|

#2

15th March 2016, 08:39 AM

| |||

| |||

| Re: HUDCO Bonds Feb

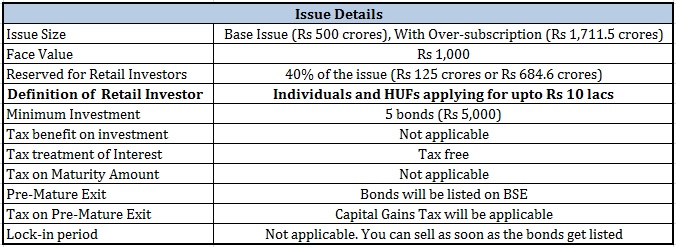

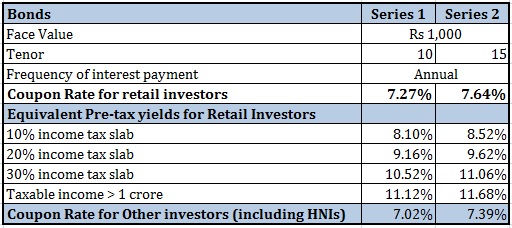

Hudco, a techno-financial institution engaged in the financing and promotion of housing and urban infrastructure projects throughout India. It was established on April 25, 1970 as a wholly owned government company with the objective to provide long term finance and undertake housing and urban infrastructure development programmes. The Company believes its organization occupies a key position in the GoI’s growth plans and implementation of its policies for the housing and urban infrastructure sector. Features of HUDCO Tax Free Bonds 2016 -Issue start date: 27-January-2016 -Issue end date: 10-February-2016 -Face value of the bond is Rs 1,000. -Minimum investment – 5 Bonds i.e. Rs 5,000 and in multiple of 1 bond thereof -Interest rates and tenure (For Retail investors of < Rs 10 Lakh investment) -10 Years – 7.27% -15 years – 7.64% -Non-Resident Indians (NRI’s) cannot apply for these tax free bonds. -Retail investors who are applying above Rs 10 Lakh investment would get 0.25% less interest compared to the rates indicated here. -Non retail investors would get an interest rate of 0.25% lower than the retail investor. -Interest is paid every year. -There is no tax on the interest from these bonds, hence no TDS would be deducted. -These tax free bonds would be listed on BSE. Hence these are liquid investments, provided there is buyer in stock exchange. -You can apply for these tax free bonds in physical form and demat form. HUDCO Tax-Free Bonds Issue: Salient Features  HUDCO Tax-Free Bonds Interest Rate  |