|

#2

4th December 2017, 04:16 PM

| |||

| |||

| Re: Growth Rate Of HDFC Bank In

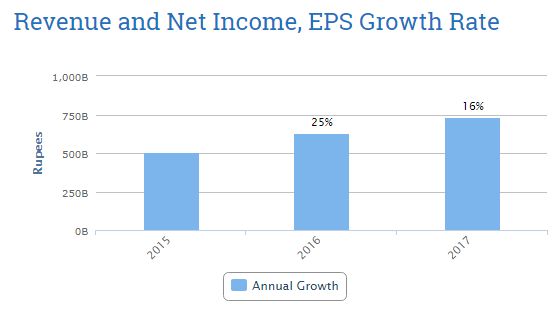

Retained Earnings Growth is the percent increase / decrease of a companys retained net income or reserves/surplus over time. A company can use retained earnings to maintain current operations, or to invest in new ventures. Annual Growth Rate of HDFC Bank Ltd 1 year Revenue 16.01% Net Income 19% EPS Basic 18% Revenue and Net Income, EPS Growth Rate  Key Financial Ratios of HDFC Bank Mar 17 Mar 16 Mar 15 Mar 14 Mar 13 Investment Valuation Ratios Face Value 2.00 2.00 2.00 2.00 2.00 Dividend Per Share 11.00 9.50 8.00 6.85 5.50 Operating Profit Per Share (Rs) 55.68 44.77 36.16 29.65 21.97 Net Operating Profit Per Share (Rs) 270.46 238.20 193.38 171.47 147.37 Free Reserves Per Share (Rs) -- -- -- -- -- Bonus in Equity Capital -- -- -- -- -- Profitability Ratios Interest Spread 7.46 7.52 8.01 8.01 8.78 Adjusted Cash Margin(%) 63.17 18.31 18.91 18.65 17.60 Net Profit Margin 20.99 20.41 21.07 20.61 19.18 Return on Long Term Fund(%) 105.60 70.54 66.77 81.47 80.09 Return on Net Worth(%) 16.26 16.91 16.47 19.50 18.57 Adjusted Return on Net Worth(%) 56.69 16.91 16.47 19.50 18.57 Return on Assets Excluding Revaluations 349.12 287.47 247.39 181.23 152.20 Return on Assets Including Revaluations 349.12 287.47 247.39 181.23 152.20 Management Efficiency Ratios Interest Income / Total Funds 8.81 9.27 8.96 9.22 9.50 Net Interest Income / Total Funds 4.21 4.25 4.14 4.14 4.28 Non Interest Income / Total Funds 1.56 1.65 1.66 1.78 1.86 Interest Expended / Total Funds 4.60 5.02 4.82 5.08 5.22 Operating Expense / Total Funds 2.40 2.50 2.46 2.55 2.87 Profit Before Provisions / Total Funds 3.27 3.29 3.22 3.22 3.10 Net Profit / Total Funds 1.85 1.89 1.89 1.90 1.82 Loans Turnover 0.14 0.15 0.15 0.15 0.16 Total Income / Capital Employed(%) 10.38 10.92 10.62 11.00 11.36 Interest Expended / Capital Employed(%) 4.60 5.02 4.82 5.08 5.22 Total Assets Turnover Ratios 0.09 0.09 0.09 0.09 0.10 Asset Turnover Ratio 0.09 0.10 0.10 0.10 0.11 Profit And Loss Account Ratios Interest Expended / Interest Earned 52.18 54.18 53.79 55.07 54.91 Other Income / Total Income 15.07 15.15 15.66 16.14 16.35 Operating Expense / Total Income 23.12 22.93 23.20 23.18 25.25 Selling Distribution Cost Composition -- -- -- -- -- Balance Sheet Ratios Capital Adequacy Ratio 14.60 15.53 16.79 16.07 16.80 Advances / Loans Funds(%) 84.21 84.82 80.97 82.33 79.93 Debt Coverage Ratios Credit Deposit Ratio 85.64 83.24 81.71 81.79 80.14 Investment Deposit Ratio 31.79 33.13 35.13 35.05 38.51 Cash Deposit Ratio 5.71 5.77 6.46 6.02 5.46 Total Debt to Owners Fund 8.02 8.25 8.00 9.36 9.09 Financial Charges Coverage Ratio 1.73 1.68 1.69 1.66 1.63 Financial Charges Coverage Ratio Post Tax 1.43 1.40 1.42 1.40 1.38 Leverage Ratios Current Ratio 0.06 0.07 0.04 0.06 0.06 Quick Ratio 11.19 14.51 12.69 8.55 7.84 Cash Flow Indicator Ratios Dividend Payout Ratio Net Profit -- 19.53 19.62 19.38 19.46 Dividend Payout Ratio Cash Profit -- 18.47 18.44 17.96 17.74 Earning Retention Ratio 100.00 80.47 80.38 80.62 80.54 Cash Earning Retention Ratio 100.00 81.53 81.56 82.04 82.26 AdjustedCash Flow Times 12.49 42.03 41.46 40.15 40.15 |