|

#2

27th August 2015, 11:50 AM

| |||

| |||

| Re: NPS South Indian Bank

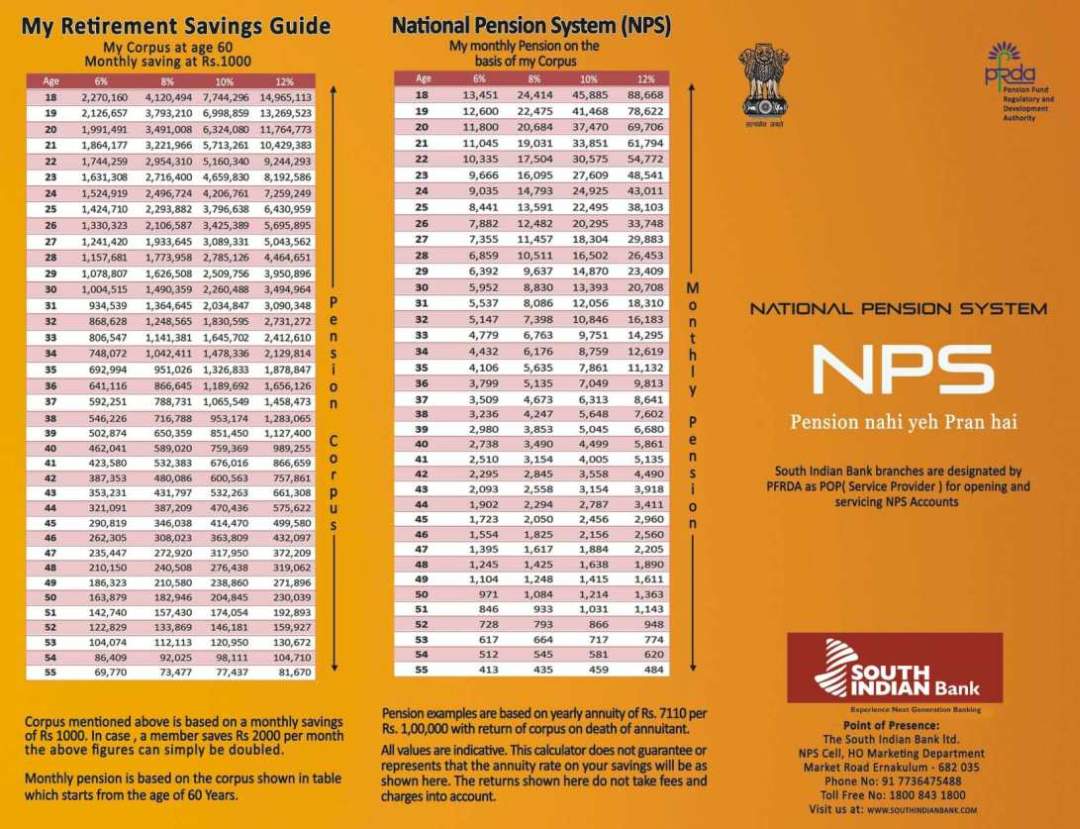

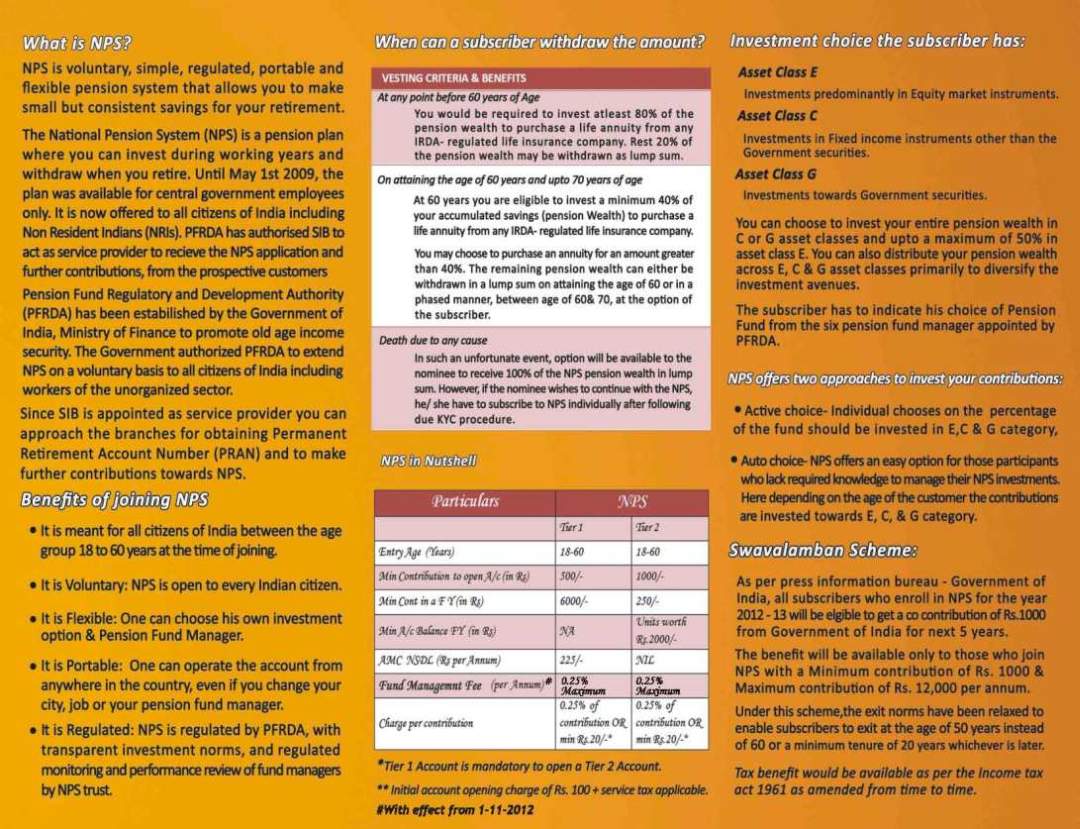

South Indian Bank New Pension System (NPS) has been launched across the country with effect from 1st May 2009, NPS is available in three distinct models: All Citizens Model Available to all citizens of India (Age: 18years to 60years), including NRIs. Corporate Model – Any corporate entity can opt for this model to disburse the benefits of NPS to its employees. NPS Lite - Available to all citizens of India (Age: 18years to 60years) belonging to unorganized sector. Documents Required Proof of Identity (Copy of any one of the given below documents) Passport issued by Government of India Ration card with photograph Bank Pass book or certificate with Photograph Voters Identity card with photograph and residential address Valid Driving license with photograph PAN Card issued by Income tax department SIB NPS details      |