|

#2

31st August 2015, 05:01 PM

| |||

| |||

| Re: Kerala Gramin Bank Personal Loan

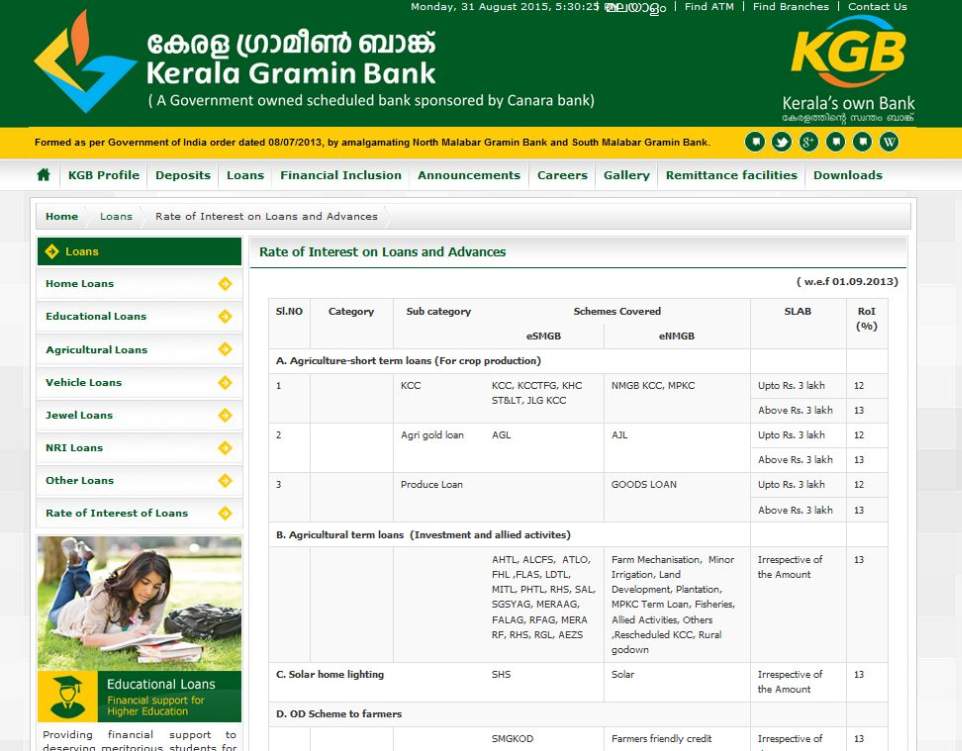

As you want to get the interest rates of Kerala Gramin Bank Personal Loan so here is the information of the same for you: Here for your reference I am giving you the process of getting the interest rates of Kerala Gramin Bank Personal Loan: (1). Firstly go to the official website of State Bank of India which looks like this image:  (2). Now on this page at the top side of the page you will find some tabs and from those tabs choose the tab of “Loans” and from this tab choose the tab of “Rate of Interest of Loans” (3). Now you will be directed to the next page which looks like this image:  Now on this page you will get the interest rates of Kerala Gramin Bank Personal Loan Contact Details: Kerala Gramin Bank Vadakkenchery branch, 1st Floor, Sha Tower Mandham Vadakkencherry, Kerala 678683 India [MAP]Kerala Gramin Bank Vadakkencherry[/MAP] |