|

#2

2nd December 2014, 03:57 PM

| |||

| |||

| Re: Insurance practice the chartered insurance institute

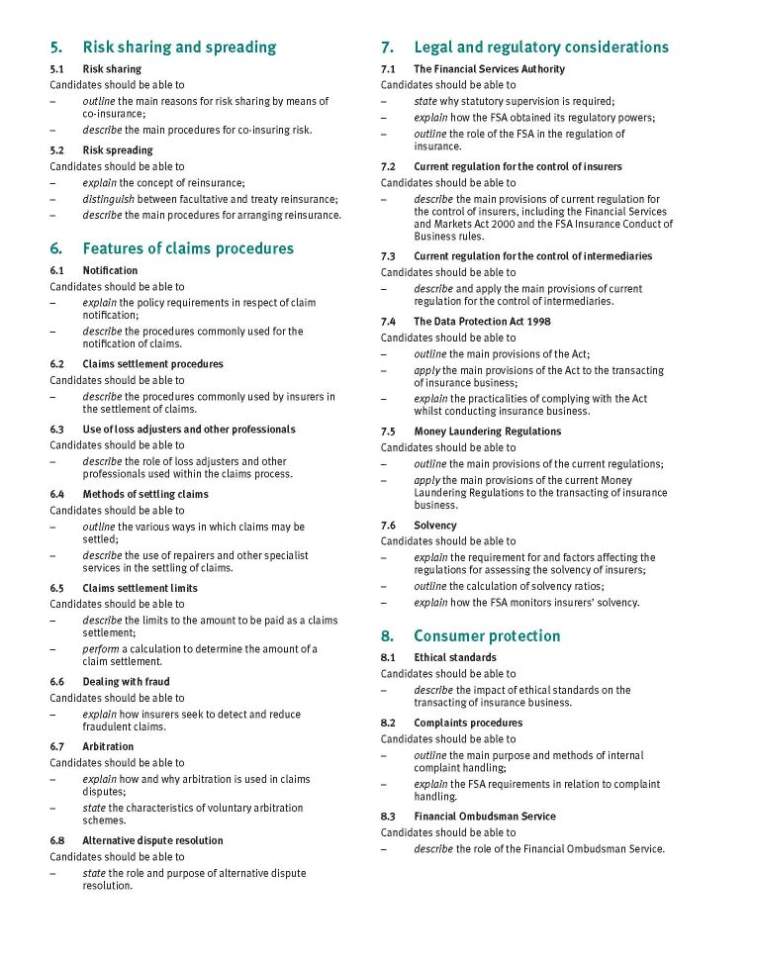

Chartered Insurance Institute provides accreditation and professional qualifications to UK and international members. Insurance practice To develop in the candidate: Knowledge and understanding of market principles and practice; Knowledge and understanding of the main classes of business and the cover provided under each; Knowledge and understanding of the regulation of the insurance market; Knowledge and understanding of procedures used to underwrite insurance; Knowledge and understanding of the operation of general claims procedures; The ability to apply knowledge and skills to simple situations Point of Insurance practice: Insurance coverage The general structure of the insurance market Arranging insurance Underwriting insurance Risk sharing and spreading Features of claims procedures Legal and regulatory considerations Consumer protection     |