|

#2

30th October 2014, 10:29 AM

| |||

| |||

| Re: Difference between ICWA and C.A

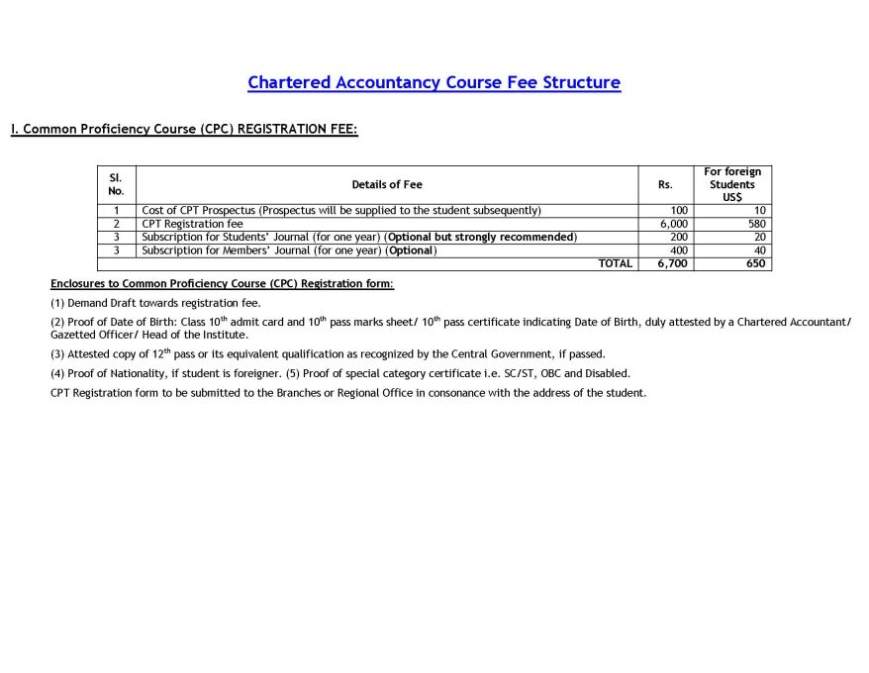

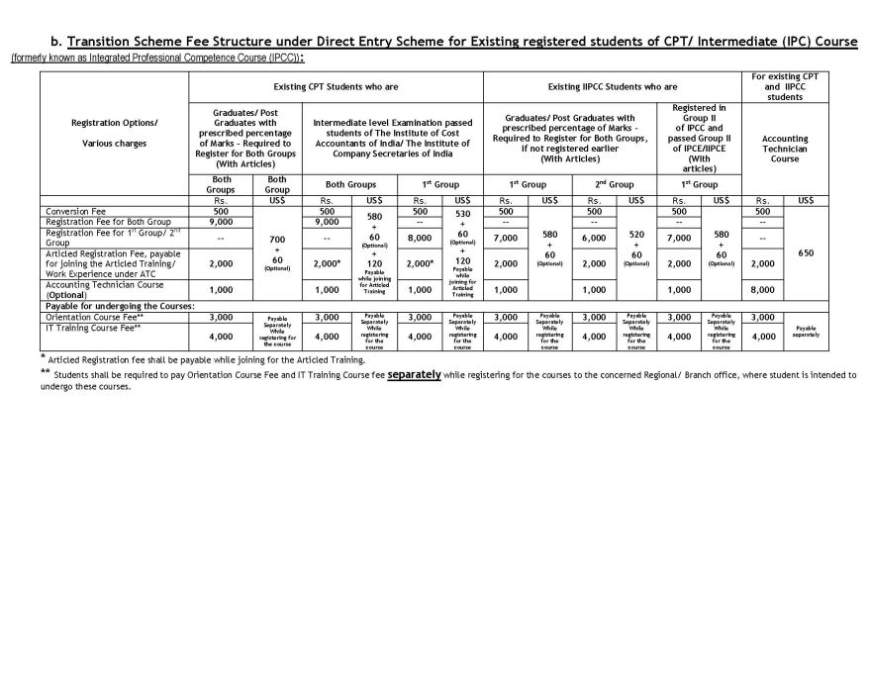

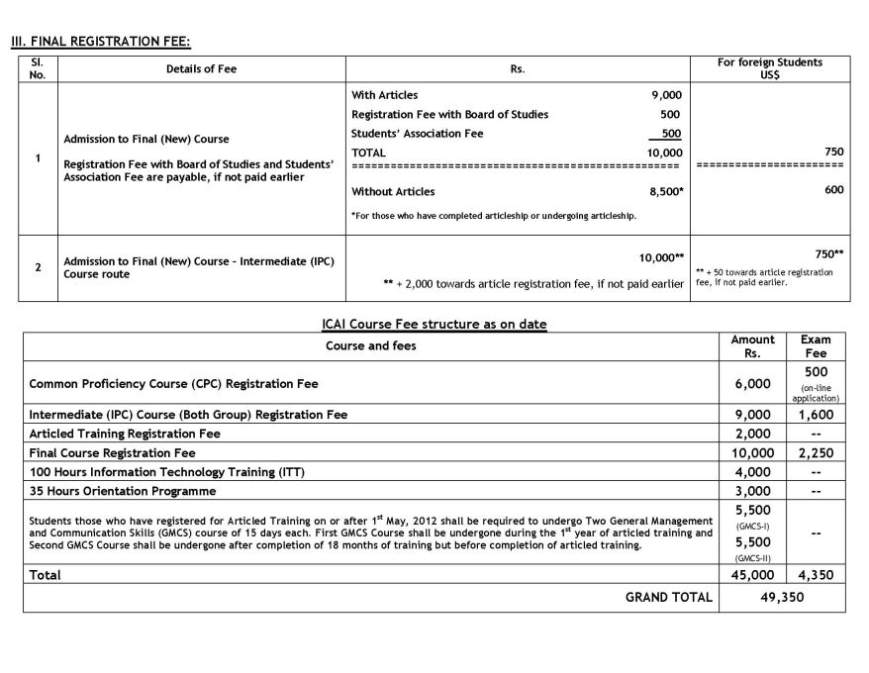

ICWAI is Institute of Cost and Works Accountants of India The ICWAI course is divided into three parts. Foundation course, Intermediate course Final course Minimum qualification is 10+2. Students who have completed their graduation need not appear for the foundation test. They can directly appear for the intermediate course. Job types available for ICWA holders are Cost Consultant Finance Director Financial Controller Cost Controller Financial Consultant CA is the Chartered Accountancy Course. It is a professional course in the field of Accounting. It is about financial management, taxation and accounting. Job types available for CA holders are Taxation Manager Finance Controller Auditor Accounts Manager Finance Director Finance Advisor CA course is much broader compared to ICWA CA holders are allowed to operate individually where as ICWA holder can only work in companies. ICWA is much more suited for those who want to specialize in costing. Now it is up to you which is suitable for you The fees structure ICWA course Foundation Course: INR 3,500/ Intermediate Course: INR 15,700/(INR 19,700/if Oral Coaching is opted i.e. INR 4,000 extra for oral coaching) Final Course: INR 11,000/(INR 16,000/if Oral Coaching is opted i.e. INR 4,000 extra for oral coaching) Fees structure CA course      |