|

#2

1st February 2017, 11:21 AM

| |||

| |||

| Re: Oriental Bank of Commerce CMA Data

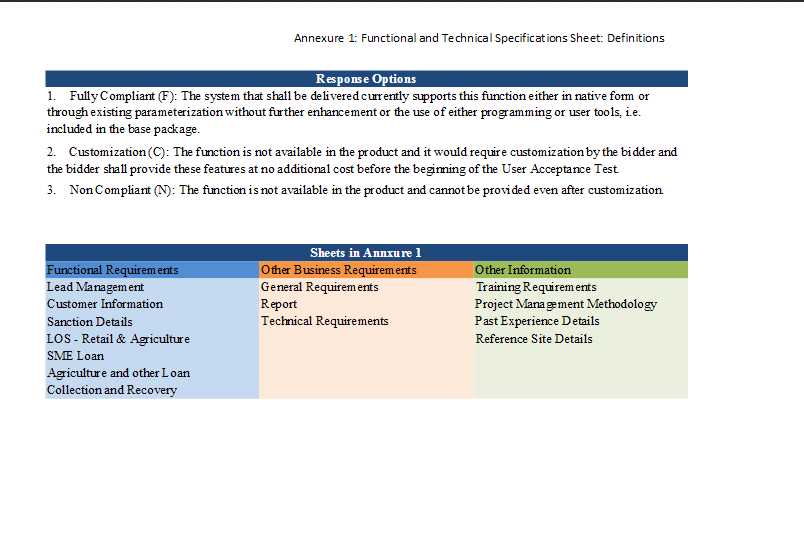

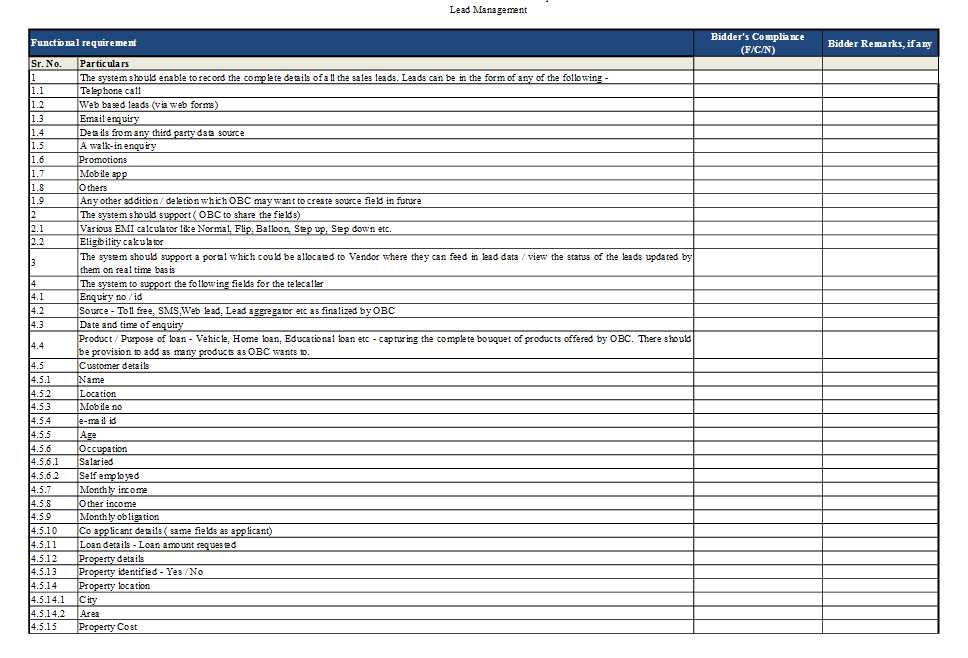

Credit Monitoring Arrangement (CMA) information is an essential zone to comprehend a man who manages fund in an association. This is a basic examination of present and anticipated money related articulations of a credit candidate by the financier. Information CMA is a methodical examination of working capital administration of the borrower and the motivation behind this announcement is to guarantee the utilization of long haul and fleeting assets have been utilized . CMA Basically contains information that, taking after the seven states. 1. specific existing and proposed limits: It is the main articulation in the CMA information that contains this reserve and store based points of confinement of non-borrower credit limits and their utilization and history. With the present impediments of assets, which is the breaking point proposed or the borrower will be said in this announcement is an essential report data gave by the borrower, the financier. 2. working Declaration: This is the second explanation gave by the borrower, it demonstrates that the marketable strategy of the borrower gives the present deals, immediate and aberrant expenses, pre-and after duty, and also projections of offers, costs and benefit circumstance for 3-5 years in view of the borrower's working capital request. 3. investigation of adjust: accounting report examination for present and anticipated articulation is the third in the CMA information. This announcement gives a point by point investigation of current and non-current resources, settled resources, money and bank, the present position and long haul obligation of the borrower. 4. Near table of current resources and liabilities: . Fourth explanation which gives a near investigation of current resources and current liabilities of the borrower development 5. Figure MPBF: This is an essential articulation and computation that demonstrates the Maximum Permissible Bank Finance. This announcement, which ascertains the borrower working capital GAP and fund qualified in two strategies credit, the principal strategy for advance will empower MPBF 75% of the work GAP net capital is Current resources less present liabilities, Second technique advance will empower MPBF 75% of current resources less present liabilities. 6. subsidize income: income examination articulation for the present time frame and anticipated is one of the states in the CMA information. 7 Ratio Analysis: This is the last explanation that gives the key proportions for the count on the premise of information from the AMC arranged and displayed to the bank financing. 8. Conclusion: In this article, I attempted to give an essential thought of a CMA information and substance. Ideally this will be valuable for readers.   Functional and Technical Specifications for Supply, Implementation & Management of Loan Origination System |