|

#2

13th August 2014, 07:18 AM

| |||

| |||

| Re: ITO Examination Syllabus

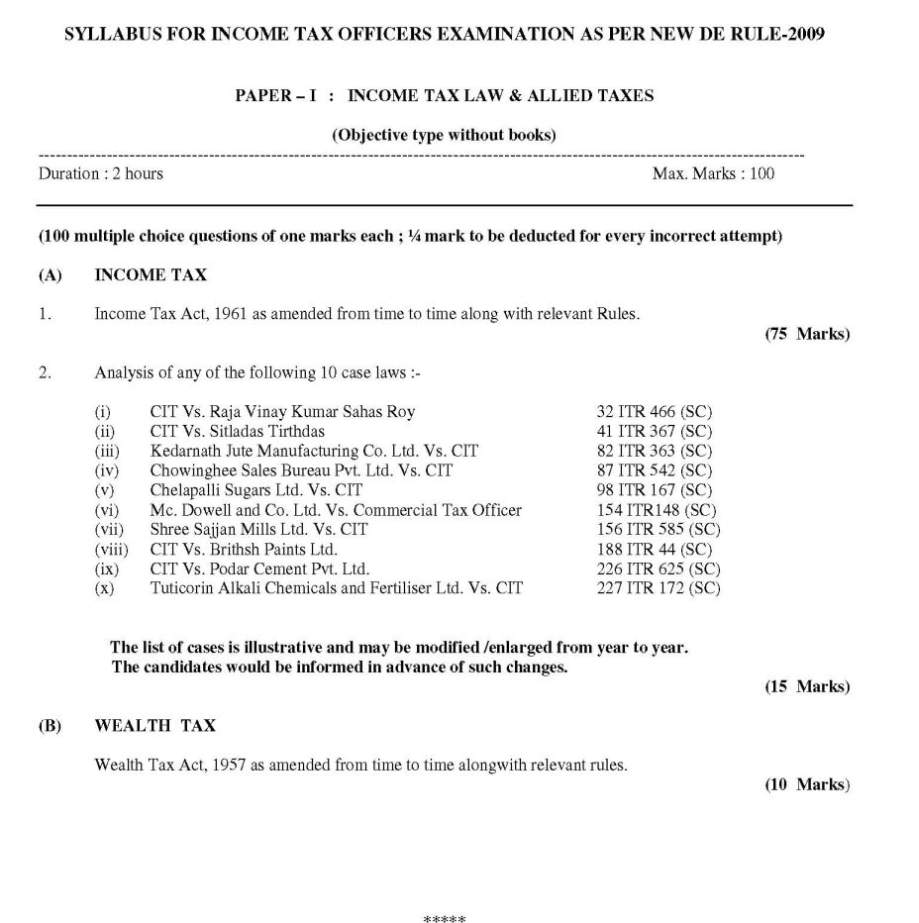

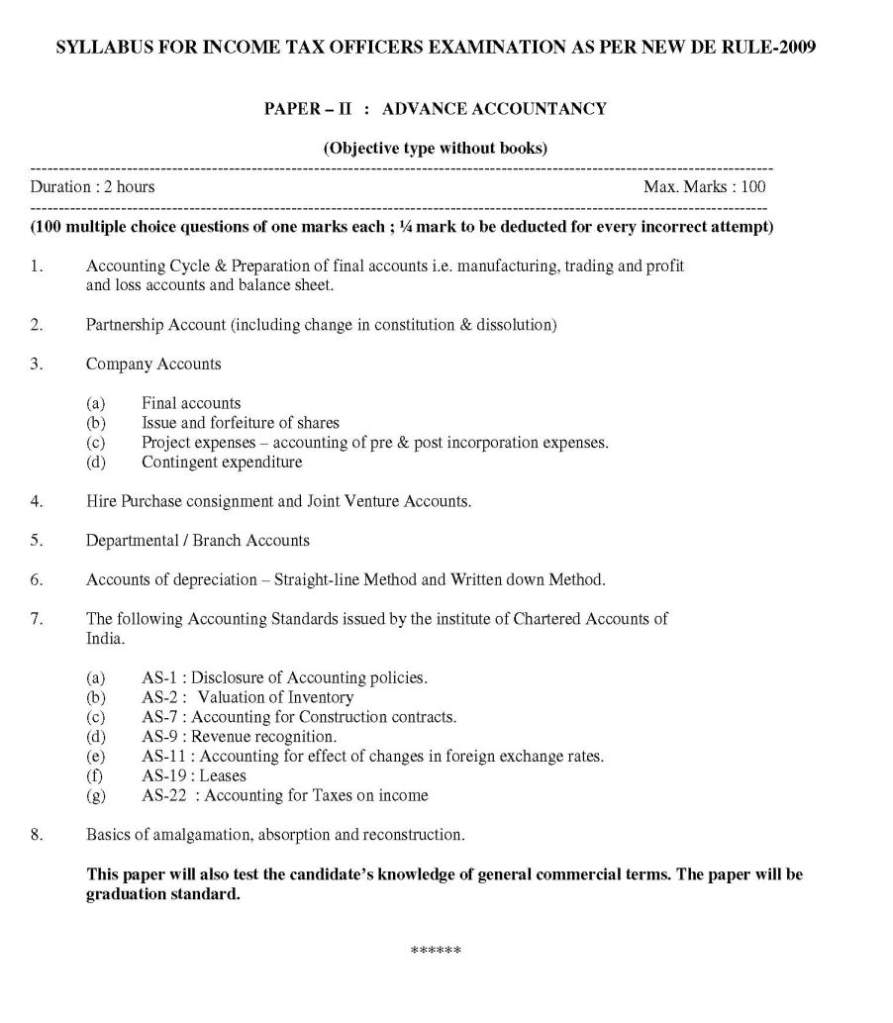

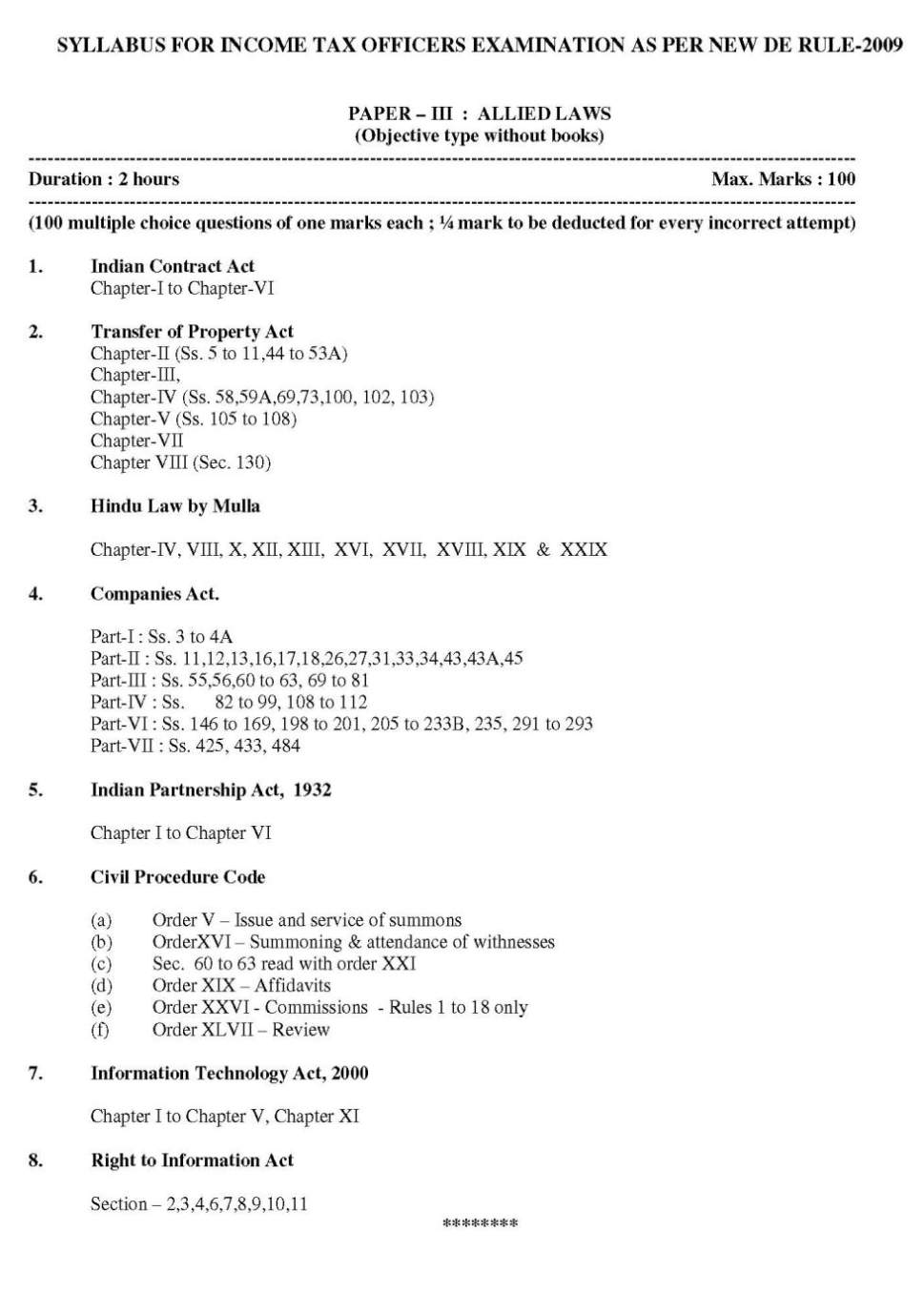

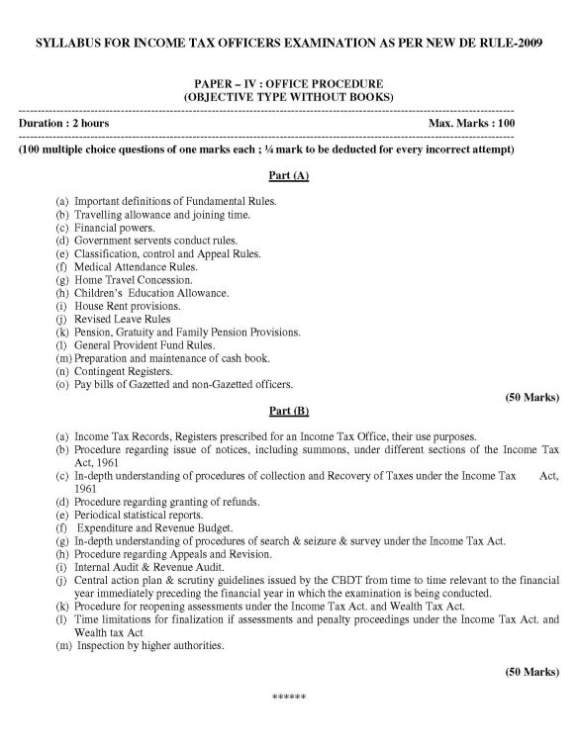

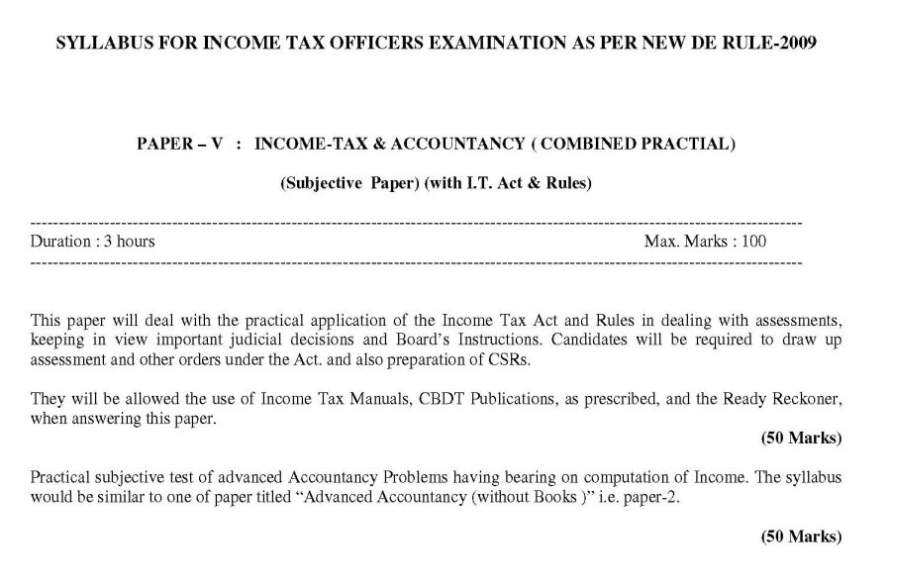

Here I am giving you syllabus for income tax officers examination..... The Income Tax Officer Exam paper has following topics: PAPER – I : INCOME TAX LAW & ALLIED TAXES PAPER – II : ADVANCE ACCOUNTANCY PAPER – III : ALLIED LAWS PAPER – IV : OFFICE PROCEDURE PAPER – V : INCOME-TAX & ACCOUNTANCY ( COMBINED PRACTIAL) Paper 1: INCOME TAX 1. Income Tax Act, 1961 as amended from time to time along with relevant Rules. (75 Marks) 2. Analysis of any of the following 10 case laws :- (i) CIT Vs. Raja Vinay Kumar Sahas Roy 32 ITR 466 (SC) (ii) CIT Vs. Sitladas Tirthdas 41 ITR 367 (SC) (iii) Kedarnath Jute Manufacturing Co. Ltd. Vs. CIT 82 ITR 363 (SC) (iv) Chowinghee Sales Bureau Pvt. Ltd. Vs. CIT 87 ITR 542 (SC) (v) Chelapalli Sugars Ltd. Vs. CIT 98 ITR 167 (SC) (vi) Mc. Dowell and Co. Ltd. Vs. Commercial Tax Officer 154 ITR148 (SC) (vii) Shree Sajjan Mills Ltd. Vs. CIT 156 ITR 585 (SC) (viii) CIT Vs. Brithsh Paints Ltd. 188 ITR 44 (SC) (ix) CIT Vs. Podar Cement Pvt. Ltd. 226 ITR 625 (SC) (x) Tuticorin Alkali Chemicals and Fertiliser Ltd. Vs. CIT 227 ITR 172 (SC) The list of cases is illustrative and may be modified /enlarged from year to year. The candidates would be informed in advance of such changes. (15 Marks) (B) WEALTH TAX Wealth Tax Act, 1957 as amended from time to time alongwith relevant rules.      |