|

#2

19th August 2014, 07:56 AM

| |||

| |||

| Re: Required % to do CA course in graduation

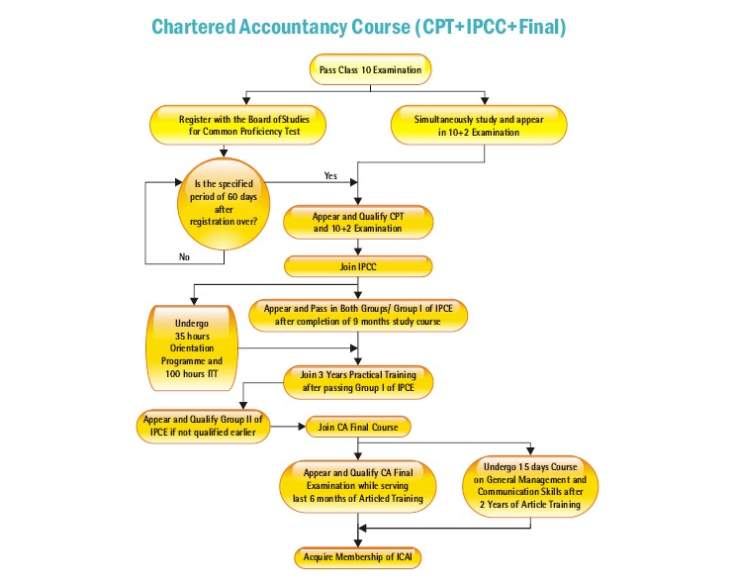

Chartered Accountancy course is offered by the Institute of Chartered Accountants of India. This examination has following three stages: CPT (common proficiency test) IPCC (integrated professional competence course) Article ship and final course Duration of the course: 3 years. As you have completed graduation you will be accepted for the CPT (common proficiency test) you can directly apply for the IPCC (integrated professional competence course) Image  IPCC (integrated professional competence course) covers following topics: Group-I consists of following paper/subjects:- Paper 1: Accounting (100 Marks) Paper 2: Business Laws, Ethics and Communication (100 Marks) Law (60 Marks), Business Laws (30 Marks), Company Law (30 Marks) Business Ethics (20 Marks) Business Communication (20 Marks) Paper 3: Cost Accounting and Financial Management Cost Accounting (50 Marks) Financial Management (50 Marks) Paper 4: Taxation Income-tax (50 Marks) Service Tax (25 Marks) and VAT (25 marks) Group-II consists of following paper/subjects:- Paper 5: Advanced Accounting (100 Marks) Paper 6: Auditing and Assurance (100 Marks) Paper 7: Information Technology and Strategic Management Information Technology (50 Marks) Strategic Management (50 Marks) After completing IPCC course, you need to register for CA final Course. It covers following topics: Group -I consists of following subjects/papers Paper 1: Financial Reporting (100 Marks) Paper 2: Strategic Financial Management (100 Marks) Paper 3: Advanced Auditing and Professional Ethics (100 Marks) Paper 4: Corporate and Allied Laws (100 Marks) Company Law (70 Marks) Allied Laws (30 Marks) Group -II consists of following subject/papers Paper 5: Advanced Management Accounting (100 Marks) Paper 6: Information Systems Control and Audit (100 Marks) Paper 7: Direct Tax Laws (100 Marks) Paper 8: Indirect Tax Laws (100 Marks) Central Excise (40 Marks) Service Tax & VAT (40 Marks) Customs (20 Marks) Last edited by Raman Vij; 19th August 2014 at 08:30 AM. |