|

#2

7th September 2015, 09:56 AM

| |||

| |||

| Re: Indian Institute of Banking and Finance Risk Management

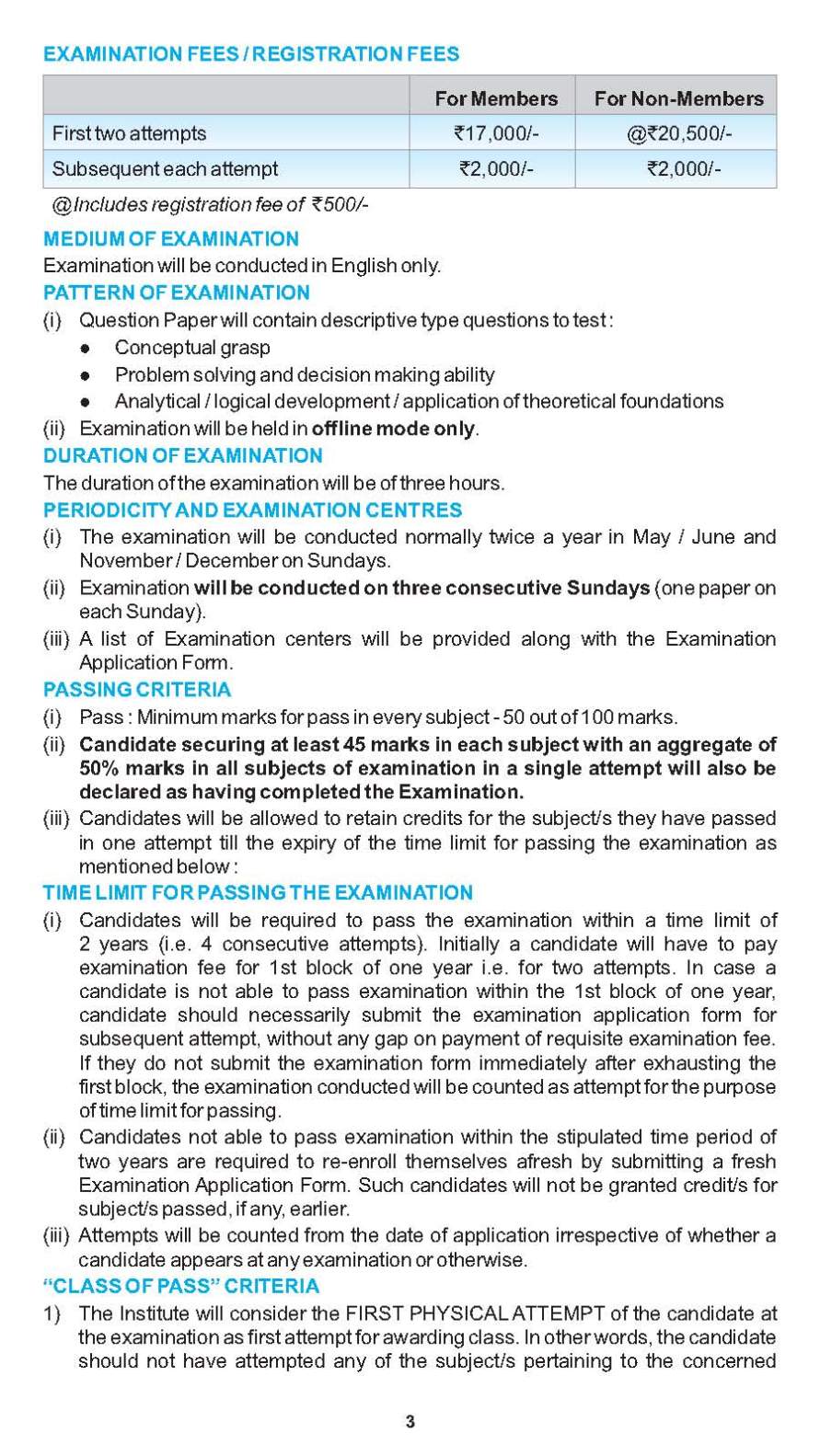

Indian Institute of Banking & Finance was established on 30th April, 1928, It conducts the Diploma in Treasury Investment and Risk Management Examination Important Dates: (Last date for applying for examination: 09/10/2015) Last Date for receipt of Change of Centre Requests at the respective Zonal Offices for the Examinations scheduled for JAN 2016 : 30th November 2015 Examination DATE SUBJECTS 03/01/2016 Sunday Financial Markets - An Overview 10/01/2016 Sunday Treasury Management 17/01/2016 Sunday Risk Management Syllabus Diploma in Treasury, Investment And Risk Management PAPER - I : FINANCIAL MARKETS: AN OVERVIEW A) Money Market B) Fixed Income Securities - Bonds - valuation - Govt. Securities C) Capital Markets [as it pertains to Bonds, etc.] D) Foreign Exchange Markets E) Brief Outline on Derivative Markets PAPER - II : TREASURY MANAGEMENT A) Treasury B) Cost Centre / Profit Centre, Integrated Treasury, Planning & Control, Risk Analysis C) Liquidity Management - CRR / CCIL/ RTGS D) Implications of Treasury on International Banking Need for the market Participants nstruments of Money Market, their characteristics, Direct / Indirect Instruments Repurchase Agreements (REPOS) Types of interest rate quotations Broad Trends Primary & Secondary market Regulations of the capital market Principles of valuation Settlements of Transactions GDRs / ADRs Brief outline of Equity Market Foreign markets Role of banks in the market Spot and Forward mechanism, Swap, outright deals and dealer operations / other deals lPremium and discount New Instruments Futures, options, swaps Annexure - Price calculation of various instruments i) Objectives of Treasury ii) Structure and Organization iii) Functions of a Treasurer iv) Responsibility of a Treasurer Objectives, Sources and deployment Internet control, Netting Global scenario & treasury operation Exchange rate mechanism Structure : Front, Back & Mid office 8 Dealing and trading operations : Control and orderly conduct, moral and ethical codes, checks of balances Revaluation : Mark to market and profit calculations, VaR (Value at Risk) Internal & External Audit Role of Reserve Bank of India Risk Process - Risk Organization Key Risks - Interest Rate Risk, Market Risk, Currency Risk, Credit Risk, Liquidity Risk, Legal and operational Risk Calculation Risk Exposure Analysis Risk Management / Mitigation policy Risk Immunization Policy / Strategy fixing exposure limits Delegation with accountability i) Open position ii) Asset position limit iii) Deal size iv) Individual dealer’s limit v) Stop loss limits Components: Multi currency balance sheet Organizational Structure Risk Management policy & procedure Risk adjusted return on capital Capital adequacy norms lALCO techniques / tools - GAPAnalysis Simulation, Duration Analysis, Linear and other statistical methods of Internal Control Forward, Futures, options Strategies and Arbitrage opportunities Implications to hedge and position through derivative products Operational clarity and documentation and monitoring E) Regulation, Supervision and Compliance of Treasury Functions F) Integrated Treasury G) Bond Dynamics H) Role of Information Technology in treasury management and Bond Dynamics I) Accounting Valuation and Elimination of Exposures PAPER - III : RISK MANAGEMENT A) Risk : Definition B) Risk Measurement and Control C) Asset Liability Management D) Risk Hedging Instruments & Mechanism : E) Challenges of BASLE-II : F) Role of Mid Office / Risk Management Dept : G) System Audit significance in risk managemen / mitigations Indian Institute of Banking & Finance Diploma in Treasury, Investment and Risk Management Syllabus     For more details here is the PDF file; |