|

#2

29th July 2014, 03:54 PM

| |||

| |||

| Re: ICWAI Financial Accounting Question Paper

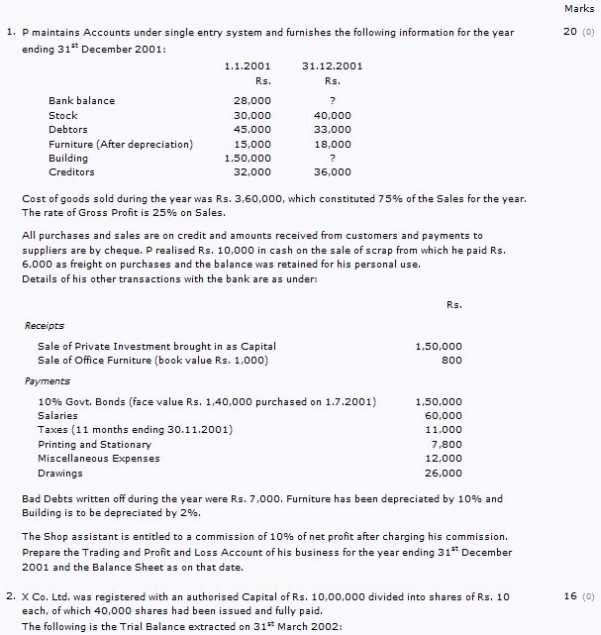

Here I am providing the list of few questions of Financial Accounting Question Paper of ICWAI which you are looking for . 1. P maintains Accounts under single entry system and furnishes the following information for the year ending 31st December 2001: 1.1.2001 Rs. 31.12.2001 Rs. Bank balance Stock Debtors Furniture (After depreciation) Building Creditors 28,000 30,000 45,000 15,000 1,50,000 32,000 ? 40,000 33,000 18,000 ? 36,000 Cost of goods sold during the year was Rs. 3,60,000, which constituted 75% of the Sales for the year. The rate of Gross Profit is 25% on Sales. All purchases and sales are on credit and amounts received from customers and payments to suppliers are by cheque. P realised Rs. 10,000 in cash on the sale of scrap from which he paid Rs. 6,000 as freight on purchases and the balance was retained for his personal use. Details of his other transactions with the bank are as under: Rs. Receipts Sale of Private Investment brought in as Capital Sale of Office Furniture (book value Rs. 1,000) 1,50,000 800 Payments 10% Govt. Bonds (face value Rs. 1,40,000 purchased on 1.7.2001) Salaries Taxes (11 months ending 30.11.2001) Printing and Stationary Miscellaneous Expenses Drawings 1,50,000 60,000 11,000 7,800 12,000 26,000 Bad Debts written off during the year were Rs. 7,000. Furniture has been depreciated by 10% and Building is to be depreciated by 2%. The Shop assistant is entitled to a commission of 10% of net profit after charging his commission. Prepare the Trading and Profit and Loss Account of his business for the year ending 31st December 2001 and the Balance Sheet as on that date. 20 (0)      |