|

#4

13th September 2019, 08:09 AM

| |||

| |||

| Re: Licentiate General Insurance Exam Paper

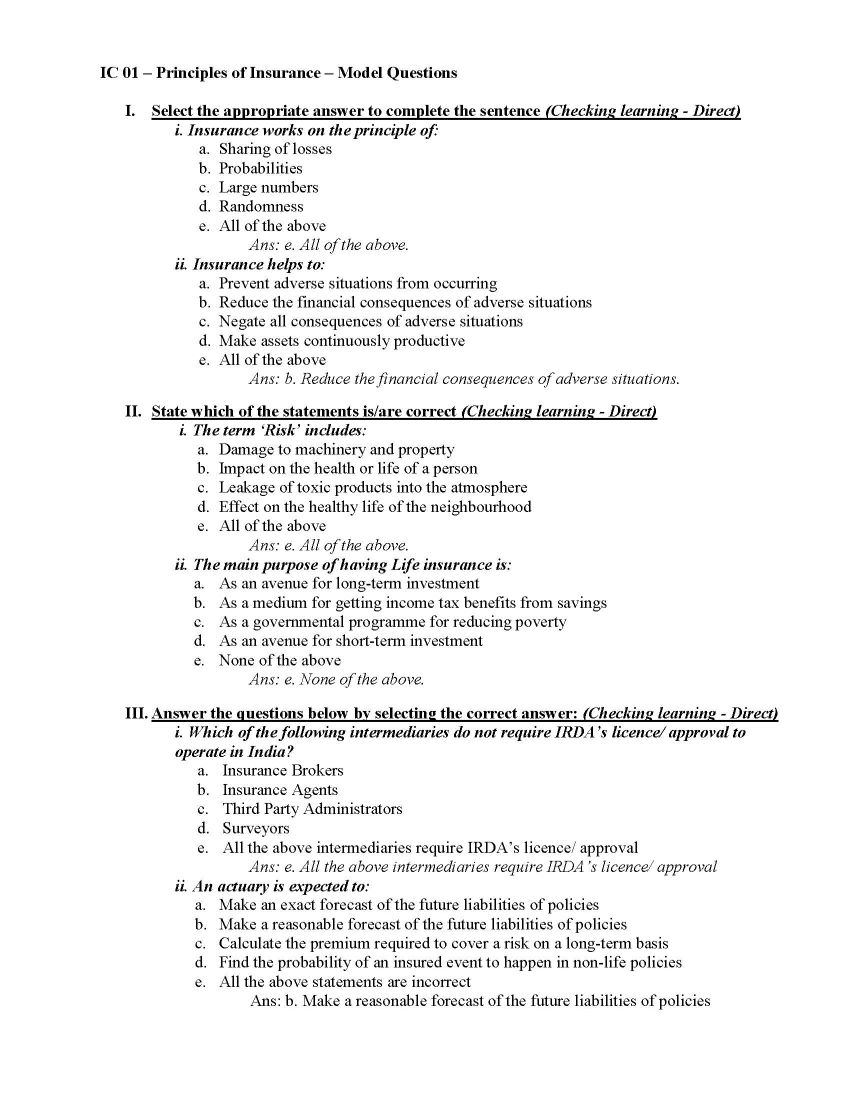

As you are asking for Licentiate General Insurance Exam question Paper for this exam preparation so on your demand I am providing same : IC 01 Principles of Insurance Model Questions I. Select the appropriate answer to complete the sentence (Checking learning - Direct) i. Insurance works on the principle of: a. Sharing of losses b. Probabilities c. Large numbers d. Randomness e. All of the above Ans: e. All of the above. ii. Insurance helps to: a. Prevent adverse situations from occurring b. Reduce the financial consequences of adverse situations c. Negate all consequences of adverse situations d. Make assets continuously productive e. All of the above Ans: b. Reduce the financial consequences of adverse situations. II. State which of the statements is/are correct (Checking learning - Direct) i. The term Risk includes: a. Damage to machinery and property b. Impact on the health or life of a person c. Leakage of toxic products into the atmosphere d. Effect on the healthy life of the neighbourhood e. All of the above Ans: e. All of the above. ii. The main purpose of having Life insurance is: a. As an avenue for long-term investment b. As a medium for getting income tax benefits from savings c. As a governmental programme for reducing poverty d. As an avenue for short-term investment e. None of the above Ans: e. None of the above. III. Answer the questions below by selecting the correct answer: (Checking learning - Direct) i. Which of the following intermediaries do not require IRDAs licence/ approval to operate in India? a. Insurance Brokers b. Insurance Agents c. Third Party Administrators d. Surveyors e. All the above intermediaries require IRDAs licence/ approval Ans: e. All the above intermediaries require IRDAs licence/ approval ii. An actuary is expected to: a. Make an exact forecast of the future liabilities of policies b. Make a reasonable forecast of the future liabilities of policies c. Calculate the premium required to cover a risk on a long-term basis d. Find the probability of an insured event to happen in non-life policies e. All the above statements are incorrect Ans: b. Make a reasonable forecast of the future liabilities of policies Licentiate General Insurance Exam question Paper    |