|

#2

16th August 2014, 09:40 AM

| |||

| |||

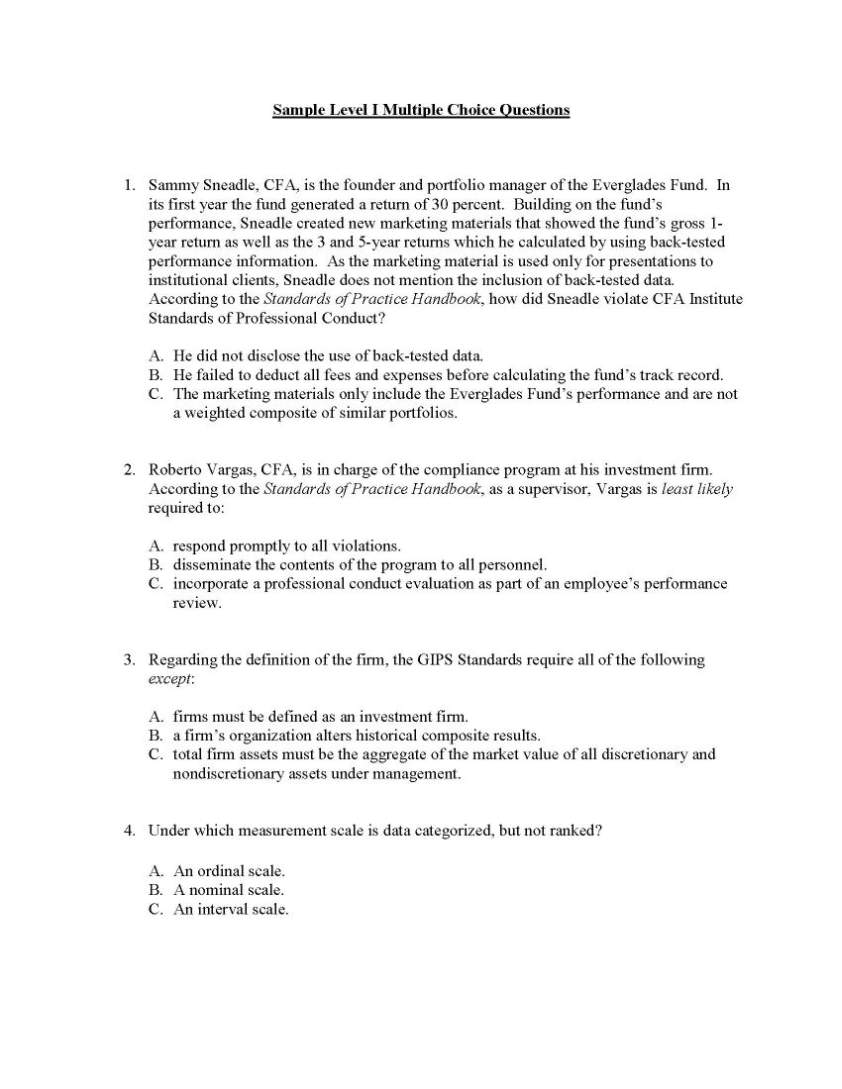

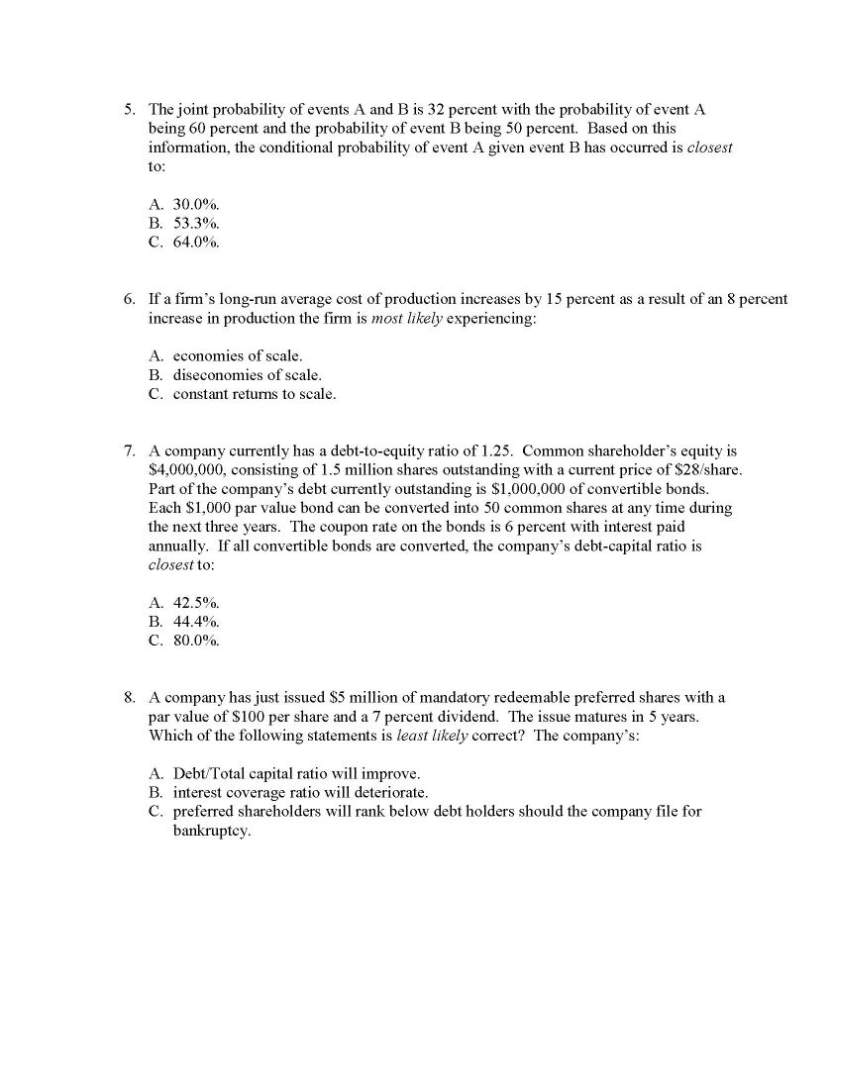

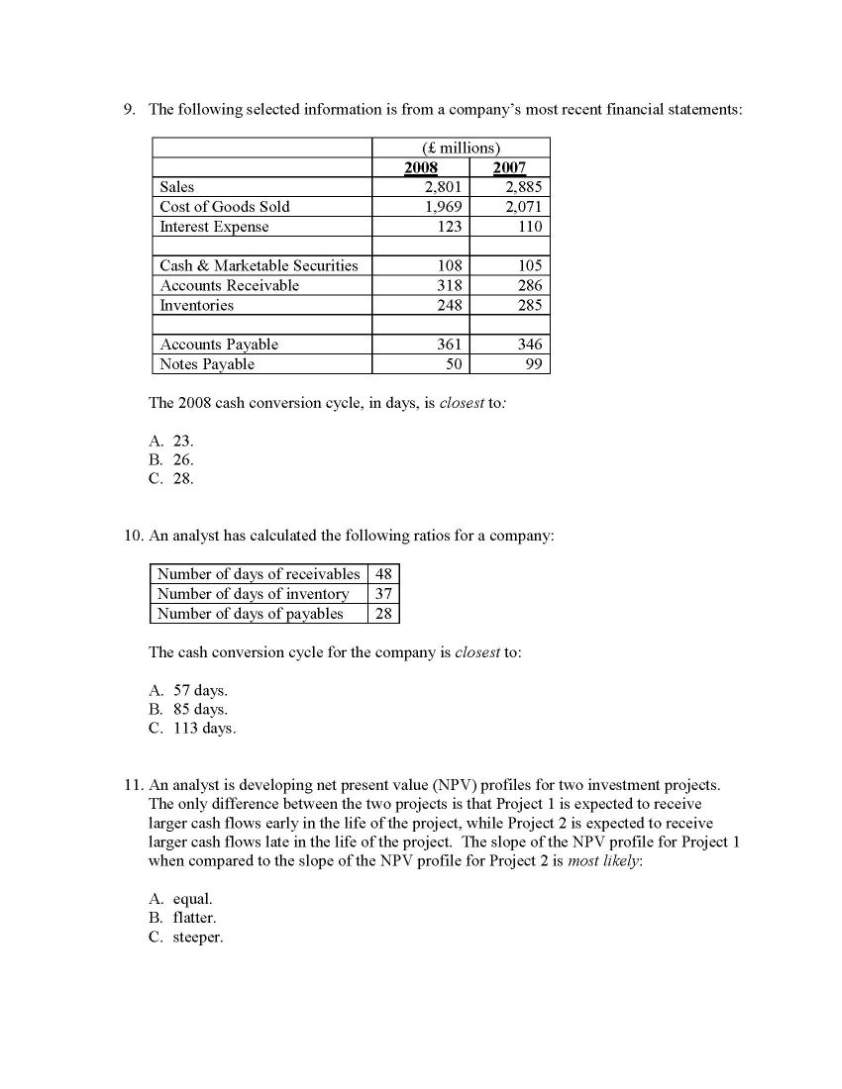

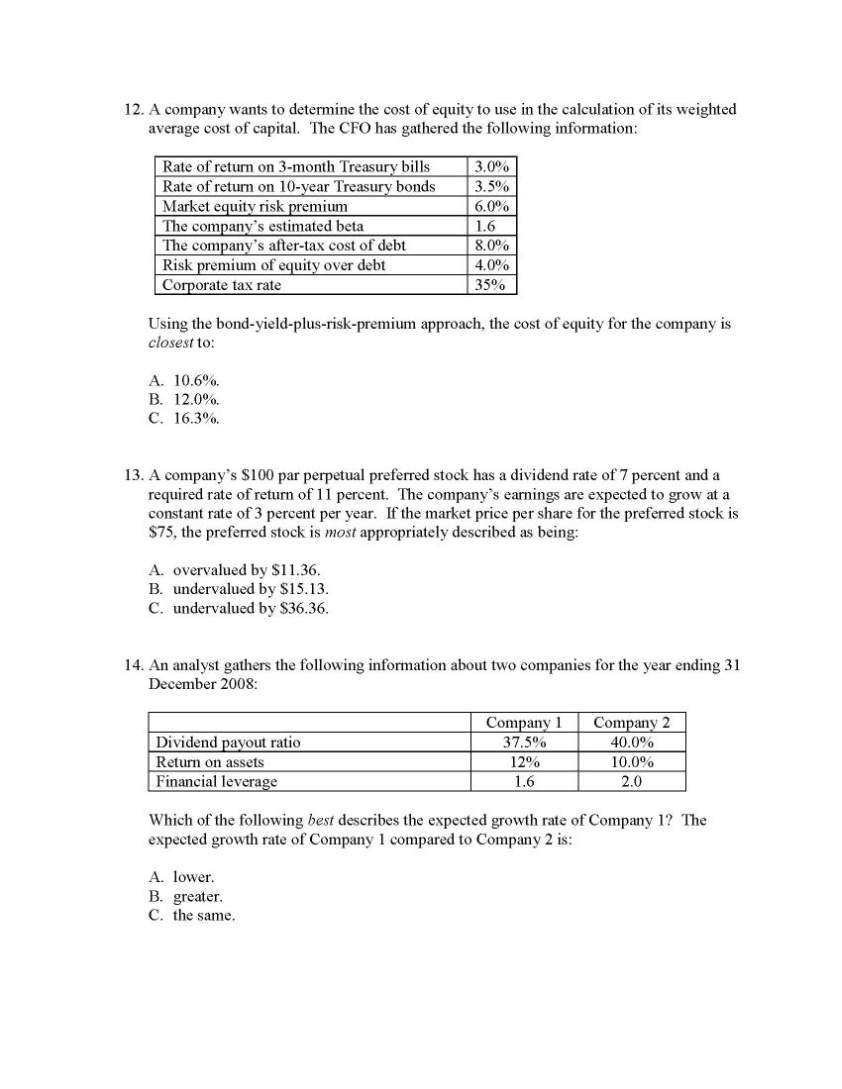

| Re: Sample Questions CFA Institute

Some of the Sample Questions of CFA Institute are as follows: 1. Sammy Sneadle, CFA, is the founder and portfolio manager of the Everglades Fund. In its first year the fund generated a return of 30 percent. Building on the fund’s performance, Sneadle created new marketing materials that showed the fund’s gross 1- year return as well as the 3 and 5-year returns which he calculated by using back-tested performance information. As the marketing material is used only for presentations to institutional clients, Sneadle does not mention the inclusion of back-tested data. According to the Standards of Practice Handbook, how did Sneadle violate CFA Institute Standards of Professional Conduct? A. He did not disclose the use of back-tested data. B. He failed to deduct all fees and expenses before calculating the fund’s track record. C. The marketing materials only include the Everglades Fund’s performance and are not a weighted composite of similar portfolios. 2. Roberto Vargas, CFA, is in charge of the compliance program at his investment firm. According to the Standards of Practice Handbook, as a supervisor, Vargas is least likely required to: A. respond promptly to all violations. B. disseminate the contents of the program to all personnel. C. incorporate a professional conduct evaluation as part of an employee’s performance review. 3. Regarding the definition of the firm, the GIPS Standards require all of the following except: A. firms must be defined as an investment firm. B. a firm’s organization alters historical composite results. C. total firm assets must be the aggregate of the market value of all discretionary and nondiscretionary assets under management. 4. Under which measurement scale is data categorized, but not ranked? A. An ordinal scale. B. A nominal scale. C. An interval scale. 5. The joint probability of events A and B is 32 percent with the probability of event A being 60 percent and the probability of event B being 50 percent. Based on this information, the conditional probability of event A given event B has occurred is closest to: A. 30.0%. B. 53.3%. C. 64.0%. 6. If a firm’s long-run average cost of production increases by 15 percent as a result of an 8 percent increase in production the firm is most likely experiencing: A. economies of scale. B. diseconomies of scale. C. constant returns to scale. 7. A company currently has a debt-to-equity ratio of 1.25. Common shareholder’s equity is $4,000,000, consisting of 1.5 million shares outstanding with a current price of $28/share. Part of the company’s debt currently outstanding is $1,000,000 of convertible bonds. Each $1,000 par value bond can be converted into 50 common shares at any time during the next three years. The coupon rate on the bonds is 6 percent with interest paid annually. If all convertible bonds are converted, the company’s debt-capital ratio is closest to: A. 42.5%. B. 44.4%. C. 80.0%. 8. A company has just issued $5 million of mandatory redeemable preferred shares with a par value of $100 per share and a 7 percent dividend. The issue matures in 5 years. Which of the following statements is least likely correct? The company’s: A. Debt/Total capital ratio will improve. B. interest coverage ratio will deteriorate. C. preferred shareholders will rank below debt holders should the company file for bankruptcy. Sample Questions CFA Institute     Contact Detail: C F A Institute 7th Floor 131 Finsbury Pavement, London EC2A 1NT, United Kingdom Map: [MAP]https://www.google.co.in/maps?q=CFA+Institute&hl=en&sll=39.169881,-86.514909&sspn=0.0091,0.018475&hq=CFA+Institute&ra dius=15000&t=m&z=12[/MAP] in afor more detail in atteched pdf file.... |