|

#2

12th September 2015, 03:31 PM

| |||

| |||

| Re: Punjab National Bank Demand Draft Slip

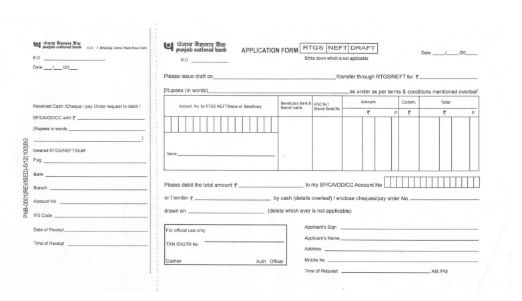

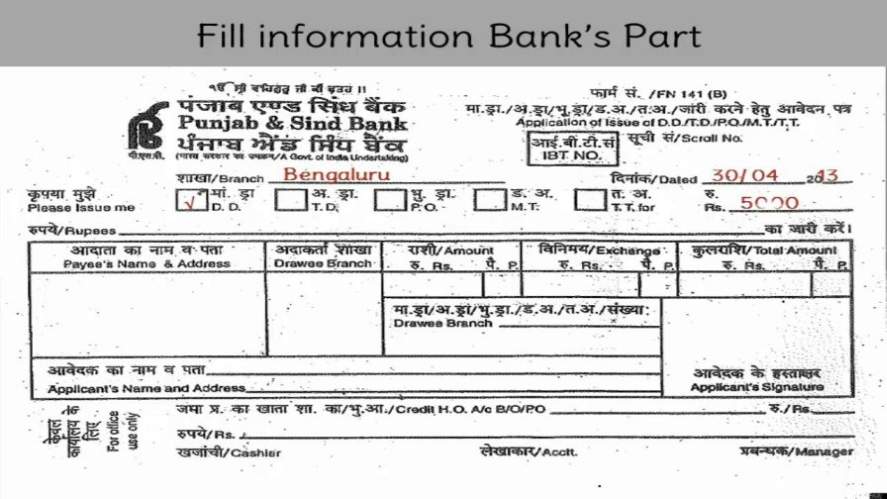

Punjab National Bank was founded in May 19, 1894, it is an Indian financial services company and the bank has over 6,300 branches and over 7,900 ATMs across 764 cities. Demand draft is a negotiable instrument similar to a bill of exchange and the bank issues a demand draft to a client (drawer), directing another bank (drawee). The Demand draft can also be compared to a cheque…. Demand Draft Revalidation fees: Rs.100/- Demand Draft Cancellation Charges fees: Draft upto Rs.500/- Rs. 20/- per draft Draft above Rs. 500/- Rs. 100/- per draft Punjab National Bank Demand Draft Slip  Address: Punjab National Bank 7, Bhikaji Cama Place Bhikaji Cama Place, R.K. Puram New Delhi, Delhi 110066 Map: [MAP]Punjab National Bank[/MAP] |