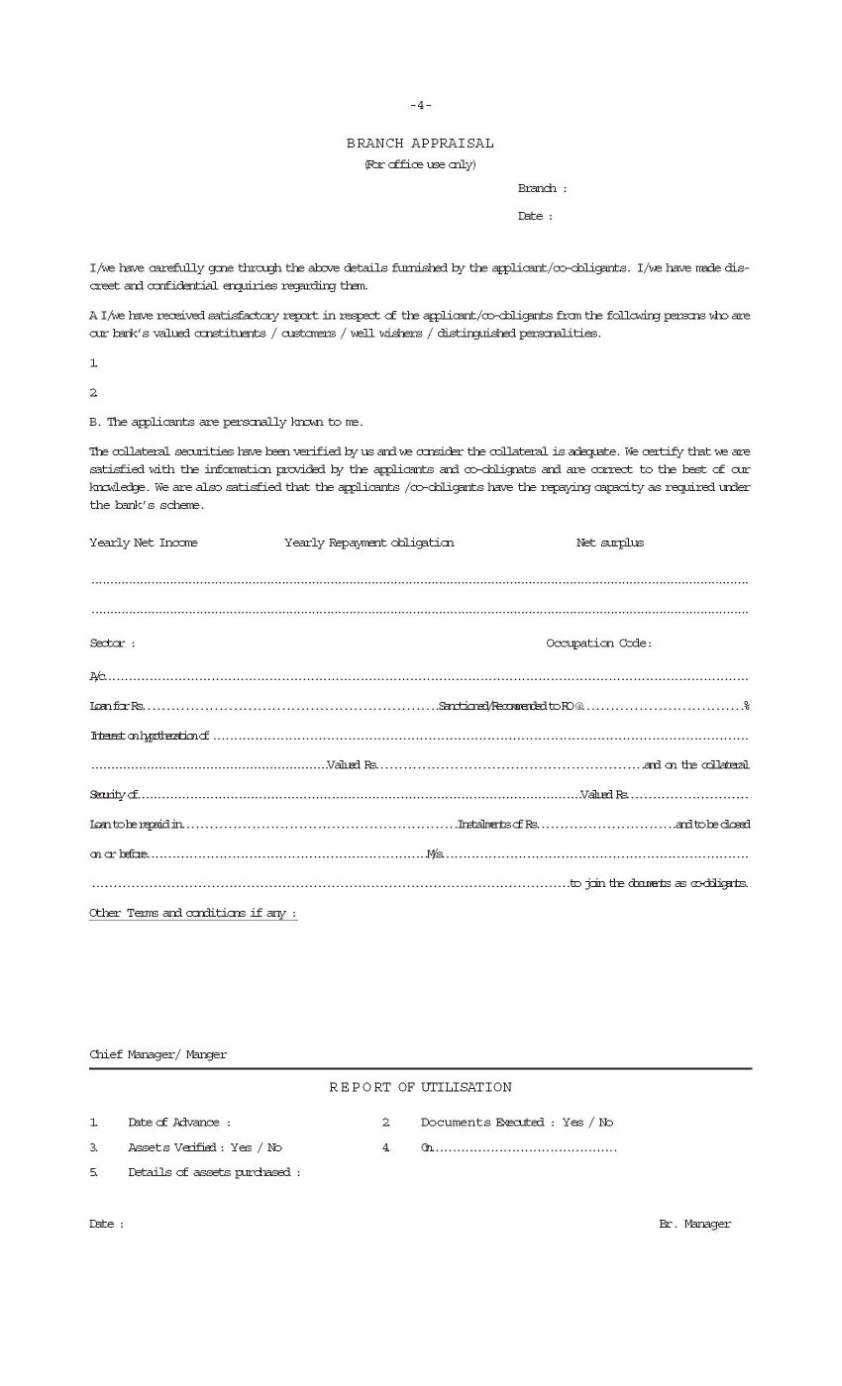

As you want to get the details of South Indian Bank Car Loan or Vehicle Loan and interest rates so here is the information of the same for you: 1) Purpose : Purchase of new vehicles Takeover of Existing Vehicle loans Reimbursement of Purchase Cost is restricted to within Three months from date of purchase For purchase of second hand vehicle 2) Type: Broadly Classified in to 6 by focussing on target Customers. Mobi Loan (Salaried Class) - Employees of MNCs, State/Central Govt, IT Companies etc Mobi Loan (Business Class) - Self Employed, Business people Mobi Loan (Next Generation) - Professionals with net monthly income of Rs 60000/- Mobi Loan (NRI) - NRI individual/jointly with NRI or resident spouse. Mobi Loan (Agriculturist) - Persons whose main source of income is Agriculture. Mobi Loan (Senior Citizen/Pensioner) - Pensioners/HNIs without pension 3) General Terms Type of Vehicle Private, Commercial/Taxi vehicle Vehicles for Agriculture/allied purposes Cost of Vehicle Basic Cost + accessories + Duties +Taxes + Octroi + Onetime tax +Comprehensive insurance premium for the first year period Repayment period Maximum 5 Years and (7 years with 100% Collatteral Security) Age of the borrower should not exceed 75 years, on completion of the loan term Rate of Interest Click here to view the latest Interest Rates Margin 5% to 15% ( 25% for Second hand vehicles) Loan amount Minimum loan amount – Rs 2.00 lacs for four wheelers and Rs.50,000/- for Two wheelers . No upper ceiling Collateral Collateral - Deposit/Property/Gold/LIC/NSC Guarantor • Where there is no collateral security, Aggregate Net worth of the signatories to the loan documents (in land & building) should be twice the loan amount. • If married, spouse to join the documents as co-borrower. Inspection & Documentation Charges NIL Upfront charges 0.25% of the loan amount (one-time) or Rs.5000/-whichever is less Pre payment penalty NIL DOMESTIC RATE OF INTEREST - GENERAL BASE RATE (BR) 10.20% (w.e.f 01.05.2015) OTHER LOAN CATEGORIES Sl No: Category Interest Rate 1 TOD in Current A/c BR + 9.20% 2 NSC / KVP /LIC (upto 12 Months) BR + 3.70% 3 NSC / KVP /LIC (above 12 Months) BR + 4.30% Loans and OD against deposits a) Domestic deposits i) Up to and inclusive of Rs. 10.00 lacs Deposit rate + 2% ii) Above Rs. 10.00 lacs Deposit rate + 1% b) NRE deposits i) Loans against NRE deposits Deposit rate + 1% ii) Foreign currency loans against FCNAB deposits Deposit rate + 1% iii) Rupee loans against FCNAB deposits 10.50% Application Form:     Contact Details: South Indian Bank-Corporate Branch 15, Door No.2, Ward No.45, Oswal Chambers Hare Street, Strand Rd, Church Lane Dal Housie, B B D Bagh Kolkata, West Bengal 700001 India Map Location: [MAP]South Indian Bank-Corporate Branch[/MAP] |