|

#2

12th June 2015, 01:07 PM

| |||

| |||

| Re: Company National Insurance Rates UK

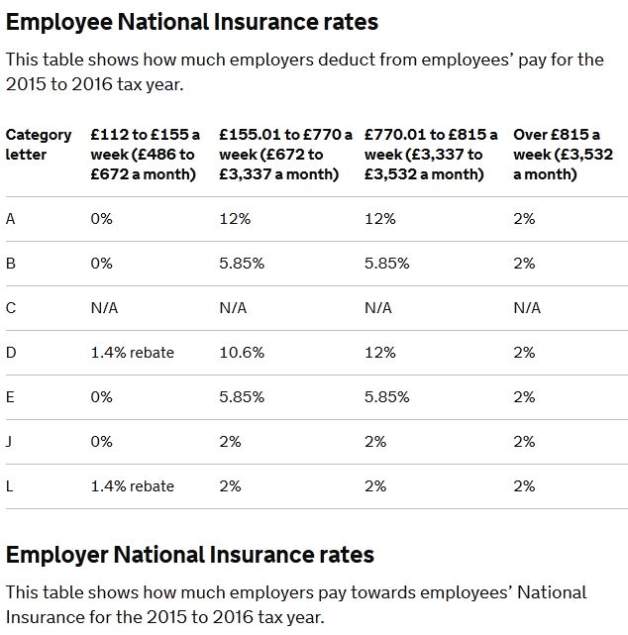

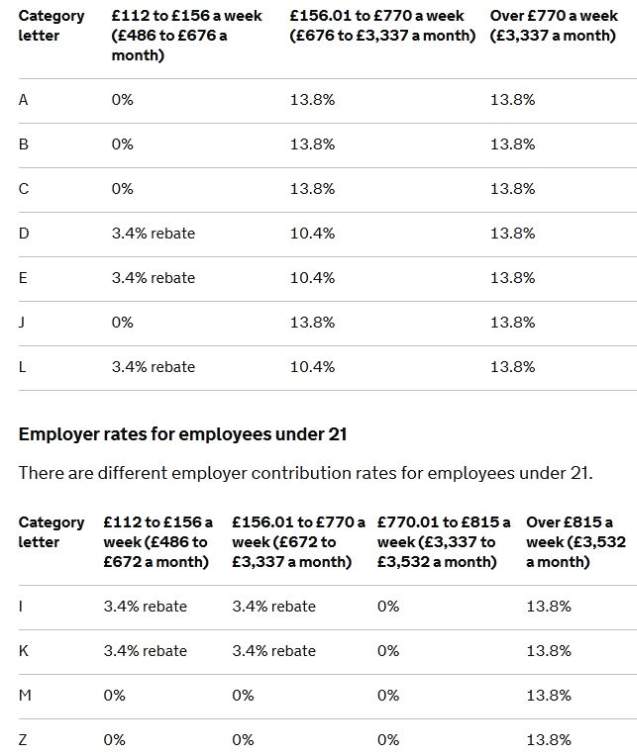

National Insurance (NI) in the United Kingdom is a system of contributions paid by workers and employers towards the cost of certain state benefits. National Insurance rates in UK divided in following categories: National Insurance Corporation tax Capital gains tax Motoring taxes Inheritance tax Stamp duty Insurance Premium Tax Air Passenger Duty PAYE Contribution Rates - Employees The history of the rates charged is as given below: 1975 - 1976 the contribution was at 5.50% up to the upper limit. 1976 - 1978 the contribution was at 5.75% up to the upper limit. 1978 - 1979 the contribution was at 6.50% up to the upper limit. 1979 - 1980 the contribution was at 6.75% up to the upper limit. 1980 - 1981 the contribution was at 7.75% up to the upper limit. 1981 - 1982 the contribution was at 8.75% up to the upper limit. 1982 - 1989 the contribution was at 9.00% up to the upper limit. 1989 - 1994 the contribution was at 2.00% on the lower band of earnings and then at 9.00% up to the upper limit. 1995 - 1999 the contribution was at 2.00% on the lower band of earnings and then at 10.00% up to the upper limit. 1999 - 2003 the contribution was at 0.00% on the lower band of earnings and then at 10.00% up to the upper limit. 2003 - 2011 the contribution was at 0.00% on the lower band of earnings and then at 11.00% up to the upper limit and 1% on earnings over the upper limit. 2011 - 2015 the contribution was at 0.00% on the lower band of earnings and then at 12.00% up to the upper limit and 2% on earnings over the upper limit.   |