|

#2

8th August 2014, 04:17 PM

| |||

| |||

| Re: Income Tax Inspector Job Profile

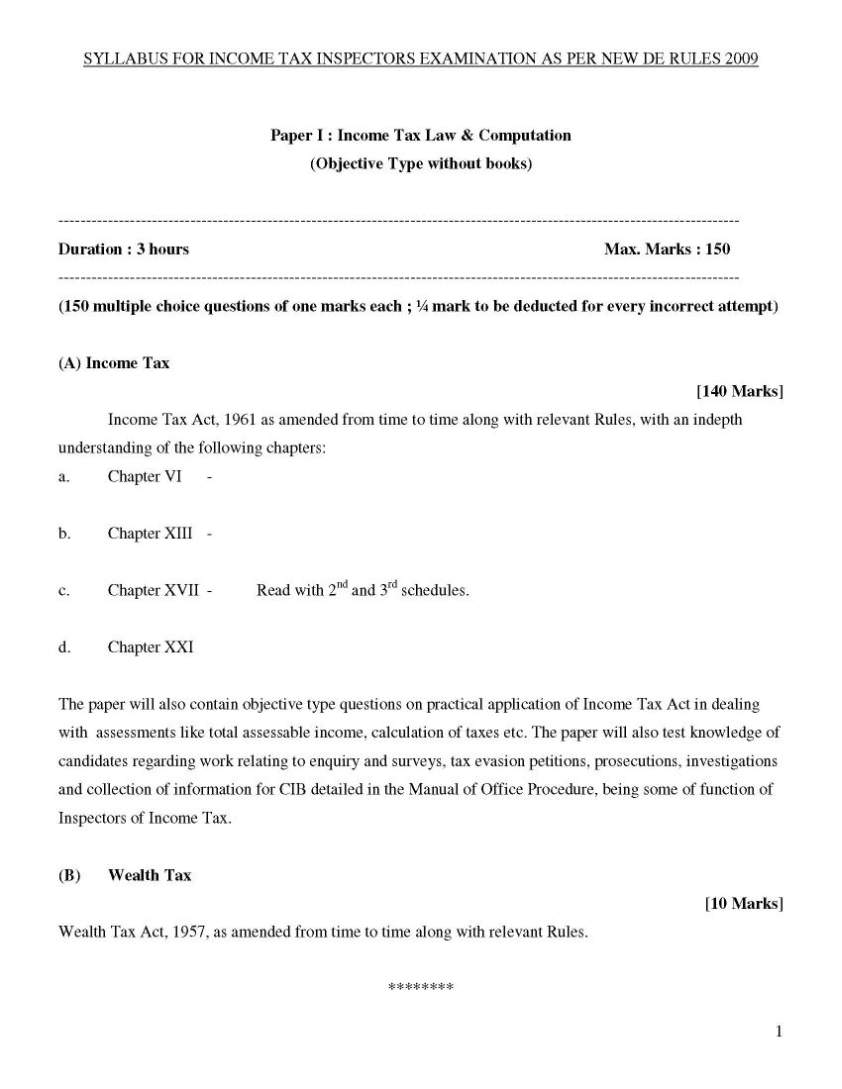

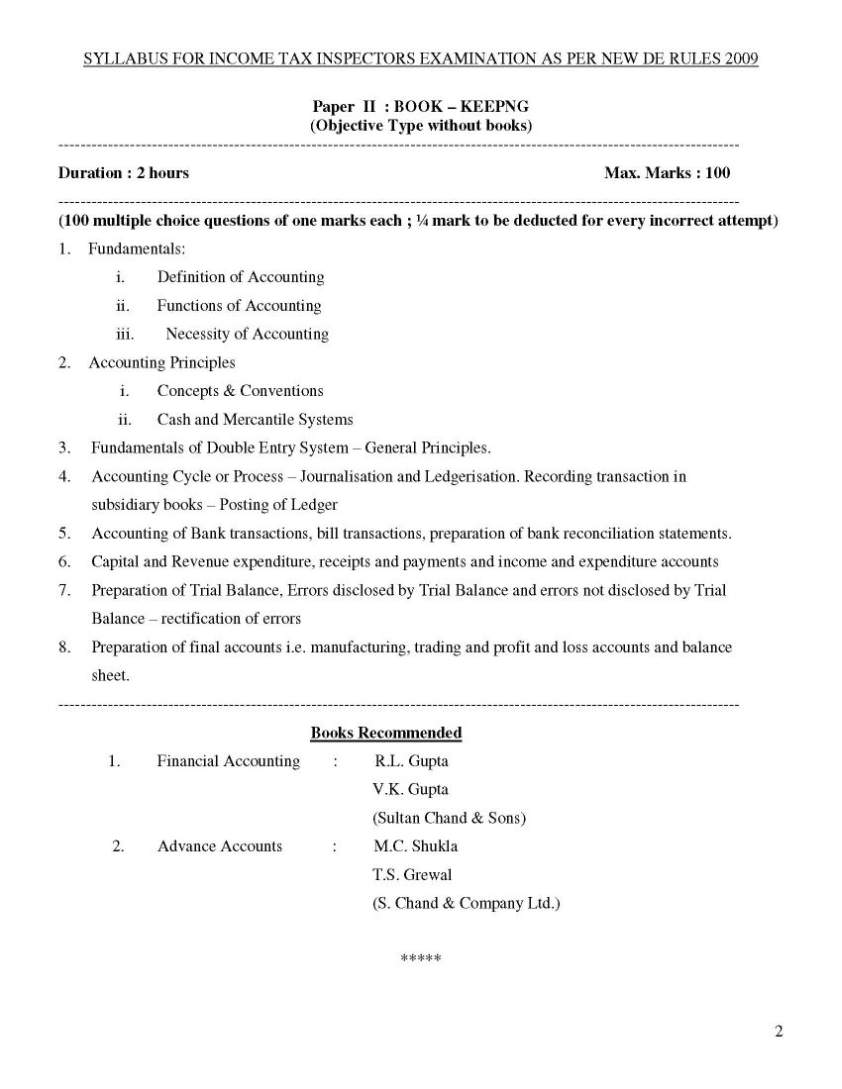

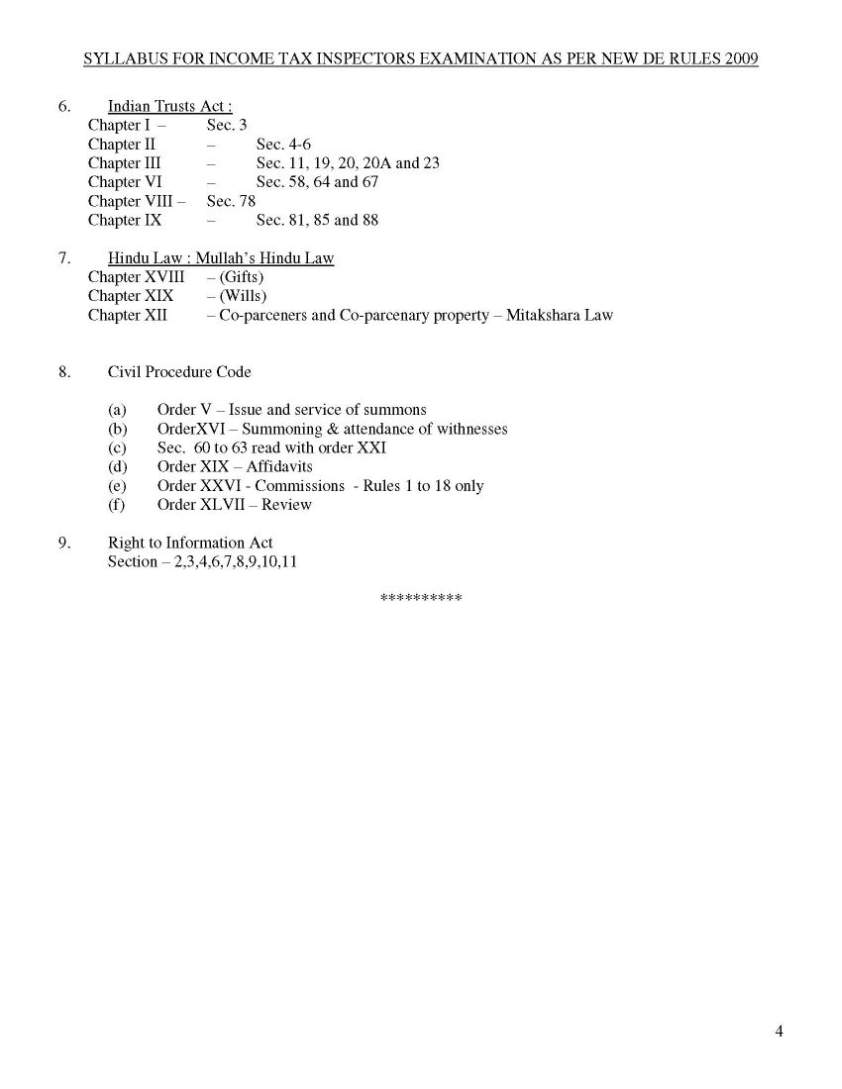

Here I am giving you information about job profile for Income Tax Officer post exam conducted by Staff Selection Commission (SSC).. Job profile : Income Tax Officer make organizations and individuals pay the correct amount of tax at the right time. TAX officer offer information and advice to individuals, businesses and organizations on a range of tax and related issues Even they do full inquiry in case of any disparacy Eligibility for the post: The applicant should hold Bachelor degree in any discipline with good academic record from any recognized university of India. Age limit: 19 to 33 years (as on 01.02.2014) Salary : Sales Tax Inspector: Rs 9300-34800 + Grade Pay Rs 4300/- The Income Tax Officer Exam paper has following topics: PAPER – I : INCOME TAX LAW & ALLIED TAXES PAPER – II : ADVANCE ACCOUNTANCY PAPER – III : ALLIED LAWS PAPER – IV : OFFICE PROCEDURE PAPER – V : INCOME-TAX & ACCOUNTANCY ( COMBINED PRACTIAL) Income Tax Officer Exam syllabus       |