|

#2

25th July 2017, 03:31 PM

| |||

| |||

| Re: SBBJ NRI Account

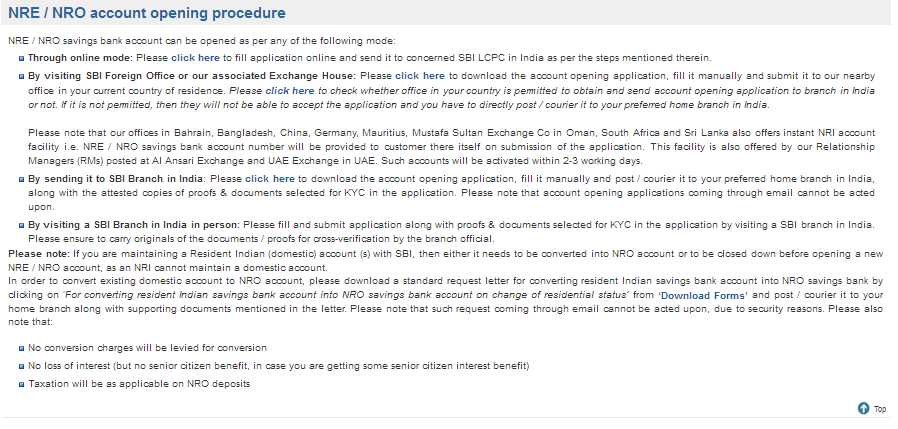

As on 1st April 2017 State Bank of Bikaner and Jaipur merged with State Bank of India. Your earnings abroad can earn striking returns back home. Select from the range of accounts, with flexibility to maintain savings in Indian or foreign currency, offering tax free interest income in India as well as other benefits. NRE / NRO account opening procedure  Accounts NRE NRO Purpose of account To park funds remitted from overseas to India To park funds remitted from overseas to India or funds from Indian sources Currency Rupees Rupees Types of account Savings, Current, Fixed Deposits (TDR/STDR) and RD Savings, Current, Fixed Deposits (TDR/ STDR) and RD Investment Term Min: 1 Year Max: 10 Years Min: 7 Days Max: 10 Years Initial funding for opening (common for both) Savings, Current: Nil RD: Rs. 100 TDR, STDR: Rs. 1000 Minimum Balance (common for both) Savings, Current: Monthly Average Balance (MAB): Metro MAB: Rs. 5000/- Urban MAB: Rs. 3000/- Semi-Urban MAB: Rs. 2000/- Rural MAB: Rs. 1000/- RD: Rs. 100 TDR, STDR: For Personal Banking Branches in: Metro / Urban centres: Rs. 1 lakh Semi-Urban / Rural centres: Rs. 50,000 For all other Branches: Rs. 1000 Joint Holding with NRIs Resident Indians on Former or Survivor basis NRIs Resident Indians on Former or Survivor basis Repatriability of Principal Freely Repatriable Current income up to USD 1 million (Conditional) Repatriability of Interest Freely Repatriable Freely Repatriable subject to deduction of tax Taxability in India Interest income tax free in India Interest income is taxed as per India Income Tax Rules. Reduced tax under Double Tax Avoidance Agreement |