|

#2

23rd March 2016, 04:49 PM

| |||

| |||

| Re: CPA Pakistan Exemptions For MBA

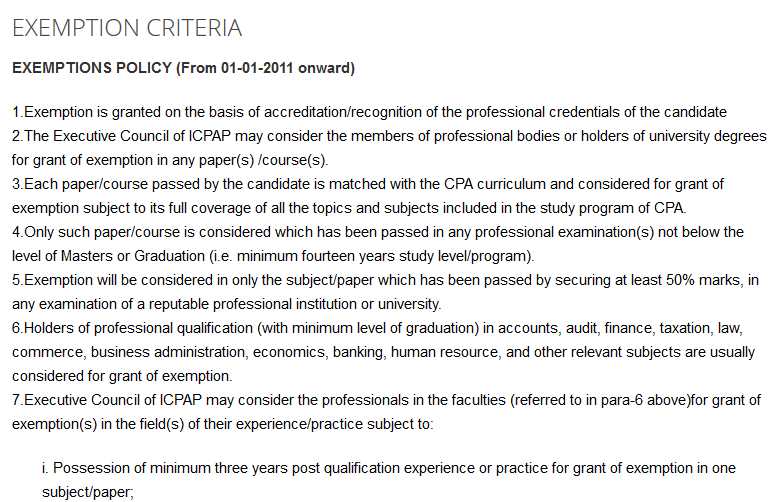

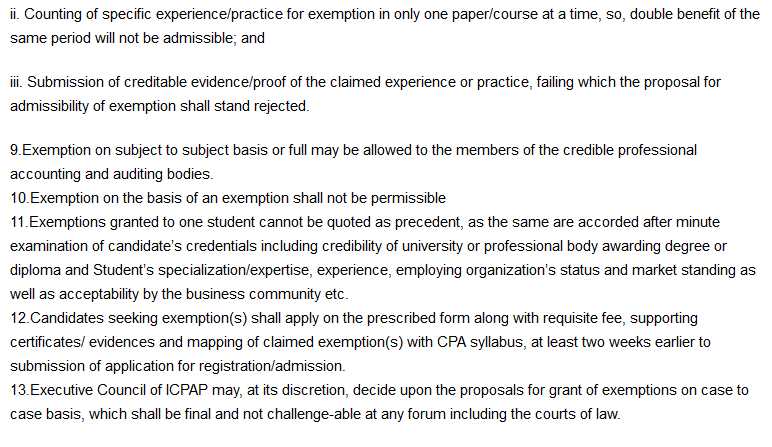

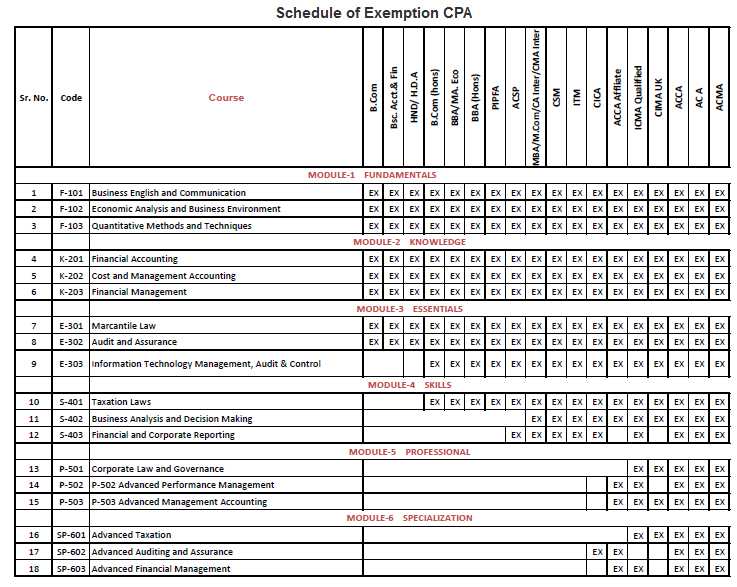

The Institute of Certified Public Accountants of Pakistan (ICPAP) is an autonomous institution and not affiliated to any University, nor is it a University under the UGC/HEC Act. It was established in August, 1992 with the objective of professional training in Accounting & Finance in accordance with the IAS/IFRS and relevant Pakistani corporate laws. MBA Exemption Criteria- The Executive Council of ICPAP may consider the members of professional bodies or holders of university degrees for grant of exemption in any paper(s) /course(s). Exemption is granted on the basis of accreditation/recognition of the professional credentials of the candidate Each paper/course passed by the candidate is matched with the CPA curriculum Only such paper/course is considered which has been passed in any professional examination(s) not below the level of Masters or Graduation Exemption will be considered in only the subject/paper which has been passed by securing at least 50% marks, in any examination of a reputable professional university. Holders of professional qualification (with minimum level of graduation) in accounts, audit, finance, taxation, law, commerce, business administration, economics, banking, human resource, and other relevant subjects are usually considered for grant of exemption. Executive Council of ICPAP may consider the professionals in the faculties for grant of exemption(s) in the field(s) of their experience/practice subject to- Minimum three years post qualification experience or practice for grant of exemption in one subject/paper Counting of specific experience/practice for exemption in only one paper/course at a time, so, double benefit of the same period will not be admissible; and Submission of creditable evidence/proof of the claimed experience or practice, failing which the proposal for admissibility of exemption shall stand rejected. Exemption on subject to subject basis or full may be allowed to the members of the credible professional accounting and auditing bodies. Exemption on the basis of an exemption shall not be permissible    |