|

#2

10th May 2016, 11:56 AM

| |||

| |||

| Re: Maximizer V

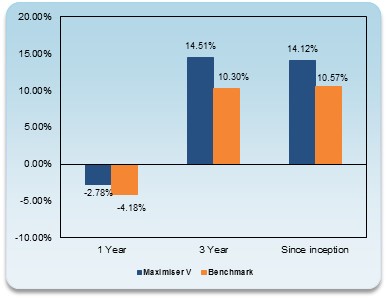

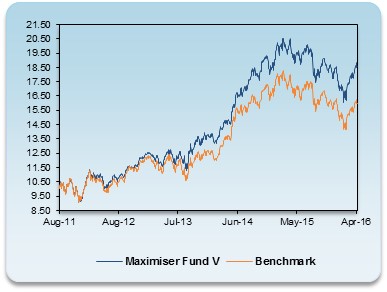

Maximiser Fund V as on March 31, 2016 SFIN: ULIF 114 15/03/11 LMaximis5 105 (NAV in Rs.): 18.06 Fund Objective The objective of the fund is to provide long-term capital appreciation through investments primarily in equity and equity-related instruments Date of Inception: Aug 29, 2011 Benchmark: S&P BSE 100 Annualized Returns  NAV Movement  AUM (Rs. million) 87,471.3 Asset Allocation Allocation in Fund Equity 88.9% Debt and Other Current Asset & Equivalent 11.1% Total 100% Sector Allocation Allocation as a % in Equity Financials 22.5% Computer Programming/Consultancy 13.7% Telecommunications 11.8% Motor Vehicles 11.6% Epc/Infrastructure 5.9% Petroleum Products 5.9% Textiles 5.0% Tobacco 4.8% Extraction Of Crude Petroleum/Natural Gas 4.5% Machinery & Equipment 3.5% Utilities 3.0% Pharmaceuticals 1.7% Other Transport Equipments 1.7% Mining Support Service 1.5% Others 2.7% Top 20 Equity Stocks Allocation as a % in Equity Tata Motors Ltd. 10.1% H D F C Bank Ltd. 9.2% Bharti Airtel Ltd. 8.7% Infosys Ltd. 8.7% Axis Bank Ltd. 8.0% Larsen & Toubro Ltd. 5.9% Reliance Industries Ltd. 5.6% Grasim Industries Ltd. 5.0% I T C Ltd. 4.8% Oil & Natural Gas Corpn. Ltd. 4.5% Mahindra & Mahindra Ltd. 3.5% H C L Technologies Ltd. 3.3% Idea Cellular Ltd. 3.1% State Bank Of India 2.5% Power Grid Corpn. Of India Ltd. 2.1% Hero Motocorp Ltd. 1.7% Indusind Bank Ltd. 1.6% Oil India Ltd. 1.5% Tata Consultancy Services Ltd. 1.5% Maruti Suzuki India Ltd. 1.5% Maximiser Fund V ICICI  |